Tip Credit Notice and Policy Arizona Restaurant Systems Inc Form

What is the Tip Credit Notice and Policy Arizona Restaurant Systems Inc

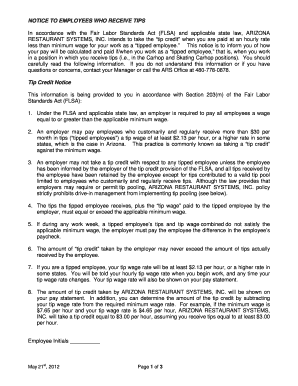

The Tip Credit Notice and Policy from Arizona Restaurant Systems Inc outlines the regulations and practices regarding the use of tip credits in the restaurant industry. This policy is essential for employers and employees to understand how tips can be counted towards meeting minimum wage requirements. The notice provides clarity on the legal framework surrounding tip credits, ensuring compliance with state and federal laws. It serves as a formal communication tool that informs employees about their rights and the employer's obligations regarding tips.

Key elements of the Tip Credit Notice and Policy Arizona Restaurant Systems Inc

Key elements of the Tip Credit Notice and Policy include detailed information about the tip credit amount, which is the portion of an employee's tips that can be used to satisfy minimum wage obligations. The policy specifies the conditions under which tip credits can be applied, including the requirement that employees must be informed of their rights regarding tips. Additionally, it outlines the responsibilities of employers in maintaining accurate records of tips received and ensuring that employees are compensated fairly. Understanding these elements is crucial for both employers and employees in the restaurant sector.

How to use the Tip Credit Notice and Policy Arizona Restaurant Systems Inc

Using the Tip Credit Notice and Policy involves several steps that ensure compliance and transparency in the workplace. Employers should distribute the notice to all tipped employees and provide a thorough explanation of its contents. Employees should review the notice carefully to understand their rights regarding tips and how these affect their overall compensation. It is also important for employers to maintain documentation that demonstrates compliance with the policy, including records of tip distributions and any communications with employees regarding their tips.

Legal use of the Tip Credit Notice and Policy Arizona Restaurant Systems Inc

The legal use of the Tip Credit Notice and Policy is governed by both federal and state labor laws. Employers must adhere to the stipulations set forth in the policy to avoid legal repercussions. This includes ensuring that the policy is accessible to all employees and that they are adequately informed about how tips are handled. Non-compliance can result in penalties, including back pay for employees and potential fines for employers. Understanding the legal framework surrounding the Tip Credit Notice is vital for maintaining a fair workplace.

Steps to complete the Tip Credit Notice and Policy Arizona Restaurant Systems Inc

Completing the Tip Credit Notice and Policy involves a series of steps that both employers and employees should follow. Employers need to ensure that the notice is properly drafted and includes all necessary information regarding tip credits. Once finalized, the notice should be distributed to all employees, ideally during an orientation session or staff meeting. Employees should acknowledge receipt of the notice, and employers should keep records of these acknowledgments. Regular training sessions can also help reinforce the policy and ensure that everyone understands their rights and responsibilities.

Examples of using the Tip Credit Notice and Policy Arizona Restaurant Systems Inc

Examples of using the Tip Credit Notice and Policy include scenarios where a restaurant implements a new tipping structure. For instance, if a restaurant decides to increase the tip credit amount, it must update the notice accordingly and communicate this change to all employees. Another example is when an employee raises a concern about their tips; the employer can refer to the policy to address the issue transparently. These examples illustrate the practical applications of the policy in everyday operations within the restaurant industry.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tip credit notice and policy arizona restaurant systems inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tip Credit Notice And Policy Arizona Restaurant Systems Inc.?

The Tip Credit Notice And Policy Arizona Restaurant Systems Inc. outlines the regulations and practices regarding tip credits for employees in the restaurant industry. This policy ensures compliance with state laws while maximizing employee earnings. Understanding this policy is crucial for restaurant owners to maintain legal standards and foster a fair work environment.

-

How can airSlate SignNow help with the Tip Credit Notice And Policy Arizona Restaurant Systems Inc.?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to the Tip Credit Notice And Policy Arizona Restaurant Systems Inc. This streamlines the process of distributing important policy documents to employees, ensuring they are informed and compliant. With our solution, you can easily manage and track document workflows.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the management of documents like the Tip Credit Notice And Policy Arizona Restaurant Systems Inc. You can choose a plan that fits your budget while ensuring you have access to essential tools for document management.

-

What features does airSlate SignNow offer for managing policies?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These features are particularly beneficial for managing documents like the Tip Credit Notice And Policy Arizona Restaurant Systems Inc. With our platform, you can ensure that all policy documents are easily accessible and legally binding.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow efficiency. This is particularly useful for businesses that need to manage the Tip Credit Notice And Policy Arizona Restaurant Systems Inc. alongside other operational tools. Our integrations allow for a cohesive experience across different platforms.

-

What are the benefits of using airSlate SignNow for restaurant policies?

Using airSlate SignNow for restaurant policies like the Tip Credit Notice And Policy Arizona Restaurant Systems Inc. provides numerous benefits, including improved compliance, faster document turnaround, and enhanced employee communication. Our platform simplifies the process of managing important documents, ensuring that your team is always informed and compliant with state regulations.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents such as the Tip Credit Notice And Policy Arizona Restaurant Systems Inc. We implement advanced encryption and security protocols to protect your data, ensuring that your documents are secure throughout the signing process.

Get more for Tip Credit Notice And Policy Arizona Restaurant Systems Inc

Find out other Tip Credit Notice And Policy Arizona Restaurant Systems Inc

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document