Qualified Personal Residence Trust Form

What is the Qualified Personal Residence Trust Form

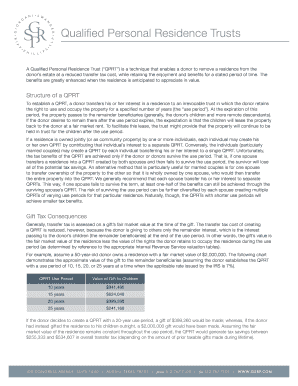

The Qualified Personal Residence Trust Form is a legal document used to establish a trust that allows individuals to transfer their personal residence into a trust while retaining the right to live in the home for a specified period. This form is particularly beneficial for estate planning, as it helps reduce the taxable value of an estate, thereby minimizing estate taxes upon the individual's passing. By creating this trust, the grantor can ensure that the residence is passed on to beneficiaries while potentially avoiding significant tax implications.

How to use the Qualified Personal Residence Trust Form

Using the Qualified Personal Residence Trust Form involves several steps. First, the grantor must decide on the terms of the trust, including the duration for which they will retain the right to live in the residence. Next, the grantor completes the form, detailing the property and the beneficiaries. Once the form is filled out, it must be signed and notarized to ensure its legal validity. Afterward, the trust should be funded by transferring the title of the residence into the trust. This process ensures that the property is managed according to the trust's terms.

Steps to complete the Qualified Personal Residence Trust Form

Completing the Qualified Personal Residence Trust Form requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the property, including the address and legal description.

- Identify the beneficiaries who will inherit the residence.

- Determine the length of time the grantor will retain the right to live in the home.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign the form in the presence of a notary public to validate the document.

- Transfer the title of the property into the trust to complete the process.

Key elements of the Qualified Personal Residence Trust Form

Several key elements are essential when filling out the Qualified Personal Residence Trust Form. These include:

- The name and address of the grantor, who establishes the trust.

- The names of the beneficiaries who will receive the property upon the grantor's death.

- The specific property being placed into the trust, including its legal description.

- The duration of the grantor's right to reside in the property.

- Provisions for managing the property during the trust period.

Legal use of the Qualified Personal Residence Trust Form

The Qualified Personal Residence Trust Form is legally recognized in the United States and must comply with state laws regarding trusts and estate planning. It is crucial that the form is executed correctly to ensure its enforceability. The trust must be irrevocable, meaning that once the property is transferred into the trust, the grantor cannot reclaim it. This legal structure provides clarity and security for both the grantor and the beneficiaries, ensuring that the property is managed according to the grantor's wishes.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Qualified Personal Residence Trust Form. It is essential for the grantor to understand the tax implications of transferring a residence into a trust. The IRS may require that the trust be structured in a way that meets certain criteria to qualify for favorable tax treatment. Additionally, the grantor must report the trust on their tax returns, and any income generated from the property may be subject to taxation. Consulting with a tax professional can help ensure compliance with IRS regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the qualified personal residence trust form 38020327

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Qualified Personal Residence Trust Form?

A Qualified Personal Residence Trust Form is a legal document that allows individuals to transfer their personal residence into a trust while retaining the right to live in it for a specified period. This form is essential for estate planning, as it helps reduce the taxable value of the estate and can provide signNow tax benefits.

-

How can I create a Qualified Personal Residence Trust Form using airSlate SignNow?

Creating a Qualified Personal Residence Trust Form with airSlate SignNow is straightforward. You can easily customize templates, fill in the necessary details, and eSign the document securely. Our platform provides an intuitive interface that simplifies the entire process.

-

What are the benefits of using a Qualified Personal Residence Trust Form?

Using a Qualified Personal Residence Trust Form can help you minimize estate taxes and protect your assets. By transferring your residence into a trust, you can also ensure that your property is passed on to your beneficiaries according to your wishes, while retaining the right to live in it during your lifetime.

-

Is there a cost associated with the Qualified Personal Residence Trust Form on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for creating a Qualified Personal Residence Trust Form. However, our pricing is competitive and offers great value for the features provided, including secure eSigning and document management. You can choose from various subscription plans based on your needs.

-

Can I integrate the Qualified Personal Residence Trust Form with other applications?

Absolutely! airSlate SignNow allows seamless integration with various applications, making it easy to manage your Qualified Personal Residence Trust Form alongside other documents and workflows. You can connect with popular tools like Google Drive, Dropbox, and more to streamline your document management process.

-

What features does airSlate SignNow offer for the Qualified Personal Residence Trust Form?

airSlate SignNow offers a range of features for the Qualified Personal Residence Trust Form, including customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the efficiency of your estate planning process and ensure that your documents are handled securely.

-

How does airSlate SignNow ensure the security of my Qualified Personal Residence Trust Form?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure cloud storage to protect your Qualified Personal Residence Trust Form and other sensitive documents. Additionally, our platform complies with industry standards to ensure your data remains confidential and secure.

Get more for Qualified Personal Residence Trust Form

- Legg mason beneficiary audit worksheet form

- Hsf master claim form

- Demonstration and illustrated talks score sheet florida 4 h form

- Activity assessment forms

- Rental agreement and release of liability mountain high form

- Mentee assignment notice district 25 toastmasters d25toastmasters form

- Applicsion cum appraisalsanction form

- Software endr license agreement template form

Find out other Qualified Personal Residence Trust Form

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure