Hartford Simple Ira 2014

Understanding the Hartford Simple IRA

The Hartford Simple IRA is a retirement savings plan designed for small businesses and their employees. It allows employees to contribute a portion of their salary to a retirement account, while employers can also make contributions. This plan is particularly beneficial for small business owners looking to offer retirement benefits without the complexities of traditional pension plans. The contributions made to a Simple IRA are tax-deferred, meaning taxes are paid upon withdrawal during retirement.

How to Utilize the Hartford Simple IRA

To effectively use the Hartford Simple IRA, employees need to enroll in the plan through their employer. Once enrolled, employees can decide how much of their salary to contribute, up to a specified limit set by the IRS. Employers must also contribute, either by matching employee contributions up to three percent of their salary or by making a flat contribution of two percent for all eligible employees. Understanding these contribution options is crucial for maximizing retirement savings.

Obtaining the Hartford Simple IRA

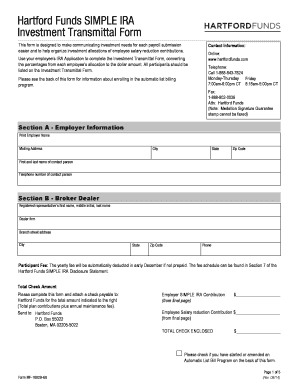

To obtain a Hartford Simple IRA, small business owners must first establish the plan by completing necessary paperwork and selecting a financial institution that offers Simple IRA accounts. Employers should inform their employees about the plan, including eligibility requirements and contribution limits. Once the plan is set up, employees can fill out the required forms to start contributing to their accounts.

Steps to Complete the Hartford Simple IRA

Completing the Hartford Simple IRA involves several key steps:

- Determine eligibility: Ensure that both the employer and employees meet the eligibility criteria.

- Choose a financial institution: Select a bank or financial service provider that offers Simple IRA accounts.

- Complete the plan adoption agreement: The employer must fill out and sign the adoption agreement to establish the plan.

- Notify employees: Inform employees about the plan, including contribution options and deadlines.

- Enroll employees: Employees need to complete enrollment forms to start contributing.

Key Elements of the Hartford Simple IRA

Several key elements define the Hartford Simple IRA:

- Contribution limits: Employees can contribute a maximum amount set annually by the IRS.

- Employer matching: Employers can choose to match employee contributions or provide a flat percentage.

- Tax benefits: Contributions are made pre-tax, reducing taxable income for the year.

- Withdrawal rules: Withdrawals before age fifty-nine and a half may incur penalties, with certain exceptions.

IRS Guidelines for the Hartford Simple IRA

The IRS outlines specific guidelines for managing a Simple IRA, including contribution limits, eligibility requirements, and withdrawal rules. Employers must adhere to these guidelines to maintain the plan's tax-advantaged status. It is essential for both employers and employees to stay informed about any changes to IRS regulations that may affect their contributions and withdrawals.

Eligibility Criteria for the Hartford Simple IRA

Eligibility for the Hartford Simple IRA typically includes:

- Employers with fewer than one hundred employees who earned at least five thousand dollars in the previous year.

- Employees who have earned at least five thousand dollars in compensation during any two preceding years and are expected to earn that amount in the current year.

Understanding these criteria helps ensure that both employers and employees can take full advantage of the benefits offered by the Simple IRA plan.

Create this form in 5 minutes or less

Find and fill out the correct hartford simple ira

Create this form in 5 minutes!

How to create an eSignature for the hartford simple ira

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Hartford Simple IRA?

A Hartford Simple IRA is a retirement savings plan designed for small businesses and their employees. It allows employees to contribute a portion of their salary to a retirement account, with the employer also making contributions. This plan is easy to set up and maintain, making it an attractive option for businesses looking to offer retirement benefits.

-

How does the Hartford Simple IRA benefit my business?

Implementing a Hartford Simple IRA can enhance employee satisfaction and retention by providing a valuable retirement savings option. It also offers tax advantages for both employers and employees, as contributions are tax-deductible. This can help your business attract and retain top talent in a competitive job market.

-

What are the costs associated with a Hartford Simple IRA?

The costs of a Hartford Simple IRA typically include minimal setup fees and administrative expenses, which are generally lower than other retirement plans. Employers are required to match employee contributions up to a certain percentage, which can be budgeted accordingly. Overall, it remains a cost-effective solution for small businesses.

-

Can I integrate the Hartford Simple IRA with airSlate SignNow?

Yes, you can integrate the Hartford Simple IRA with airSlate SignNow to streamline the documentation process. This integration allows for easy eSigning of necessary forms and agreements related to the IRA. By using airSlate SignNow, you can ensure that all documents are securely signed and stored, enhancing your operational efficiency.

-

What features does the Hartford Simple IRA offer?

The Hartford Simple IRA offers features such as employee salary deferral contributions, employer matching contributions, and tax-deferred growth on investments. Additionally, it provides flexibility in investment choices, allowing employees to tailor their retirement savings to their individual needs. This makes it a versatile option for small businesses.

-

Who is eligible to participate in a Hartford Simple IRA?

Employees of small businesses with fewer than 100 employees are typically eligible to participate in a Hartford Simple IRA. Additionally, employees must have earned at least $5,000 in compensation during any two preceding years to qualify. This ensures that the plan is accessible to a broad range of employees.

-

What are the contribution limits for a Hartford Simple IRA?

For 2023, the contribution limit for a Hartford Simple IRA is $15,500 for employees, with an additional catch-up contribution of $3,500 for those aged 50 and over. Employers are required to match contributions up to 3% of employee compensation or make a flat contribution of 2%. These limits help employees save effectively for retirement.

Get more for Hartford Simple Ira

- Ce1207 calculation of impervious percentage form doc

- Appeals appeal form

- Child and adolescent psychiatric evaluation template form

- Exclusive holidays ltd booking form

- Domestic renewable heat incentive hiversion 1 2 form

- Hvac focused checklist docx form

- Old mutual wealth withdrawal form

- Dhs 2114 eng mdhs request for medical opinion form

Find out other Hartford Simple Ira

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement