Establishing secure connection…Loading editor…Preparing document…

We are not affiliated with any brand or entity on this form.

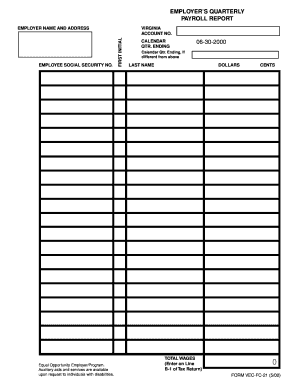

EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO 2000

be ready to get more

Create this form in 5 minutes or less

Find and fill out the correct employer s quarterly payroll report employee social security no

Versions

Form popularity

Fillable & printable

4.7 Satisfied (74 Votes)

4.6 Satisfied (88 Votes)

Create this form in 5 minutes!

How to create an eSignature for the employer s quarterly payroll report employee social security no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO.?

The EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO. is a crucial document that employers must file quarterly to report wages paid and taxes withheld for their employees. This report includes essential information such as the employee's Social Security number, which is vital for accurate tax reporting and compliance.

-

How can airSlate SignNow help with the EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO.?

airSlate SignNow simplifies the process of preparing and submitting the EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO. by providing an intuitive platform for document management and eSigning. With our solution, you can easily fill out, sign, and send your payroll reports securely and efficiently.

-

What features does airSlate SignNow offer for payroll reporting?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows that streamline the preparation of the EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO. These tools help ensure accuracy and compliance while saving time and reducing errors.

-

Is airSlate SignNow cost-effective for small businesses needing to file payroll reports?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible, allowing you to choose the best option that fits your budget while providing the necessary tools to manage the EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO. efficiently.

-

Can I integrate airSlate SignNow with my existing payroll software?

Absolutely! airSlate SignNow offers seamless integrations with various payroll software solutions, making it easy to incorporate our platform into your existing workflow. This integration ensures that you can efficiently manage the EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO. without disrupting your current processes.

-

What are the benefits of using airSlate SignNow for payroll documentation?

Using airSlate SignNow for payroll documentation, including the EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO., provides numerous benefits such as enhanced security, reduced paperwork, and improved efficiency. Our platform allows for quick access to documents and ensures that all signatures are legally binding and compliant.

-

How secure is airSlate SignNow for handling sensitive payroll information?

airSlate SignNow prioritizes the security of your sensitive payroll information, including the EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO. We utilize advanced encryption and security protocols to protect your data, ensuring that only authorized users have access to sensitive documents.

Get more for EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO

- 2014 mana community grant application mana form

- 2579 pdf 2pages form

- Soaring eagle credit card authorization form

- Sleep inn cancellation fax sheet form

- One time credit card payment authorization form household

- Credit card authorization form hotel

- Econo lodge credit card authorization form

- Authorization for release of information form dbhddorg

Find out other EMPLOYER S QUARTERLY PAYROLL REPORT EMPLOYEE SOCIAL SECURITY NO

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors

be ready to get more

Get this form now!

If you believe that this page should be taken down, please follow our DMCA take down process here.