Microsoft Word 2989011Exemption from Workers Compensation Form 13L 50 Rev 4 DOC

What is the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc

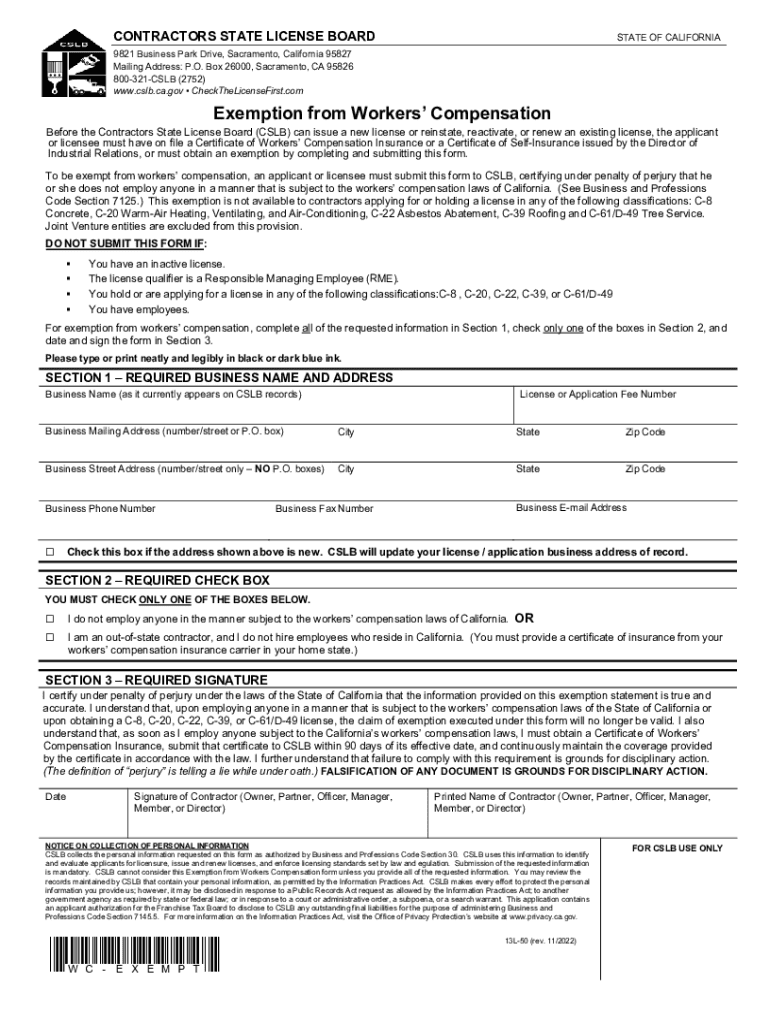

The Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 is a legal document used in the United States to formally request an exemption from workers' compensation requirements. This form is essential for businesses or individuals seeking to demonstrate that they meet specific criteria that exempt them from the standard workers' compensation obligations. It is particularly relevant for certain types of employment situations, such as independent contractors or specific industries where traditional workers' compensation coverage may not apply.

How to use the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc

Using the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 involves several key steps. First, download the form and open it in Microsoft Word. Carefully read the instructions provided within the document to ensure proper completion. Fill in the required fields with accurate information, including your name, business details, and the specific reasons for requesting the exemption. Once completed, review the form for any errors and ensure all necessary signatures are included before submission.

Steps to complete the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc

Completing the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 requires attention to detail. Follow these steps:

- Open the form in Microsoft Word.

- Enter your personal information, including your name and contact details.

- Provide information about your business or employment situation.

- Clearly state the reason for your exemption request.

- Review the form for accuracy and completeness.

- Sign and date the form where indicated.

Key elements of the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc

Key elements of the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 include:

- Identification of the applicant and their business.

- Specific reasons for requesting an exemption.

- Signature of the applicant or authorized representative.

- Date of submission.

These elements are crucial for ensuring that the form is valid and meets the necessary legal requirements for exemption from workers' compensation.

Eligibility Criteria

Eligibility for using the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 typically includes factors such as the nature of the work, the type of business entity, and compliance with state-specific regulations. Independent contractors, certain small businesses, and individuals in specific industries may qualify for this exemption. It is important to review the criteria carefully to determine if you meet the requirements before submitting the form.

Form Submission Methods

The Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through state workers' compensation boards.

- Mailing the completed form to the appropriate office.

- In-person delivery to designated state agencies.

Check with your local workers' compensation office for specific submission guidelines and procedures.

Handy tips for filling out Microsoft Word 2989011Exemption From Workers Compensation Form 13L 50 Rev 4 doc online

Quick steps to complete and e-sign Microsoft Word 2989011Exemption From Workers Compensation Form 13L 50 Rev 4 doc online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents could be. Gain access to a GDPR and HIPAA compliant service for optimum straightforwardness. Use signNow to e-sign and send out Microsoft Word 2989011Exemption From Workers Compensation Form 13L 50 Rev 4 doc for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the microsoft word 2989011exemption from workers compensation form 13l 50 rev 4 doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc?

The Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc is a standardized document used to request an exemption from workers' compensation requirements. This form is essential for businesses looking to comply with legal regulations while ensuring proper documentation.

-

How can airSlate SignNow help with the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc?

airSlate SignNow streamlines the process of sending and eSigning the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc. Our platform allows users to easily upload, edit, and share the document, ensuring a smooth workflow and quick turnaround times.

-

What are the pricing options for using airSlate SignNow with the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that enhance the management of documents like the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc.

-

What features does airSlate SignNow provide for the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc?

With airSlate SignNow, you can utilize features such as customizable templates, automated workflows, and secure eSigning for the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc. These features enhance efficiency and ensure compliance with legal standards.

-

Is it easy to integrate airSlate SignNow with other applications for the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc?

Yes, airSlate SignNow offers seamless integrations with various applications, making it easy to manage the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc alongside your existing tools. This integration capability enhances productivity and streamlines your document management processes.

-

What are the benefits of using airSlate SignNow for the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc?

Using airSlate SignNow for the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc provides numerous benefits, including improved efficiency, reduced turnaround times, and enhanced security. Our platform ensures that your documents are handled professionally and securely.

-

Can I track the status of the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of the Microsoft Word 2989011 Exemption From Workers Compensation Form 13L 50 Rev 4 doc in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Microsoft Word 2989011Exemption From Workers Compensation Form 13L 50 Rev 4 doc

Find out other Microsoft Word 2989011Exemption From Workers Compensation Form 13L 50 Rev 4 doc

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now