Ct Annual Report Form

What is the Ct Annual Report Form

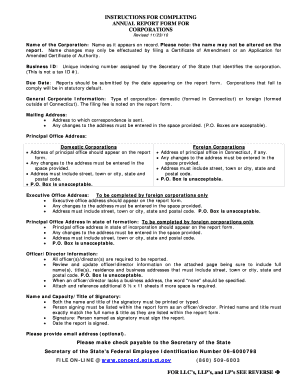

The Ct Annual Report Form is a legal document required for businesses registered in Connecticut. This form serves to provide the state with essential information about the business, including its current status, financial condition, and operational details. It is typically filed by various business entities, such as corporations, limited liability companies (LLCs), and partnerships, to maintain compliance with state regulations.

Steps to complete the Ct Annual Report Form

Completing the Ct Annual Report Form involves several key steps:

- Gather necessary information, such as the business name, address, and identification number.

- Provide details about the business structure, including ownership and management information.

- Include financial data, such as revenue and assets, as required by the state.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines for the Ct Annual Report Form. Typically, the report is due on the anniversary of the business's formation. Failure to file by this deadline may result in penalties or administrative dissolution of the business entity. Keeping track of these dates ensures compliance and helps avoid unnecessary complications.

Form Submission Methods

The Ct Annual Report Form can be submitted through various methods to accommodate different preferences:

- Online: Businesses can file the form electronically through the Connecticut Secretary of State's website.

- Mail: The completed form can be printed and sent via postal service to the appropriate state office.

- In-Person: Businesses may also choose to deliver the form directly to the state office.

Key elements of the Ct Annual Report Form

The Ct Annual Report Form includes several key elements that must be accurately filled out:

- Business Information: Name, address, and identification number.

- Management Details: Names and addresses of directors and officers.

- Financial Information: Revenue, assets, and any other financial disclosures required.

Penalties for Non-Compliance

Failure to file the Ct Annual Report Form on time can lead to significant penalties. These may include late fees, loss of good standing, and even administrative dissolution of the business. Understanding these consequences emphasizes the importance of timely and accurate filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct annual report form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct Annual Report Form?

The Ct Annual Report Form is a document required by the state of Connecticut for businesses to report their financial status and other essential information annually. Completing this form is crucial for maintaining good standing with the state and ensuring compliance with local regulations.

-

How can airSlate SignNow help with the Ct Annual Report Form?

airSlate SignNow provides an easy-to-use platform for businesses to complete and eSign the Ct Annual Report Form efficiently. With our solution, you can streamline the document preparation process, ensuring that your report is submitted accurately and on time.

-

What are the pricing options for using airSlate SignNow for the Ct Annual Report Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need a basic plan for occasional use or a comprehensive solution for frequent document management, our pricing is designed to be cost-effective while providing all the necessary features for handling the Ct Annual Report Form.

-

Are there any features specifically designed for the Ct Annual Report Form?

Yes, airSlate SignNow includes features tailored for the Ct Annual Report Form, such as customizable templates, automated reminders, and secure eSigning capabilities. These features help ensure that your report is completed accurately and submitted on time, reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for the Ct Annual Report Form?

Using airSlate SignNow for the Ct Annual Report Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the entire process, allowing you to focus on your business while ensuring compliance with state requirements.

-

Can I integrate airSlate SignNow with other tools for managing the Ct Annual Report Form?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications, making it easy to manage the Ct Annual Report Form alongside your other workflows. This integration capability enhances productivity and ensures that all your documents are organized and accessible.

-

Is it easy to eSign the Ct Annual Report Form using airSlate SignNow?

Yes, eSigning the Ct Annual Report Form with airSlate SignNow is straightforward and user-friendly. Our platform allows you to sign documents electronically from any device, ensuring that you can complete your report quickly and efficiently, no matter where you are.

Get more for Ct Annual Report Form

Find out other Ct Annual Report Form

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe