Borrowers Authorization Forms Fillable 2007-2026

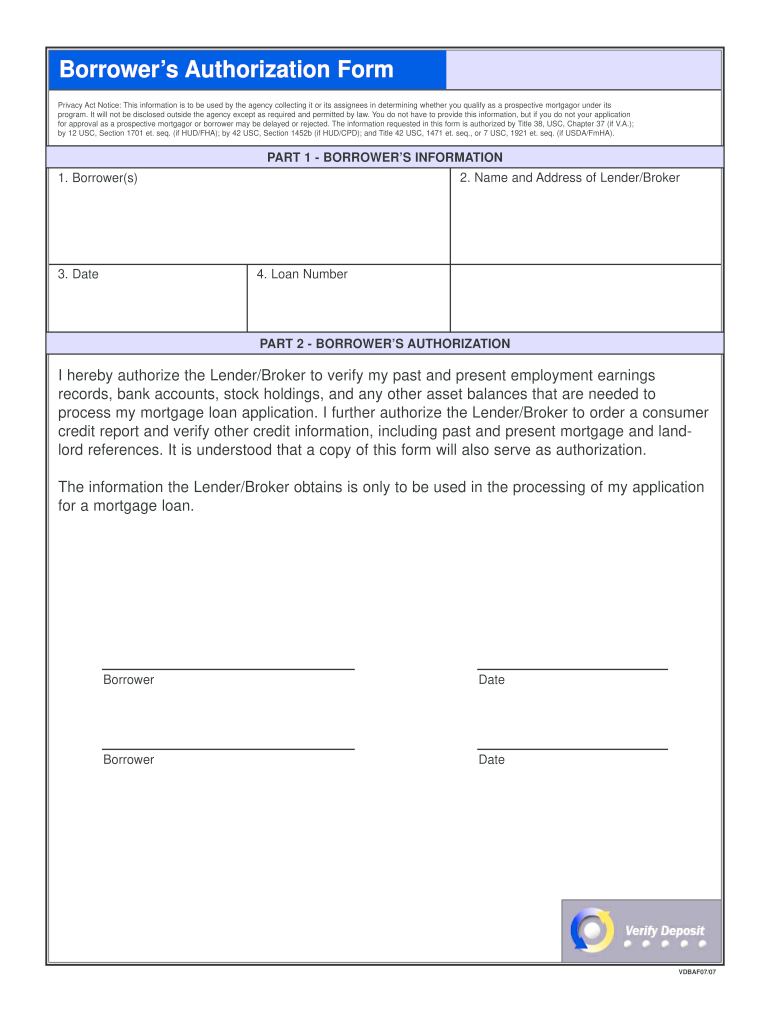

What is the borrower authorization form?

The borrower authorization form is a legal document that allows a lender or third party to access a borrower's financial information. This form is essential in various transactions, particularly in the mortgage industry, where it facilitates the release of loan information. By signing this form, borrowers give permission for their financial details, such as credit history and income verification, to be shared with authorized entities. This process is crucial for loan approval and ensures that lenders have the necessary information to assess the borrower's creditworthiness.

Key elements of the borrower authorization form

Understanding the key elements of the borrower authorization form is vital for ensuring its effectiveness. The essential components typically include:

- Borrower Information: This section captures the borrower's full name, address, and contact details.

- Authorization Statement: A clear statement granting permission for the lender or third party to access specified financial information.

- Duration of Authorization: Indicates how long the authorization remains valid, which can vary based on the lender's requirements.

- Signature and Date: The borrower's signature and the date of signing, confirming consent.

These elements ensure that the form is legally binding and that all parties understand the scope of the authorization.

Steps to complete the borrower authorization form

Completing the borrower authorization form involves several straightforward steps:

- Gather Required Information: Collect all necessary details, including personal information and any relevant financial data.

- Fill Out the Form: Enter the information accurately in the designated fields of the form.

- Review the Document: Check for any errors or omissions to ensure the information is complete and correct.

- Sign and Date: Provide your signature and the date to validate the authorization.

- Submit the Form: Send the completed form to the lender or relevant party as instructed.

Following these steps helps ensure that the authorization is processed smoothly and efficiently.

Legal use of the borrower authorization form

The borrower authorization form is legally recognized under various regulations, including the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws affirm the validity of electronic signatures and ensure that the form can be used in digital transactions. It is crucial for borrowers to understand that by signing this form, they are granting legal permission for their financial information to be accessed, which can impact their credit and loan approval process.

How to obtain the borrower authorization form

Obtaining the borrower authorization form is a straightforward process. Borrowers can typically acquire the form through the following methods:

- From Lenders: Most lenders provide their own version of the borrower authorization form, which can be requested directly.

- Online Resources: Various financial websites offer downloadable templates of the borrower authorization form.

- Legal Advisors: Consulting with a legal professional can also provide access to standardized forms tailored to specific needs.

Ensuring that the correct version of the form is used is essential for compliance and legal validity.

Examples of using the borrower authorization form

The borrower authorization form is commonly used in several scenarios, including:

- Mortgage Applications: When applying for a mortgage, lenders require access to the borrower's financial history to assess eligibility.

