Dtf 406 Form

What is the Dtf 406

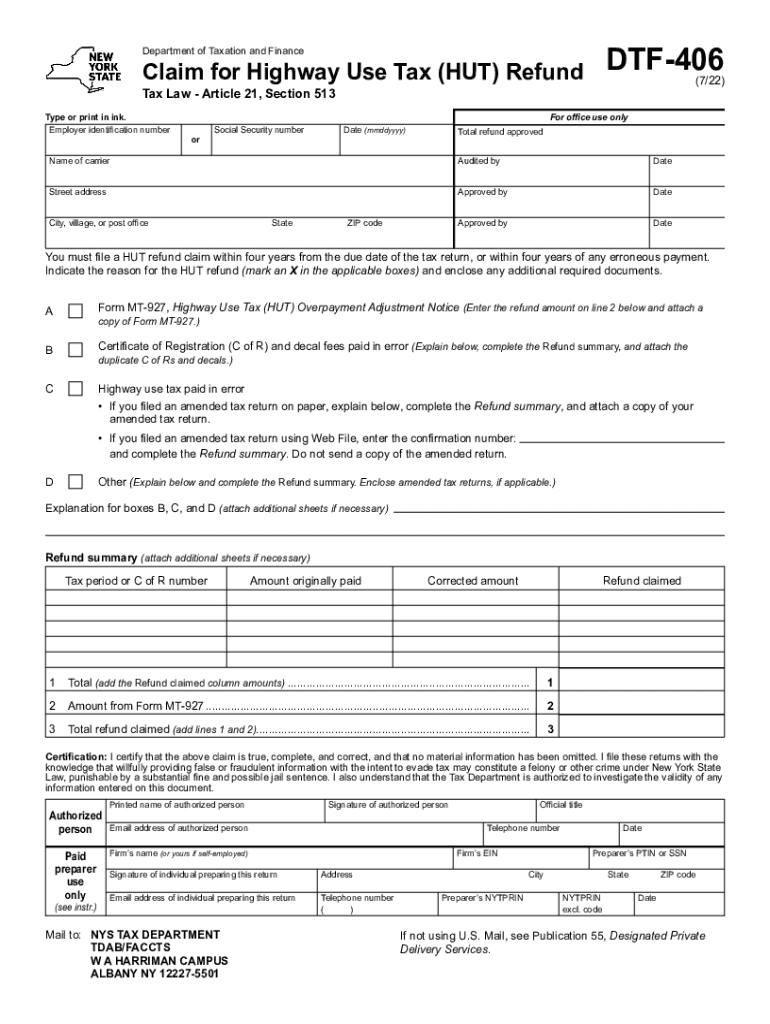

The Dtf 406 is a tax form used in the state of New York to report and claim a credit for taxes paid to other jurisdictions. This form is particularly relevant for individuals and businesses who have income sourced from outside New York and have paid taxes to those jurisdictions. By filing the Dtf 406, taxpayers can potentially reduce their New York State tax liability by claiming a credit for taxes already paid elsewhere.

How to use the Dtf 406

To use the Dtf 406 effectively, taxpayers should first gather all necessary information regarding taxes paid to other states or jurisdictions. This includes documentation of income earned and taxes withheld. Once the relevant data is collected, taxpayers can fill out the form, ensuring that all sections are completed accurately. The Dtf 406 can be filed along with the New York State income tax return, allowing for the credit to be applied to the overall tax liability.

Steps to complete the Dtf 406

Completing the Dtf 406 involves several key steps:

- Gather all documentation related to income earned and taxes paid to other jurisdictions.

- Fill out the personal information section, including your name, address, and Social Security number.

- Detail the income earned in other jurisdictions and the corresponding taxes paid.

- Calculate the credit amount based on the taxes paid and any limitations set by New York State.

- Review the completed form for accuracy before submission.

Legal use of the Dtf 406

The Dtf 406 is legally recognized by the New York State Department of Taxation and Finance. It is essential for taxpayers who qualify for a credit to file this form correctly to avoid potential penalties. Using the Dtf 406 allows taxpayers to comply with state tax laws while ensuring they do not pay taxes on the same income in multiple jurisdictions.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Dtf 406. Typically, the form must be submitted by the same deadline as the New York State income tax return. For most individuals, this is April fifteenth. However, if an extension is filed for the tax return, the Dtf 406 can also be submitted later, but it is crucial to adhere to the extended deadline to avoid penalties.

Required Documents

When completing the Dtf 406, certain documents are required to support the claims made on the form. These documents include:

- W-2 forms or 1099s showing income earned in other jurisdictions.

- Tax returns or tax payment receipts from the other states.

- Any other documentation that verifies the taxes paid to other jurisdictions.

Form Submission Methods

The Dtf 406 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices, if required.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 406 779088739

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Dtf 406 and how does it relate to airSlate SignNow?

Dt 406 is a specific feature within the airSlate SignNow platform that enhances document signing capabilities. It allows users to streamline their eSigning processes, making it easier to manage and send documents securely. By utilizing Dtf 406, businesses can improve their workflow efficiency.

-

How much does airSlate SignNow with Dtf 406 cost?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses. Dtf 406 is included in all subscription tiers, ensuring that users can access its benefits without additional costs. For detailed pricing, visit our pricing page.

-

What are the key features of Dtf 406 in airSlate SignNow?

Dt 406 offers several key features, including customizable templates, real-time tracking, and secure cloud storage. These features help businesses manage their documents more effectively and ensure compliance with legal standards. With Dtf 406, users can also automate repetitive tasks, saving time and resources.

-

What are the benefits of using Dtf 406 for document signing?

Using Dtf 406 enhances the document signing experience by providing a user-friendly interface and robust security measures. It allows for faster turnaround times and reduces the likelihood of errors in the signing process. Overall, Dtf 406 helps businesses improve their operational efficiency.

-

Can Dtf 406 integrate with other software applications?

Yes, Dtf 406 can seamlessly integrate with various software applications, enhancing its functionality. This integration allows businesses to connect their existing tools with airSlate SignNow, creating a more cohesive workflow. Popular integrations include CRM systems, project management tools, and cloud storage services.

-

Is Dtf 406 suitable for small businesses?

Absolutely! Dtf 406 is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective nature and user-friendly features make it an ideal choice for small businesses looking to streamline their document signing processes without breaking the bank.

-

How secure is the Dtf 406 feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, and Dtf 406 is no exception. The feature employs advanced encryption and authentication protocols to ensure that all documents are protected during the signing process. Users can trust that their sensitive information remains confidential and secure.

Get more for Dtf 406

Find out other Dtf 406

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word