Traditional IRA Withdrawal Authorization AG Financial Solutions 2015

Understanding the Traditional IRA Withdrawal Authorization

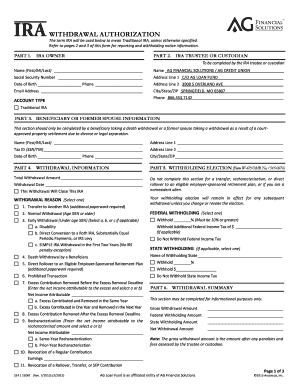

The Traditional IRA Withdrawal Authorization from AG Financial Solutions is a formal document that allows account holders to request distributions from their Traditional Individual Retirement Accounts (IRAs). This authorization is crucial for individuals seeking to access their retirement funds while ensuring compliance with IRS regulations. The form typically requires the account holder's personal information, the amount to be withdrawn, and the reason for the withdrawal, which may include retirement, hardship, or other qualifying events.

Steps to Complete the Traditional IRA Withdrawal Authorization

Completing the Traditional IRA Withdrawal Authorization involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and account details.

- Specify the amount you wish to withdraw and the purpose of the withdrawal.

- Review the IRS guidelines related to withdrawals to ensure compliance and understand potential tax implications.

- Sign and date the form to validate your request.

- Submit the completed form through the specified method, whether online, by mail, or in person.

Legal Considerations for the Traditional IRA Withdrawal Authorization

Understanding the legal implications of the Traditional IRA Withdrawal Authorization is essential for account holders. Withdrawals from a Traditional IRA may be subject to income tax and, if taken before the age of fifty-nine and a half, may incur an additional ten percent penalty. It is important to be aware of the IRS guidelines regarding qualified distributions to avoid unnecessary penalties. Consulting with a tax professional can provide clarity on the legal requirements and potential consequences of your withdrawal.

Required Documents for Withdrawal Authorization

When submitting the Traditional IRA Withdrawal Authorization, certain documents may be required to process your request efficiently. These may include:

- A copy of your government-issued identification, such as a driver's license or passport.

- Proof of your current address, if it differs from what is on file.

- Any additional documentation that supports the reason for the withdrawal, such as medical bills for hardship withdrawals.

IRS Guidelines for Traditional IRA Withdrawals

The IRS has specific guidelines governing withdrawals from Traditional IRAs. Account holders should be aware of the following key points:

- Withdrawals are generally taxed as ordinary income.

- Early withdrawals may incur penalties unless they meet certain exceptions.

- Account holders must begin taking required minimum distributions (RMDs) by age seventy-two.

Form Submission Methods for Traditional IRA Withdrawal Authorization

The Traditional IRA Withdrawal Authorization can be submitted via various methods, depending on the preferences of AG Financial Solutions. Common submission methods include:

- Online submission through the AG Financial Solutions portal.

- Mailing the completed form to the designated address provided by AG Financial Solutions.

- Delivering the form in person to a local AG Financial Solutions office, if available.

Eligibility Criteria for Withdrawals

Before submitting the Traditional IRA Withdrawal Authorization, it is important to determine your eligibility for withdrawal. Generally, account holders can withdraw funds under the following conditions:

- Reaching the age of fifty-nine and a half.

- Experiencing financial hardship, which may require documentation.

- Meeting other IRS-defined criteria for qualified distributions.

Create this form in 5 minutes or less

Find and fill out the correct traditional ira withdrawal authorization ag financial solutions

Create this form in 5 minutes!

How to create an eSignature for the traditional ira withdrawal authorization ag financial solutions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Traditional IRA Withdrawal Authorization AG Financial Solutions?

The Traditional IRA Withdrawal Authorization AG Financial Solutions is a streamlined process that allows individuals to authorize withdrawals from their Traditional IRA accounts. This service ensures that all necessary documentation is completed efficiently, making it easier for users to manage their retirement funds.

-

How does airSlate SignNow facilitate Traditional IRA Withdrawal Authorization AG Financial Solutions?

airSlate SignNow simplifies the Traditional IRA Withdrawal Authorization AG Financial Solutions by providing an intuitive platform for eSigning and document management. Users can easily create, send, and sign withdrawal authorization forms, ensuring a smooth and compliant process.

-

What are the pricing options for using Traditional IRA Withdrawal Authorization AG Financial Solutions?

Pricing for Traditional IRA Withdrawal Authorization AG Financial Solutions through airSlate SignNow is competitive and designed to fit various business needs. We offer flexible subscription plans that cater to both individual users and larger organizations, ensuring you only pay for what you need.

-

What features are included in the Traditional IRA Withdrawal Authorization AG Financial Solutions?

The Traditional IRA Withdrawal Authorization AG Financial Solutions includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the user experience and ensure that all withdrawals are processed efficiently and securely.

-

What benefits does airSlate SignNow provide for Traditional IRA Withdrawal Authorization AG Financial Solutions?

Using airSlate SignNow for Traditional IRA Withdrawal Authorization AG Financial Solutions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Users can complete their withdrawal authorizations quickly, allowing for faster access to their funds.

-

Can I integrate airSlate SignNow with other financial tools for Traditional IRA Withdrawal Authorization AG Financial Solutions?

Yes, airSlate SignNow can be integrated with various financial tools and software to enhance the Traditional IRA Withdrawal Authorization AG Financial Solutions. This integration allows for seamless data transfer and improved workflow, making it easier to manage your financial documents.

-

Is there customer support available for Traditional IRA Withdrawal Authorization AG Financial Solutions?

Absolutely! airSlate SignNow provides dedicated customer support for users of the Traditional IRA Withdrawal Authorization AG Financial Solutions. Our team is available to assist with any questions or issues you may encounter, ensuring a smooth experience.

Get more for Traditional IRA Withdrawal Authorization AG Financial Solutions

- Application for sublease maryland form

- Maryland post 497310353 form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out maryland form

- Property manager agreement maryland form

- Agreement for delayed or partial rent payments maryland form

- Tenants maintenance repair request form maryland

- Guaranty attachment to lease for guarantor or cosigner maryland form

- Amendment to lease or rental agreement maryland form

Find out other Traditional IRA Withdrawal Authorization AG Financial Solutions

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later