Application for a Canada Pension Plan Retirement Pension Form

What is the Application For A Canada Pension Plan Retirement Pension

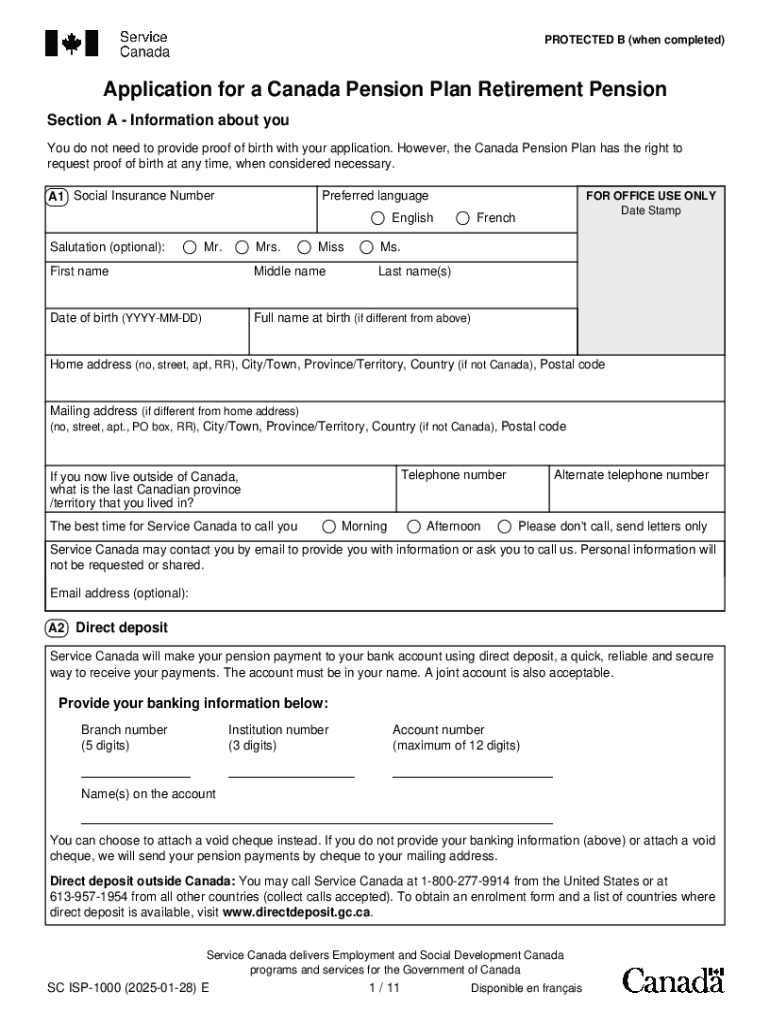

The Application For A Canada Pension Plan Retirement Pension is a formal request submitted by individuals seeking to receive retirement benefits under the Canada Pension Plan (CPP). This program is designed to provide financial support to Canadians who have contributed to the CPP during their working years. The application process ensures that eligible individuals can access their pension benefits when they retire, helping to secure their financial stability in retirement.

Eligibility Criteria

To qualify for the Canada Pension Plan Retirement Pension, applicants must meet specific eligibility requirements. Generally, individuals must have made at least one valid contribution to the CPP and be at least 60 years old. The amount of the pension is based on the contributions made during the applicant's working life, with higher contributions leading to a larger pension. It is important to review your contribution history to understand your potential benefits.

Steps to complete the Application For A Canada Pension Plan Retirement Pension

Completing the Application For A Canada Pension Plan Retirement Pension involves several key steps:

- Gather necessary documents, such as your Social Insurance Number and contribution history.

- Determine your eligibility based on your age and contribution record.

- Fill out the application form accurately, ensuring all required information is provided.

- Submit the application either online, by mail, or in person at a Service Canada office.

- Keep a copy of your submitted application for your records.

Required Documents

When applying for the Canada Pension Plan Retirement Pension, certain documents are essential to complete the application process. Applicants should have the following:

- Proof of identity, such as a driver's license or passport.

- Your Social Insurance Number (SIN).

- Details of your contribution history, which can be obtained from the Canada Revenue Agency (CRA).

- Any other relevant personal information that may be required by Service Canada.

Form Submission Methods

The Application For A Canada Pension Plan Retirement Pension can be submitted through various methods to accommodate different preferences:

- Online: Applicants can complete and submit the application through the Service Canada website.

- By Mail: Completed forms can be sent to the appropriate Service Canada office.

- In-Person: Individuals may also submit their applications directly at a Service Canada office, where staff can assist with the process.

Application Process & Approval Time

The application process for the Canada Pension Plan Retirement Pension typically involves several stages. After submission, Service Canada reviews the application to verify eligibility and completeness. The approval time can vary based on the volume of applications being processed, but applicants can generally expect a response within a few weeks. It is advisable to apply well in advance of the desired retirement date to ensure timely processing.

Handy tips for filling out Application For A Canada Pension Plan Retirement Pension online

Quick steps to complete and e-sign Application For A Canada Pension Plan Retirement Pension online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents could be. Gain access to a GDPR and HIPAA compliant solution for optimum simpleness. Use signNow to e-sign and send out Application For A Canada Pension Plan Retirement Pension for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for a canada pension plan retirement pension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For A Canada Pension Plan Retirement Pension?

The Application For A Canada Pension Plan Retirement Pension is a formal request to receive retirement benefits from the Canada Pension Plan. This application allows eligible individuals to access their pension funds upon signNowing retirement age, ensuring financial support during their retirement years.

-

How can airSlate SignNow assist with the Application For A Canada Pension Plan Retirement Pension?

airSlate SignNow streamlines the process of completing and submitting the Application For A Canada Pension Plan Retirement Pension. Our platform allows users to easily fill out, sign, and send their applications electronically, reducing paperwork and saving time.

-

What are the costs associated with using airSlate SignNow for my Application For A Canada Pension Plan Retirement Pension?

airSlate SignNow offers a cost-effective solution for managing your Application For A Canada Pension Plan Retirement Pension. Our pricing plans are designed to fit various budgets, ensuring that you can access essential eSigning features without breaking the bank.

-

What features does airSlate SignNow provide for the Application For A Canada Pension Plan Retirement Pension?

With airSlate SignNow, you can enjoy features such as customizable templates, secure eSigning, and real-time tracking for your Application For A Canada Pension Plan Retirement Pension. These tools enhance the efficiency and security of your application process.

-

Are there any benefits to using airSlate SignNow for my pension application?

Using airSlate SignNow for your Application For A Canada Pension Plan Retirement Pension offers numerous benefits, including increased efficiency, reduced processing time, and enhanced security. Our platform ensures that your sensitive information is protected while making the application process seamless.

-

Can I integrate airSlate SignNow with other tools for my pension application?

Yes, airSlate SignNow can be integrated with various tools and platforms to enhance your experience with the Application For A Canada Pension Plan Retirement Pension. This integration allows for better workflow management and ensures that all your documents are easily accessible.

-

Is airSlate SignNow user-friendly for completing the Application For A Canada Pension Plan Retirement Pension?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the Application For A Canada Pension Plan Retirement Pension. Our intuitive interface guides you through each step, ensuring a smooth application process.

Get more for Application For A Canada Pension Plan Retirement Pension

Find out other Application For A Canada Pension Plan Retirement Pension

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF