Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return of Fare Media Treasury

Understanding the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury

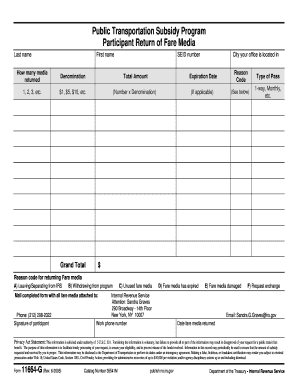

The Form 11664 G Rev 3 is a crucial document for participants in the Public Transportation Subsidy Program. This form is designed to facilitate the return of fare media to the Treasury, ensuring that participants can receive reimbursements for their public transportation expenses. The form collects essential information about the participant, including their identification details, the amount of fare media being returned, and any relevant transportation agency information. Understanding the purpose and requirements of this form is vital for ensuring compliance and maximizing benefits from the subsidy program.

Steps to Complete the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury

Completing the Form 11664 G Rev 3 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including your identification and any receipts related to the fare media. Next, fill out the participant information section, providing your full name, address, and contact details. In the fare media section, specify the type and amount of fare media you are returning. Be sure to double-check all entries for accuracy. Finally, sign and date the form before submitting it to the appropriate agency. Following these steps carefully will help streamline the process and avoid potential delays.

Eligibility Criteria for the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury

To be eligible for using the Form 11664 G Rev 3, participants must meet specific criteria set forth by the Public Transportation Subsidy Program. Generally, eligibility includes being an employee of a qualifying organization that participates in the subsidy program. Participants should also demonstrate that they have incurred transportation costs that qualify for reimbursement. It is important to review the specific eligibility requirements outlined by the program to ensure compliance and avoid issues during the reimbursement process.

Required Documents for the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury

When submitting the Form 11664 G Rev 3, participants must include certain documents to support their claims. Required documents typically include proof of fare media purchases, such as receipts or tickets, and identification verification, such as a government-issued ID. Participants may also need to provide documentation from their employer confirming their eligibility for the subsidy program. Ensuring that all required documents are included with the form can expedite the processing of reimbursements and reduce the likelihood of delays.

Form Submission Methods for the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury

Participants can submit the Form 11664 G Rev 3 through various methods, depending on the guidelines provided by the Public Transportation Subsidy Program. Common submission methods include mailing the completed form to the designated agency, submitting it in person at a local office, or using an online submission portal if available. It is essential to follow the specific instructions for submission to ensure that the form is processed efficiently and that reimbursements are received promptly.

Legal Use of the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury

The Form 11664 G Rev 3 is legally recognized for participants in the Public Transportation Subsidy Program. It serves as an official document for returning fare media and requesting reimbursements. Proper use of this form is essential to comply with federal and state regulations governing transportation subsidies. Participants should ensure that all information provided is accurate and truthful to avoid potential legal issues or penalties related to fraud or misrepresentation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 11664 g rev 3 public transportation subsidy program participant return of fare media treasury

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury?

The Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury is a document used by participants in the public transportation subsidy program to report and return fare media. This form ensures that participants comply with program requirements and helps streamline the reimbursement process.

-

How can airSlate SignNow assist with the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury?

airSlate SignNow provides an efficient platform for electronically signing and submitting the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury. Our solution simplifies the document management process, allowing users to complete and send forms quickly and securely.

-

What are the pricing options for using airSlate SignNow for the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large organization, you can choose a plan that fits your budget while ensuring you can efficiently manage the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury.

-

What features does airSlate SignNow offer for managing the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury. These tools enhance productivity and ensure compliance with program requirements.

-

Are there any integrations available for airSlate SignNow when handling the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, making it easier to manage the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury. This allows users to streamline their workflows and enhance collaboration across different tools.

-

What are the benefits of using airSlate SignNow for the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury?

Using airSlate SignNow for the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and delivered promptly.

-

Is airSlate SignNow user-friendly for completing the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury. Our intuitive interface allows users to navigate the process effortlessly.

Get more for Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury

Find out other Form 11664 G Rev 3 Public Transportation Subsidy Program Participant Return Of Fare Media Treasury

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation