BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select 2013-2026

What is the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select

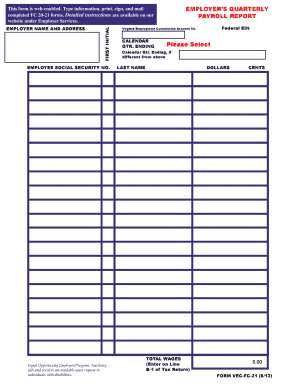

The BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select is a key document used by employers in the United States to report payroll information to tax authorities. This form typically includes details about employee wages, tax withholdings, and contributions to social security and Medicare. It is essential for maintaining compliance with federal and state payroll tax regulations.

Steps to complete the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select

Completing the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb involves several steps:

- Gather all relevant payroll data for the quarter, including employee wages and tax withholdings.

- Fill out the required sections of the form accurately, ensuring that all information is up-to-date.

- Double-check calculations for accuracy, particularly for tax withholdings and total wages paid.

- Submit the completed form to the appropriate tax authority by the designated deadline.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for submitting the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb. Generally, the form is due on the last day of the month following the end of the quarter. For example:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Legal use of the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select

The BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb is legally required for employers to accurately report payroll information. Failure to file this report can result in penalties, including fines and interest on unpaid taxes. Employers must ensure that the information provided is complete and accurate to avoid legal complications.

Key elements of the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select

Key elements of the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb include:

- Employer identification information, including name and address.

- Total wages paid to employees during the quarter.

- Amount of federal income tax withheld.

- Social security and Medicare tax amounts.

- Any additional state-specific tax information.

Who Issues the Form

The BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb is typically issued by the Internal Revenue Service (IRS) in collaboration with state tax agencies. Employers should ensure they are using the most current version of the form to comply with regulations.

Create this form in 5 minutes or less

Find and fill out the correct bemployer39s quarterlyb payroll breportb please select

Create this form in 5 minutes!

How to create an eSignature for the bemployer39s quarterlyb payroll breportb please select

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select?

The BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select is a comprehensive report that summarizes payroll information for employers on a quarterly basis. This report helps businesses ensure compliance with tax regulations and provides a clear overview of employee earnings and deductions.

-

How can airSlate SignNow help with the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select?

airSlate SignNow streamlines the process of generating and signing the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select. Our platform allows you to easily create, send, and eSign documents, ensuring that your payroll reports are accurate and compliant with regulations.

-

What features does airSlate SignNow offer for payroll reporting?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows that simplify the creation of the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select. These tools enhance efficiency and reduce the risk of errors in payroll documentation.

-

Is there a cost associated with using airSlate SignNow for payroll reports?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that facilitate the creation and management of the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select, ensuring you find a solution that fits your budget.

-

Can I integrate airSlate SignNow with other payroll systems?

Absolutely! airSlate SignNow supports integrations with various payroll systems, allowing you to seamlessly generate the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select. This integration ensures that your payroll data is accurate and readily available for reporting.

-

What are the benefits of using airSlate SignNow for payroll documentation?

Using airSlate SignNow for payroll documentation, including the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select, offers numerous benefits. These include improved efficiency, reduced paperwork, enhanced security, and the ability to track document status in real-time.

-

How secure is airSlate SignNow for handling payroll reports?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your payroll reports, including the BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select. You can trust that your sensitive information is safe with us.

Get more for BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select

- How do i get a sales tax exemption for a non profit form

- Epa 738 r 97 003 form

- Grahammanagementhouston form

- Return goods authorization supco form

- Mod scia per agriturismi comune di terni comune terni form

- Form for registration of departure abroad breda english breda

- Arrl rookie roundup log sheet arrl form

- Order fatburger online pick up form

Find out other BEMPLOYER39S QUARTERLYb PAYROLL BREPORTb Please Select

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile