Hartford Funds Simple Ira Investment Transmittal Form 2024-2026

What is the Hartford Funds Simple IRA Investment Transmittal Form

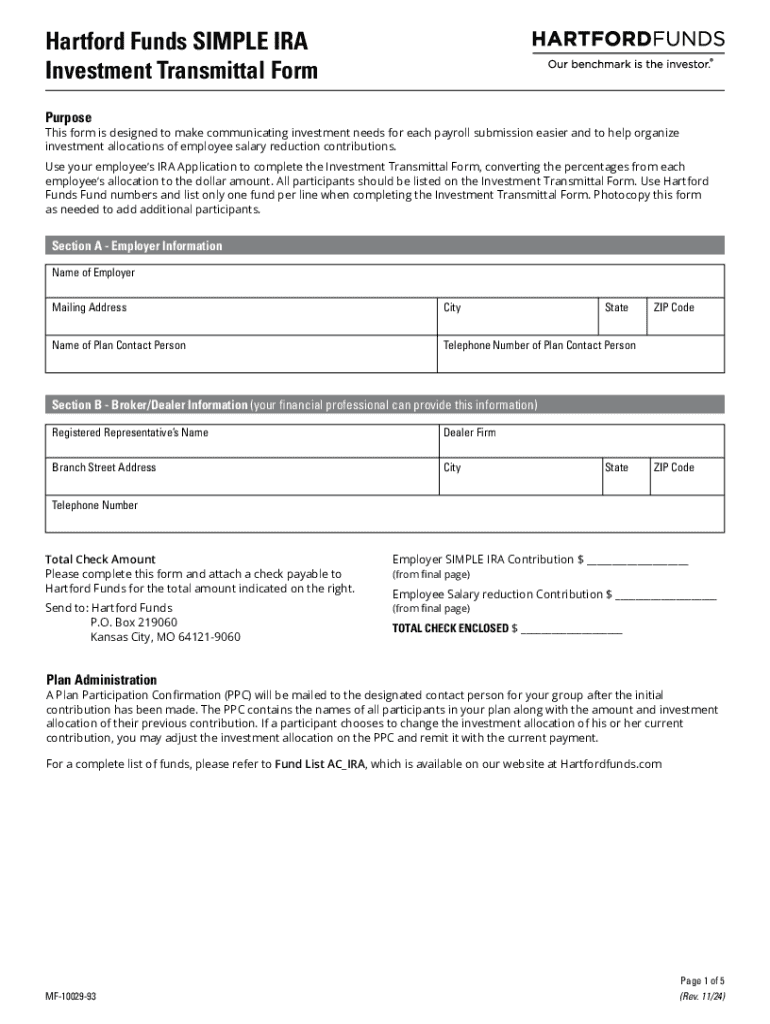

The Hartford Funds Simple IRA Investment Transmittal Form is a document used to facilitate the investment process for individuals participating in a Simple IRA plan. This form allows account holders to direct contributions into various investment options offered by Hartford Funds. It serves as a crucial tool for managing retirement savings, ensuring that funds are allocated according to the investor's preferences and financial goals.

How to use the Hartford Funds Simple IRA Investment Transmittal Form

To effectively use the Hartford Funds Simple IRA Investment Transmittal Form, individuals should first gather necessary information, including their account number and investment choices. The form typically requires details about the amount to be invested, the specific funds selected, and any relevant personal information. After completing the form, it can be submitted via the designated method, ensuring that all instructions are followed to avoid delays in processing.

Steps to complete the Hartford Funds Simple IRA Investment Transmittal Form

Completing the Hartford Funds Simple IRA Investment Transmittal Form involves several key steps:

- Review the form for clarity on required sections.

- Provide personal information, including name, address, and account number.

- Indicate the investment amounts and specific funds to be allocated.

- Check for accuracy and completeness before submission.

- Submit the form according to the provided instructions, either online or by mail.

Required Documents

When filling out the Hartford Funds Simple IRA Investment Transmittal Form, certain documents may be required to ensure proper processing. These documents can include:

- A valid government-issued ID for identity verification.

- Proof of income or employment, if applicable.

- Any previous investment statements that may aid in completing the form.

Form Submission Methods

The Hartford Funds Simple IRA Investment Transmittal Form can typically be submitted through various methods to accommodate user preferences. Common submission methods include:

- Online submission through the Hartford Funds website, which may offer a streamlined process.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at a Hartford Funds office, if available.

Eligibility Criteria

Eligibility to use the Hartford Funds Simple IRA Investment Transmittal Form generally requires that the individual is enrolled in a Simple IRA plan. Additional criteria may include:

- Being an employee of a qualifying employer that offers a Simple IRA.

- Meeting age and income requirements set forth by the IRS.

Create this form in 5 minutes or less

Find and fill out the correct hartford funds simple ira investment transmittal form

Create this form in 5 minutes!

How to create an eSignature for the hartford funds simple ira investment transmittal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hartford Funds Simple Ira Investment Transmittal Form?

The Hartford Funds Simple Ira Investment Transmittal Form is a document used to facilitate the investment process into a Simple IRA account. It allows investors to easily submit their contributions and manage their retirement savings efficiently. By using this form, you can ensure that your investments are processed correctly and in a timely manner.

-

How do I complete the Hartford Funds Simple Ira Investment Transmittal Form?

To complete the Hartford Funds Simple Ira Investment Transmittal Form, you will need to provide your personal information, including your Social Security number and account details. Follow the instructions carefully to ensure all required fields are filled out accurately. Once completed, you can submit the form electronically or via mail.

-

Are there any fees associated with the Hartford Funds Simple Ira Investment Transmittal Form?

Typically, there are no fees directly associated with submitting the Hartford Funds Simple Ira Investment Transmittal Form. However, it's important to review the specific terms and conditions of your Simple IRA account, as there may be management fees or other costs related to your investments. Always check with your financial advisor for detailed information.

-

What are the benefits of using the Hartford Funds Simple Ira Investment Transmittal Form?

Using the Hartford Funds Simple Ira Investment Transmittal Form streamlines the investment process, making it easier for you to manage your retirement savings. It ensures that your contributions are accurately recorded and processed, helping you stay on track with your retirement goals. Additionally, it provides a clear record of your investments for future reference.

-

Can I integrate the Hartford Funds Simple Ira Investment Transmittal Form with other financial tools?

Yes, the Hartford Funds Simple Ira Investment Transmittal Form can be integrated with various financial management tools and software. This integration allows for seamless tracking of your investments and simplifies the overall management of your Simple IRA. Check with your financial service provider for specific integration options.

-

Is the Hartford Funds Simple Ira Investment Transmittal Form secure?

Absolutely, the Hartford Funds Simple Ira Investment Transmittal Form is designed with security in mind. When submitted electronically, it utilizes encryption and secure protocols to protect your personal information. Always ensure you are using a secure connection when submitting sensitive documents online.

-

How long does it take to process the Hartford Funds Simple Ira Investment Transmittal Form?

The processing time for the Hartford Funds Simple Ira Investment Transmittal Form can vary, but typically it takes a few business days. Once submitted, you will receive confirmation of your investment, allowing you to track its status. For the most accurate timeline, consult with your financial advisor or the Hartford Funds customer service.

Get more for Hartford Funds Simple Ira Investment Transmittal Form

- Excellus claim form

- Tool 123 template for physicians letter to the child adolescents form

- 2020 patient information amp permanent lifetime signature

- Chiropractic concepts chiropractor in gering ne us form

- The national violent death reporting system an exciting new form

- Aap project echo case presentation form aaporg

- Cardiac diagnostic heart catheterization imaging request form

- Trustmark insurance claim form

Find out other Hartford Funds Simple Ira Investment Transmittal Form

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit