Affidavit as to Death of Grantor Request Form 2022-2026

What is the Affidavit As To Death Of Grantor Request Form

The Affidavit As To Death Of Grantor Request Form is a legal document used primarily in the United States to confirm the death of a grantor, who is an individual that has created a trust or has executed a deed. This form serves as a formal declaration that the grantor has passed away, which is essential for the administration of the grantor's estate and the proper management of any trusts or assets involved. It is often required by financial institutions, title companies, or courts to facilitate the transfer of assets or to update legal documents accordingly.

How to use the Affidavit As To Death Of Grantor Request Form

Using the Affidavit As To Death Of Grantor Request Form involves several key steps. First, gather necessary information about the grantor, including their full name, date of birth, and date of death. Next, complete the form by providing accurate details, ensuring that all required fields are filled out. Once completed, the form must be signed and notarized to validate the declaration. This notarization confirms the identity of the signer and the authenticity of the document. After notarization, the form can be submitted to the relevant parties, such as banks or courts, to initiate the necessary legal processes.

Steps to complete the Affidavit As To Death Of Grantor Request Form

Completing the Affidavit As To Death Of Grantor Request Form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, ensuring it is the latest version.

- Fill in the grantor's full name, date of birth, and date of death in the designated sections.

- Provide information about the trust or property affected by the grantor's death.

- Include your name and contact information, as the affiant.

- Sign the form in the presence of a notary public.

- Submit the completed and notarized form to the appropriate institution or agency.

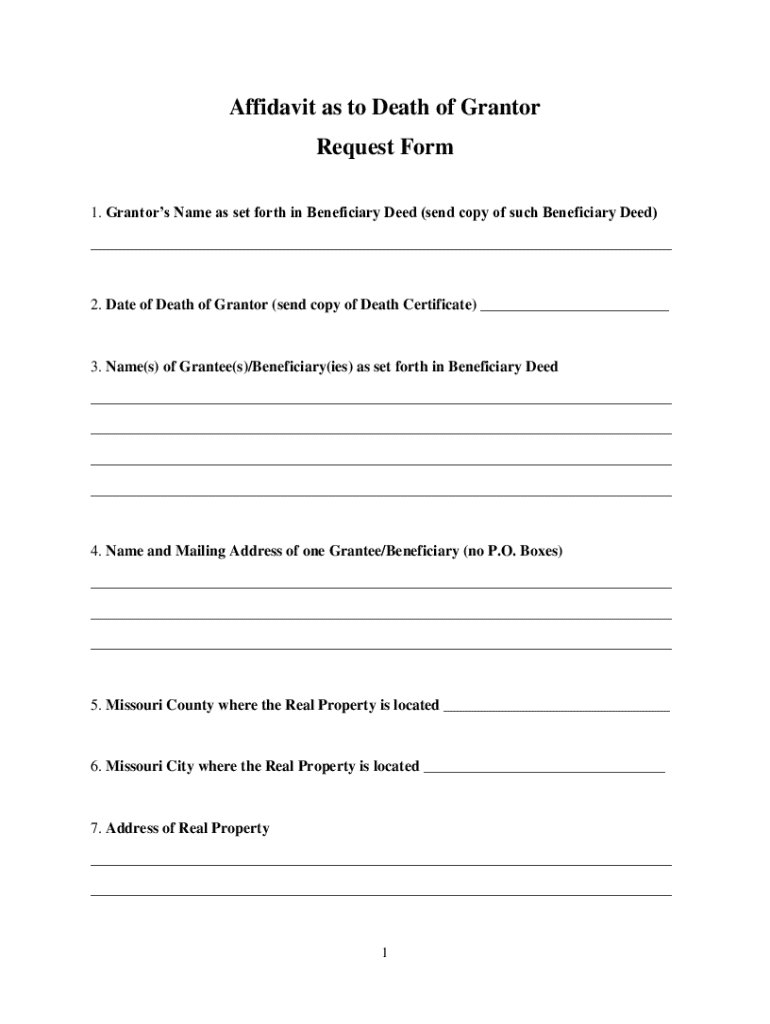

Key elements of the Affidavit As To Death Of Grantor Request Form

The Affidavit As To Death Of Grantor Request Form contains several key elements that must be accurately completed. These include:

- Grantor Information: Full name, date of birth, and date of death.

- Affiant Information: Name and contact details of the individual completing the affidavit.

- Property Details: Description of the trust or property involved.

- Notarization Section: Space for the notary public to sign and stamp the document.

Legal use of the Affidavit As To Death Of Grantor Request Form

The legal use of the Affidavit As To Death Of Grantor Request Form is crucial in estate management. This form is typically required when a grantor passes away and their assets need to be transferred or managed according to their wishes. It provides legal proof of death, which is necessary for executing a will or trust. Financial institutions often require this affidavit to release funds or transfer ownership of assets. Additionally, courts may request this document during probate proceedings to verify the grantor's death officially.

Required Documents

When preparing to submit the Affidavit As To Death Of Grantor Request Form, several documents may be required. These typically include:

- A certified copy of the grantor's death certificate.

- Any existing trust documents or wills related to the grantor.

- Identification for the affiant, such as a driver's license or passport.

Create this form in 5 minutes or less

Find and fill out the correct affidavit as to death of grantor request form

Create this form in 5 minutes!

How to create an eSignature for the affidavit as to death of grantor request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Affidavit As To Death Of Grantor Request Form?

The Affidavit As To Death Of Grantor Request Form is a legal document used to confirm the death of a grantor, facilitating the transfer of assets. This form is essential for ensuring that the estate is handled according to the grantor's wishes. Using airSlate SignNow, you can easily create and eSign this document, streamlining the process.

-

How can I create an Affidavit As To Death Of Grantor Request Form using airSlate SignNow?

Creating an Affidavit As To Death Of Grantor Request Form with airSlate SignNow is simple. You can start by selecting a template or creating a new document from scratch. Our user-friendly interface allows you to add necessary fields and eSign the document quickly, ensuring a hassle-free experience.

-

Is there a cost associated with using the Affidavit As To Death Of Grantor Request Form on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. We offer various pricing plans that cater to different business needs, ensuring you get the best value for your investment. The affordability of our service makes it easy to manage documents like the Affidavit As To Death Of Grantor Request Form.

-

What features does airSlate SignNow offer for the Affidavit As To Death Of Grantor Request Form?

airSlate SignNow provides several features for the Affidavit As To Death Of Grantor Request Form, including customizable templates, eSignature capabilities, and secure cloud storage. These features ensure that your documents are not only easy to create but also secure and accessible anytime. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other applications for managing the Affidavit As To Death Of Grantor Request Form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage your Affidavit As To Death Of Grantor Request Form seamlessly. Whether you use CRM systems, cloud storage, or project management tools, our integrations enhance your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Affidavit As To Death Of Grantor Request Form?

Using airSlate SignNow for the Affidavit As To Death Of Grantor Request Form provides numerous benefits, including time savings, enhanced security, and improved collaboration. Our platform allows multiple parties to eSign documents quickly, reducing delays in the process. Additionally, the secure storage ensures that your sensitive information is protected.

-

Is airSlate SignNow compliant with legal standards for the Affidavit As To Death Of Grantor Request Form?

Yes, airSlate SignNow is compliant with legal standards for electronic signatures and document management. This compliance ensures that your Affidavit As To Death Of Grantor Request Form is legally binding and recognized by courts. We prioritize security and legality, giving you peace of mind when using our platform.

Get more for Affidavit As To Death Of Grantor Request Form

- Notice of pendency of action corporation form

- Lien claimant furnished or supplied labor form

- Free florida eviction notice formsprocess and laws

- 5 day notice of termination of form

- 5 day notice to remedy breach of non residential form

- Charges now due and unpaid as follows form

- As a representative of a form

- That is not to say that you form

Find out other Affidavit As To Death Of Grantor Request Form

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now