Refund Application 2022-2026

What is the Refund Application

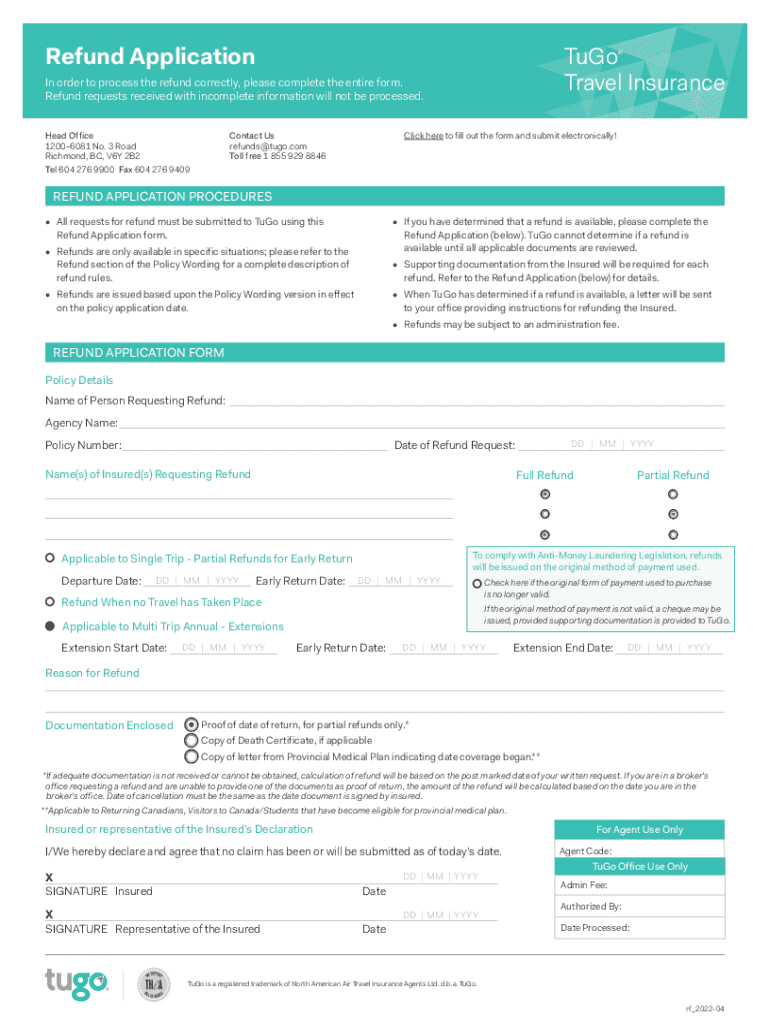

The Refund Application is a formal request submitted by individuals or businesses seeking the return of overpaid taxes or fees. This application is essential for ensuring that taxpayers receive the funds they are entitled to from the government. It typically includes details about the taxpayer, the amount to be refunded, and the reason for the request. Understanding the purpose and function of this application is crucial for anyone looking to reclaim funds efficiently.

Steps to complete the Refund Application

Completing the Refund Application involves several clear steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of payment and identification. Next, fill out the application form meticulously, ensuring that all information is correct and complete. After completing the form, review it for any errors. Finally, submit the application through the appropriate channels, whether online, by mail, or in person, depending on the specific requirements.

Required Documents

When submitting a Refund Application, certain documents are typically required to support the request. These may include:

- Proof of payment, such as receipts or bank statements

- Identification documents, such as a driver's license or Social Security card

- Any relevant tax forms that pertain to the refund

- Additional documentation that may be specified by the issuing authority

Ensuring that all required documents are included can expedite the processing of the application.

Form Submission Methods

The Refund Application can be submitted through various methods, depending on the issuing authority's guidelines. Common submission methods include:

- Online: Many agencies provide an online portal for electronic submissions, which is often the fastest method.

- Mail: Applicants can send the completed form and supporting documents via postal service. It is advisable to use certified mail for tracking.

- In-Person: Some applicants may choose to submit their application directly at local offices, which can provide immediate confirmation of receipt.

Choosing the right submission method can impact how quickly the application is processed.

Eligibility Criteria

Eligibility for submitting a Refund Application typically depends on several factors, including the type of tax or fee paid and the specific circumstances surrounding the overpayment. Generally, applicants must demonstrate that they have overpaid and provide sufficient evidence to support their claim. It is important to review the eligibility criteria outlined by the relevant tax authority to ensure compliance.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing and submitting a Refund Application for federal taxes. These guidelines include:

- Instructions on which forms to use based on the type of tax

- Deadlines for submitting refund requests

- Information on how to track the status of a refund

Familiarizing oneself with these guidelines can help ensure that the application process is smooth and successful.

Application Process & Approval Time

The application process for a Refund Application typically involves several stages, including submission, review, and approval. After submission, the relevant authority will review the application and supporting documents. The approval time can vary based on the complexity of the case and the volume of applications being processed. Generally, applicants can expect a response within a few weeks to several months, depending on the specifics of their situation.

Create this form in 5 minutes or less

Find and fill out the correct refund application 787171305

Create this form in 5 minutes!

How to create an eSignature for the refund application 787171305

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Refund Application in airSlate SignNow?

A Refund Application in airSlate SignNow refers to the process of submitting a request for a refund for services or products purchased. This feature allows users to easily manage their transactions and ensure they receive their funds back promptly. By utilizing our platform, businesses can streamline their refund processes efficiently.

-

How do I submit a Refund Application using airSlate SignNow?

To submit a Refund Application using airSlate SignNow, simply log into your account and navigate to the 'Refunds' section. Fill out the required information regarding your purchase and the reason for the refund. Once submitted, our team will review your application and respond accordingly.

-

Are there any fees associated with the Refund Application process?

No, there are no fees associated with submitting a Refund Application through airSlate SignNow. We believe in providing a transparent and user-friendly experience, ensuring that our customers can request refunds without incurring additional costs. Your satisfaction is our priority.

-

How long does it take to process a Refund Application?

The processing time for a Refund Application typically takes 5-7 business days. Once your application is submitted, our team will review it and notify you of the status. We strive to handle all requests promptly to ensure a smooth experience for our users.

-

Can I track the status of my Refund Application?

Yes, you can track the status of your Refund Application within your airSlate SignNow account. After submitting your request, you will receive updates via email, and you can also check the 'Refunds' section for real-time status updates. This feature keeps you informed throughout the process.

-

What documents do I need to provide for a Refund Application?

When submitting a Refund Application, you may need to provide proof of purchase, such as a receipt or invoice, along with any relevant details regarding the transaction. This information helps us process your request more efficiently. Ensure all documents are clear and legible for a smoother experience.

-

Is the Refund Application feature available on all pricing plans?

Yes, the Refund Application feature is available on all pricing plans offered by airSlate SignNow. We believe in providing equal access to essential features for all our users, regardless of their subscription level. This ensures that everyone can manage their transactions effectively.

Get more for Refund Application

- Statement of personal history washington county co washington or form

- Mcsa 5889 form

- Stock transfer form uk collective investment schemes

- Dd form 2883 credit worthiness evaluation july 2004 dtic

- Isp 3026 formpdffillercom 2015 2019

- Canada pension plan credit split sc isp 1901 e servicecanada gc form

- Where to send sc isp 1200 form

- Penndot form p 329

Find out other Refund Application

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document