Hartford Simple Ira 2024

What is the Hartford Simple IRA

The Hartford Simple IRA is a retirement savings plan designed for small businesses and self-employed individuals. It allows employees to contribute a portion of their salary to a retirement account, while employers can also contribute to their employees' accounts. This plan is particularly appealing due to its simplicity and lower administrative costs compared to other retirement plans. The contributions made to a Simple IRA are tax-deferred, meaning that taxes are not paid on the money until it is withdrawn during retirement.

How to use the Hartford Simple IRA

To effectively use the Hartford Simple IRA, employees must first enroll in the plan offered by their employer. Once enrolled, they can choose to contribute a percentage of their salary, up to a specified limit set by the IRS. Employers are required to match employee contributions up to a certain percentage or provide a flat contribution. The funds in the account can be invested in various financial instruments, such as stocks, bonds, or mutual funds, allowing for potential growth over time.

Steps to complete the Hartford Simple IRA

Completing the Hartford Simple IRA involves several key steps:

- Employer Setup: The employer must establish the Simple IRA plan and provide employees with necessary information.

- Employee Enrollment: Employees need to fill out an enrollment form to participate in the plan.

- Contribution Selection: Employees must decide on their contribution percentage, adhering to IRS limits.

- Investment Choices: Employees can select from various investment options offered within the plan.

- Regular Contributions: Both employee and employer contributions should be made regularly to maximize retirement savings.

Eligibility Criteria

Eligibility for the Hartford Simple IRA is generally limited to small businesses with fewer than one hundred employees. Employees must have earned at least five thousand dollars in compensation during any two preceding years and expect to earn at least five thousand dollars in the current year. This plan is designed to encourage savings among employees while providing tax benefits for both employees and employers.

IRS Guidelines

The Internal Revenue Service (IRS) sets specific guidelines for the Hartford Simple IRA, including contribution limits, withdrawal rules, and penalties for early withdrawal. For the current tax year, employees can contribute up to a specified limit, which is adjusted annually. Employers must adhere to matching contribution requirements and provide employees with a summary of the plan's features and benefits. Understanding these guidelines is crucial for both employers and employees to ensure compliance and maximize retirement savings.

Required Documents

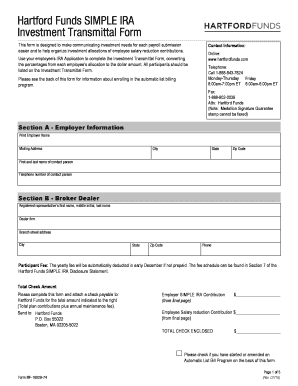

To set up and maintain a Hartford Simple IRA, several documents are typically required:

- Plan Adoption Agreement: This document outlines the terms of the Simple IRA plan established by the employer.

- Employee Enrollment Forms: Forms that employees must complete to participate in the plan.

- Contribution Records: Documentation of employee and employer contributions made to the accounts.

- Investment Statements: Regular statements detailing the performance of the investments within the Simple IRA.

Create this form in 5 minutes or less

Find and fill out the correct hartford simple ira 59225429

Create this form in 5 minutes!

How to create an eSignature for the hartford simple ira 59225429

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Hartford Simple IRA?

A Hartford Simple IRA is a retirement savings plan designed for small businesses and their employees. It allows employees to contribute a portion of their salary to a retirement account, with the employer also making contributions. This plan is easy to set up and maintain, making it an attractive option for businesses looking to offer retirement benefits.

-

How does the Hartford Simple IRA benefit my employees?

The Hartford Simple IRA provides employees with a straightforward way to save for retirement while enjoying tax advantages. Contributions are made pre-tax, reducing taxable income, and the funds grow tax-deferred until withdrawal. This encourages employees to save more effectively for their future.

-

What are the costs associated with setting up a Hartford Simple IRA?

Setting up a Hartford Simple IRA typically involves minimal costs, making it a cost-effective solution for small businesses. There may be administrative fees, but these are generally lower than those associated with other retirement plans. It's advisable to consult with a financial advisor to understand all potential costs.

-

Can I integrate the Hartford Simple IRA with airSlate SignNow?

Yes, you can integrate the Hartford Simple IRA with airSlate SignNow to streamline document management and eSigning processes. This integration allows for efficient handling of retirement plan documents, ensuring compliance and ease of access for both employers and employees. Utilizing airSlate SignNow enhances the overall experience of managing a Hartford Simple IRA.

-

What features does the Hartford Simple IRA offer?

The Hartford Simple IRA offers features such as employee salary deferral contributions, employer matching contributions, and easy portability for employees who change jobs. Additionally, it provides a straightforward setup process and minimal administrative requirements, making it an ideal choice for small businesses looking to offer retirement benefits.

-

What are the contribution limits for a Hartford Simple IRA?

For 2023, the contribution limit for a Hartford Simple IRA is $15,500 for employees under age 50, with an additional catch-up contribution of $3,500 for those aged 50 and over. Employers are required to match contributions up to 3% of employee salaries or make a 2% non-elective contribution. These limits help ensure that employees can save adequately for retirement.

-

How does the Hartford Simple IRA compare to other retirement plans?

The Hartford Simple IRA is often simpler and less costly to administer than other retirement plans like 401(k)s. It is specifically designed for small businesses, making it easier to manage with fewer regulatory requirements. This makes it an attractive option for employers who want to provide retirement benefits without the complexity of larger plans.

Get more for Hartford Simple Ira

Find out other Hartford Simple Ira

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online