- Loan Modifications: Borrowers seeking to modify their existing loans may need to authorize the lender to review their current financial situation.

- Refinancing: In refinancing scenarios, the borrower authorization form allows lenders to evaluate the borrower's creditworthiness based on updated financial information.

These examples illustrate the form's importance in facilitating various financial transactions while ensuring compliance with legal requirements.

Quick guide on how to complete mortgage authorization form fillable

The optimal method to obtain and endorse Borrowers Authorization Forms Fillable

Across the entirety of your organization, ineffective workflows surrounding document endorsement can consume a signNow amount of time. Signing documents such as Borrowers Authorization Forms Fillable is an inherent aspect of operations in any sector, which is why the effectiveness of each contract’s lifecycle impacts the overall productivity of the business. With airSlate SignNow, endorsing your Borrowers Authorization Forms Fillable can be as straightforward and rapid as possible. This platform provides the latest version of nearly any document. Even better, you can sign it immediately without the necessity of installing external software on your computer or printing any physical copies.

Steps to obtain and endorse your Borrowers Authorization Forms Fillable

- Explore our repository by category or utilize the search bar to locate the document you require.

- View the document preview by clicking on Learn more to ensure it is the correct one.

- Click Get form to start editing without delay.

- Fill out your document and include any necessary details using the toolbar.

- Once complete, click the Sign tool to endorse your Borrowers Authorization Forms Fillable.

- Choose the signature method that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to conclude editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documents effectively. You can find, complete, modify, and even send your Borrowers Authorization Forms Fillable in a single tab effortlessly. Simplify your workflows by employing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How can I fill out the authorization form in Wipro's synergy?

By authorisation form I assume that you mean LOA. Just download the pdf and sign it with stylus or get a printout,sign it and scan the copy.Now upload it!If I my assumption is wrong please provide little clear picture!Thank you!Allah maalik!

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

What does the authorization form in Wipro’s Synergy need to be filled out?

I don't exactly remember how the form was looking like in synergy portal. But I hope it is Authorizing Wipro to do background verification on all the details provided by candidate. It needs your name and signature with date.

Create this form in 5 minutes!

How to create an eSignature for the mortgage authorization form fillable

How to create an electronic signature for the Mortgage Authorization Form Fillable in the online mode

How to make an eSignature for your Mortgage Authorization Form Fillable in Google Chrome

How to generate an eSignature for signing the Mortgage Authorization Form Fillable in Gmail

How to generate an eSignature for the Mortgage Authorization Form Fillable straight from your smart phone

How to create an electronic signature for the Mortgage Authorization Form Fillable on iOS

How to make an electronic signature for the Mortgage Authorization Form Fillable on Android devices

People also ask

-

What are Borrowers Authorization Forms Fillable and how do they work?

Borrowers Authorization Forms Fillable are customizable documents that allow borrowers to grant permission for their personal information to be shared with lenders or other parties. With airSlate SignNow, you can easily create, edit, and send these forms, ensuring a seamless process for both borrowers and lenders.

-

How can airSlate SignNow help me create Borrowers Authorization Forms Fillable?

airSlate SignNow provides an intuitive platform where you can quickly design Borrowers Authorization Forms Fillable using pre-built templates or by starting from scratch. The drag-and-drop functionality simplifies the customization process, allowing you to add fields, text, and eSignature options with ease.

-

Are there any costs associated with using airSlate SignNow for Borrowers Authorization Forms Fillable?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You can choose a plan that suits your budget while benefiting from features like unlimited document signing and access to Borrowers Authorization Forms Fillable, ensuring you get great value for your investment.

-

Can I integrate airSlate SignNow with other software for Borrowers Authorization Forms Fillable?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as CRM systems and cloud storage services. This integration allows you to streamline the process of managing Borrowers Authorization Forms Fillable and enhance your overall workflow.

-

What benefits do Borrowers Authorization Forms Fillable provide?

Borrowers Authorization Forms Fillable enhance efficiency by enabling quick approvals and reducing paperwork. They also improve security and compliance, as they can be signed electronically, ensuring that sensitive information is handled properly and securely.

-

Is it easy to share Borrowers Authorization Forms Fillable with clients?

Yes, sharing Borrowers Authorization Forms Fillable through airSlate SignNow is straightforward. You can send documents via email or share links, making it easy for your clients to review and sign the forms, regardless of their location.

-

Can I track the status of Borrowers Authorization Forms Fillable sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features for all your Borrowers Authorization Forms Fillable. You will receive notifications when the document is viewed or signed, allowing you to stay updated on the progress of your requests.

Get more for Borrowers Authorization Forms Fillable

- Epp recommendation la 3009 hawai i teacher standards board form

- Birth certificate request formpdf

- Brighton hotel function package downloadsalhgroupinfo downloads alhgroup form

- Hiv test form 2013

- Time block chart cobtools nmsu form

- Dh 4159 florida department of health form

- Tran eligibility form

- Wells fargo amp company 401k plan loan payment form

Find out other Borrowers Authorization Forms Fillable

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself