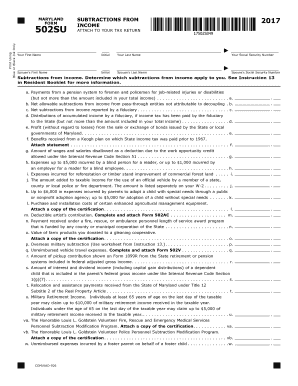

State & Local Tax Forms & Instructions Comptroller of

What is the State & Local Tax Forms & Instructions Comptroller Of

The State & Local Tax Forms & Instructions Comptroller Of are essential documents used by individuals and businesses in the United States to report their income and calculate their tax obligations to state and local authorities. These forms provide specific guidelines on how to accurately fill out tax information, ensuring compliance with state tax laws. They may include various forms tailored to different types of taxpayers, such as individuals, corporations, and partnerships, each with unique requirements and instructions.

Steps to complete the State & Local Tax Forms & Instructions Comptroller Of

Completing the State & Local Tax Forms & Instructions requires careful attention to detail. Here are the key steps:

- Gather all necessary documents, including income statements, previous tax returns, and any relevant financial records.

- Review the specific form you need to fill out, as each form has distinct instructions and requirements.

- Accurately enter your personal information, including your name, address, and Social Security number.

- Report your income, deductions, and credits as outlined in the instructions.

- Double-check your entries for accuracy before submitting the form.

- Sign and date the form where required, ensuring that all necessary signatures are included.

Legal use of the State & Local Tax Forms & Instructions Comptroller Of

Using the State & Local Tax Forms & Instructions is legally binding when completed accurately and submitted on time. These forms must adhere to the regulations set forth by state tax authorities. Failure to comply with these regulations can result in penalties or legal repercussions. It is crucial to ensure that all information provided is truthful and complete, as discrepancies may lead to audits or other legal actions.

Form Submission Methods (Online / Mail / In-Person)

There are several methods to submit the State & Local Tax Forms & Instructions, providing flexibility for taxpayers. Common submission methods include:

- Online Submission: Many states offer electronic filing options, allowing users to submit their forms directly through state tax websites.

- Mail: Taxpayers can print their completed forms and send them via postal mail to the appropriate tax office.

- In-Person: Some individuals may choose to deliver their forms in person at designated tax offices, which can provide immediate confirmation of receipt.

Filing Deadlines / Important Dates

Filing deadlines for the State & Local Tax Forms & Instructions vary by state and type of taxpayer. Generally, individual income tax returns are due on April 15 each year, while business tax deadlines may differ. It is important to stay informed about specific deadlines to avoid late fees or penalties. Taxpayers should also be aware of any extensions that may be available, which can provide additional time for filing.

Key elements of the State & Local Tax Forms & Instructions Comptroller Of

Understanding the key elements of the State & Local Tax Forms & Instructions is essential for accurate completion. Important components often include:

- Personal Information: This section requires basic details about the taxpayer, such as name, address, and identification numbers.

- Income Reporting: Taxpayers must report all sources of income, including wages, dividends, and self-employment earnings.

- Deductions and Credits: This area allows taxpayers to claim eligible deductions and credits, which can reduce their overall tax liability.

- Signature Section: A signature is typically required to validate the form, confirming that the information provided is accurate and complete.

Quick guide on how to complete fill amp esign pdf

Effortlessly Prepare fill amp esign pdf on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary forms and securely save them online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without any holdups. Manage fill amp esign pdf on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to Edit and Electronically Sign fill amp sign with Ease

- Find forms amp instructions and click on Obtain Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Complete button to secure your modifications.

- Select your preferred method for sending the form—via email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign state amp local to ensure exceptional communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs state amp local

-

How much does it cost to start a 501(c)3 in NYC?

According to the Department of State, Division of Corporations, State Records, and UCC for New York, you must pay the statutory filing fee of $75 (as of July 2017) along with a small fee to check name availability.Filling out your non-profit forms accurately is very, very important. Ultimately, what you put in your documents may affect whether you are (or will remain) tax-exempt. Now, with that being said, your state documents aren’t the only documents you must complete. You must also fill out an Application for Recognition of Exemption with the IRS. Some non-profits are eligible to fill out a streamlined version, but you should talk with an attorney or tax professional to determine which one you should complete.You may also be required to obtain certain permits or licenses in New York (at either the city or the state level). This depends on what your non-profit will do or sell in order to raise money. Without the right permits or licenses, your non-profit could be shut down.You also need to write bylaws and appoint directors to the non-profit. Directors are important and should be chosen with care. They make important business and financial decisions for your non-profit. They will also officially adopt the bylaws at the first board meeting. The bylaws explain how the non-profit will be ran.Because non-profits must remain in compliance with state and federal law, it’s a good idea to first speak with an attorney and maybe even consider allowing the attorney to fill out the documents. It’s really worth the price since the tax-exempt status of the non-profit can be affected by a mistake. If you’d like to speak with an experienced attorney, check out LawTrades. Our legal marketplace has helped connect many entrepreneurs with experienced, non-profit attorneys to get them up and running. Hope you give us a try!

-

How does WBJEE counselling work?

WBJEE counselling procedure is very much similar to the counselling procedure adopted in JEE MAINS. After obtaining a rank in the exam interested candidates will be required to generate username and password and will have to pay the registration fee. This registration fee will be non-refundable,which is around 500. After registration candidates will be required to fill their choices online through the website. After declaration of round 1 result a candidate will be left with 3 choices. 1- accept the seat and take admission in the allocated seat.2- consider the candidate for up-gradation to higher filled choices.3- surrender the seat and pull out yourself from the counselling procedure.candidates will have to report to the reporting center within the specified period of time and will have to submit their choices failing to do so in round 1 will automatically remove you from further consideration and you will loose your seat. For choices 1 & 2, candidates will have to pay seat acceptance fee which will be returned in further rounds if you opt for choice 3( but will have to report to the reporting center,otherwise the candidate will not be able to claim it).This procedure will be repeated for three rounds and extra rounds can be introduced if the counselling team feels the necessity of it.In last round you will be forced to either accept the allocated seat or surrender your seat.

-

What did you do after getting recommended from SSB?

What did you do after getting recommended from SSB?It was this day of 02nd July at SSB Bhopal when in second and last attempt I was recommended for training at OTA. Six months back, I was rejected at SSB Allahabad.When I was in the list of selected candidates, it was the biggest feeling of achievement. I had worked on it since last seven years. I had joined in the ranks of Indian Navy seven years back. After completing two years of basic training as Naval boy, I ventured onto realisation of alleviating my career from rank to Officer. I took admission for graduation as external candidate. I used to sail on board warship. I used to perform six hours duty and in next six hours of rest, I used to study for three hours and sleep for three hours. When i was in last year of the graduation, I attempted both simultaneously, the CDS exam and final year. I Passed both but got rejected in SSB. I had come to Allahabad from Andaman islands for SSB. Having been rejected, I decided not to show face to my father and went back to port Blair to be back with unit. I had one more chance . This time again I passed CDS and made it at SSB Bhopal.As I found my name in the list, I kept the happiness hidden as there were other candidates who were depressed as they could not make it.The first call I made was to my Commanding Officer. He was waiting for the news. I could hear him making announcement on PA system in unit lines about my selection. He ordered me “ Last time after you failed at SSB Allahabad, you didn't go on leave. Now proceed on two weeks leave from Bhopal. Spend time with family. After leave report at Chennai. I will have you flew in air force cargo plane to Port Blair.”I picked up my bag and left SSB centre for railway station. There was some hours left for departure of the train. It was drizzling. I went and sat in solitude at Lake Bhojtal. Closed eyes and thanked god for having bestowed on me what I dreamt. On the way, found shop selling army uniform and accessories.signNowed next day hometown of Aurangabad. Father and Mother were surprised at sudden appearance of me. I had smaller luggage. I used to always bring a defence made whiskey for father. This time I asked him to close eyes. I placed in his handIt took seconds for him to know what was it. He stood up like a young man and embraced me and started weeping. The joy of tears. The news was out in our village that someone first time is going to become officer in army. Two days later my birthday was celebrated amidst the entire village.I left after my leave was over. I reported back to Chennai. The CO had kept his promise.First time in life flew in air and that too in cargo plane.After two months, again the kind CO summoned me and asked me to pack up my bag and report to his office. He said “ I am sorry to inform you that your father has passed away. I am sanctioning you leave again. After rituals, report directly for training at OTA”. He personally dropped me at Port Blair Airport, never to be seen again later”.

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How can we fight against the NRA regarding gun control?

Are you sure that the NRA is the problem?Oh, I know that the media and the talking heads are all making them out to be some 500 lb gorilla and the reason psychos shoot up school yards, but have you ever bothered to look into the matter beyond the headlines?I’ll give you an example. In 2017, the push was for a “Universal Background Check”. The idea was to be sure that people buying guns were not criminals. Believe it or not, the NRA wholly supports this and in fact was involved with creating the current NICS (National Instant Check System) that is used.But the bill that was proposed was not what you heard in the media. First, it would not plug any “Gunshow Loophole” because there is no such thing. The only sales at a gun show that the bill covered was private sales. Of course, private sales can occur anywhere, not just gun shows.But the bill didn’t make the NICS easier for private sales. They just required all private sales to be conducted through a licensed dealer. Had this actually passed, a gun show would be an ideal location for such sales as there would be access to many dealer. In effect, you would greatly increase the number of private sales at a gun show by this law.So, what is involved with a sale through a dealer? Well, the dealer would have to do the following:1) Record the transfer in their bound book. This is a book where all the transactions of a firearm is recorded via that dealer. The book is auditable by the BATF and many dealers have faced fines for poorly kept records, so many dealers go to great pains to keep their book neat and accurate.2) Fill out the federal form 4473. This is required by all dealer sales of both new and used guns. It asks for the buyer’s name, address, the make and model of the gun, serial number, and then asks a bunch of questions. The dealer can get fined if the person fills out the form wrong. For example, answering a question with “Y” or “N” instead of “Yes” or “No” is a BATF violation. So the dealer has to carefully examine the form for errors and have the person fill out another if errors are found.3) The dealer then calls into the NICS. NICS can come back with a “Proceed”, “Denied” or “Delay”. A delay can take up to 3 days. Typically this is a name that appears similar to a Prohibited Person and requires some research. If this happens, the transfer is on hold. The dealer has no idea when the result of the research is likely to finish. If you are at a gun show, the show could be over before the approval is made.4) All this paperwork, verification, etc takes time. Time is money. So dealers charge for this service. It is typical for a dealer to charge $25-$40 per gun, but sometimes multiple guns get a discount because the dealer can process up to 4 on a single form, but when more than one gun is transferred, the dealer has to fill out Form 3310 which is supposed to help with gun trafficking.All of this is well and good if you are buying a gun from someone you don’t know and many people will require sales be conducted at a dealer for the piece of mind such protections provide. But friends and family typically do not bother with the hassle and expense.One thing you need to realize is that to get a gun dealer license is not an easy process. Since the federal government cracked down on so called “kitchen table” dealers back in the 1980’s, you now must show a commercially zoned storefront with posted business hours to qualify. Many communities don’t want gun shops, and use zoning laws to make them difficult or unattractive. For example the city of Boston does not have any dealers. In fact, the nearest dealer is 3 towns away. Many rural areas don’t have the traffic to keep a dealer in business and you’ll find they are typically only open in the evening or on a Saturday as they work another full time job. Keep this in mind as we get into the next issue.But the bill didn’t stop at sales. It stated that ALL transfers had to be done in this manner. No exceptions. So, two friends out on a hunt would need to go through the whole process listed above just to swap guns for the afternoon. Oh, and they would have to do it all again to give the gun back. It is very common on a range to try out other people’s guns - such a thing would also require the full transfer and back process. Demo guns at a national event by manufacturers? Same thing.Basically any time a gun were to swap hands, the law would apply. There are private shooting clubs where guns are treated like library books and members take whatever they want. Families regularly swap guns. Heck, some shooting courses provide guns for students to use. All of these events would have been impacted by these new transfer requirements.The NRA balked at this. Essentially the rule would curtail many of the traditions and practices that are very common and virtually never result in any kind of criminal activity. In essence it would criminalize things that simply are not crimes.Not only would it create criminals where no criminal intent existed, but the cost to manage the volume of temporary transfers, the staffing needed to take the calls and do the checks would have cost millions each year. All money that would not go toward actually dealing with criminals.When the issue was brought up, many members of Congress agreed the requirements were too restrictive and the whole bill failed to pass. The supporters of the bill did not even attempt to listen to the complaints and work out a manageable fix.Did you hear any of that in the media?But what about catching criminals?Well, the bill didn’t change anything in regards to enforcing the rules to make sure the people who should not own guns were properly entered into NICS. In fact, other than maybe getting fired, there is NO PENALTY for failing to report a person. We have laws that will jail a teacher or coach that fail to report bullies. We have laws that put priests in prison who fail to report potential inappropriate behaviors in other clergy. But we do not have any laws that punish law enforcement agents that fail to do their job and make sure that dangerous people are reported to the background system. And this bill made no effort to change that.NICS is not open to anyone but federally licensed gun dealers. The left are so worried that the system might be used to check people for things other than guns that they refuse to create a means to allow people to verify someone they are selling a gun to. It would be easy to create an app that takes a photo of the buyer and seller’s ID (or just their faces and type in some data) and then return a simple “Proceed” or “Deny” with no other details. You’d have plenty of information to audit for illegal use. And if someone didn’t have an ID, they could then use a dealer. Heck, you can’t file taxes on-line without submitting some kind of ID, so this isn’t anything unique.And yet, the bill did nothing to address the issue of accessing the NICS for easier private sales.Here is the thing. We have 20,000 gun laws in this country. On the federal side, a prohibited person touching a gun could see them in prison for a minimum of 5 years. And yet, we still see cities with high violent crime rates that have virtually no federal cases. Why isn’t law enforcement using those stiff federal laws to get the violent people off the streets? Such a program called “Project Exile” worked wonders in Richmond, VA to reduce violent crime dramatically.OK, back to the “Universal Background Check” bill.I spent a lot of words above explaining what the bill would have required of people and why the situation would have been a nightmare. You never saw any of this in the news and the media pretty much ignored the issue.When the bill was defeated, it was never reported that a “terrible bill that would have cost millions and made criminals out of the innocent was defeated”, instead, all you ever heard was“The NRA used its influence to defeat the Universal Background Check bill that would have closed the gunshow loophole”Almost everything about that statement is false.So, be careful what you want to “Fight Against”. I suspect that most of what you think about the NRA is highly biased due to the way the organization is treated in the media. When you look at the actual facts, many times their concerns are quite valid. And, they have a lot of rank and file law enforcement on their side which helps them represent real world situations. I’ve found their positions in many cases very well presented. Most of the arguments you get on TV news are highly edited and taken out of context to promote an agenda, not facilitate a debate.Make sure you know what you are fighting for. You might be surprised.

Related searches to fill amp esign pdf

Create this form in 5 minutes!

How to create an eSignature for the fill amp sign

How to create an electronic signature for your 2017 State Amp Local Tax Forms Amp Instructions Comptroller Of online

How to make an electronic signature for your 2017 State Amp Local Tax Forms Amp Instructions Comptroller Of in Chrome

How to create an electronic signature for signing the 2017 State Amp Local Tax Forms Amp Instructions Comptroller Of in Gmail

How to generate an eSignature for the 2017 State Amp Local Tax Forms Amp Instructions Comptroller Of from your mobile device

How to make an eSignature for the 2017 State Amp Local Tax Forms Amp Instructions Comptroller Of on iOS devices

How to create an eSignature for the 2017 State Amp Local Tax Forms Amp Instructions Comptroller Of on Android devices

People also ask state amp local

-

What is airSlate SignNow and how does it help to fill amp esign pdf documents?

airSlate SignNow is an intuitive platform that enables users to easily fill amp esign pdf documents. With its user-friendly interface, businesses can streamline their document workflows and ensure timely approvals while maintaining compliance.

-

How much does it cost to use airSlate SignNow for filling and eSigning PDFs?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By allowing you to fill amp esign pdf documents at a fraction of the cost of traditional methods, it provides a budget-friendly solution for efficient document management.

-

What features does airSlate SignNow offer for filling and eSigning PDFs?

The platform includes features such as customizable templates, secure document storage, and advanced collaboration tools. With airSlate SignNow, users can efficiently fill amp esign pdf documents, ensuring that their signature workflows are both productive and secure.

-

Can I manage my documents on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile devices, allowing you to fill amp esign pdf documents on the go. Its mobile functionality ensures you can manage your documents anytime, anywhere, keeping your business operations seamless.

-

Does airSlate SignNow integrate with other applications and software?

Absolutely! airSlate SignNow has numerous integrations with popular apps like Google Drive, Salesforce, and Dropbox. These integrations help you easily fill amp esign pdf documents while maintaining a connected workflow across your favorite tools.

-

Is airSlate SignNow secure for handling sensitive documents?

airSlate SignNow prioritizes security and compliance, employing industry-standard encryption for all documents. You can confidently fill amp esign pdf documents knowing that your sensitive data is protected throughout the entire signing process.

-

What industries benefit most from using airSlate SignNow to fill and eSign PDFs?

Various industries including real estate, healthcare, and education benefit signNowly from airSlate SignNow. Businesses in these sectors can efficiently fill amp esign pdf documents, enhancing their operational efficiency and customer experience.

Get more for fill amp esign pdf

Find out other fill amp sign

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF