TR 12 Affidavit to a Fact Rev 12 21 This Publication Will Address Whether Sales or Compensating Use Tax is Due on a Particular V 2022

Understanding the TR 12 Affidavit To A Fact Rev 12 21

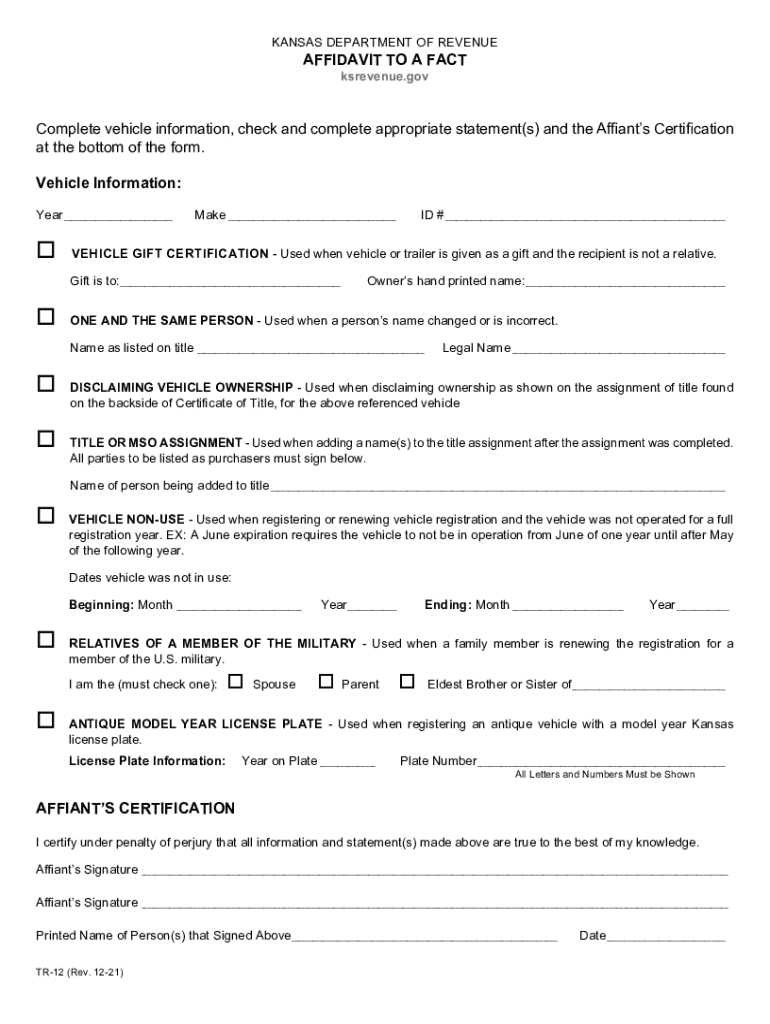

The TR 12 Affidavit To A Fact Rev 12 21 is a critical document that addresses the sales or compensating use tax obligations associated with vehicle transactions. This affidavit clarifies whether such taxes are due, the applicable rates, and the entities responsible for payment. It serves as a formal declaration to ensure compliance with tax regulations in the United States, particularly for vehicle purchases.

Steps to Complete the TR 12 Affidavit

Completing the TR 12 Affidavit involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the vehicle transaction, including purchase price and vehicle identification details. Next, accurately fill out the affidavit, ensuring that all required fields are completed. Review the document for any errors before submission. Finally, submit the affidavit to the appropriate tax authority as specified in the instructions.

Legal Use of the TR 12 Affidavit

The TR 12 Affidavit is legally recognized in the United States as a valid document for declaring tax obligations related to vehicle transactions. It is essential for individuals and businesses to understand that failing to file this affidavit correctly can lead to penalties or legal repercussions. Proper use of this form ensures that all tax liabilities are met, protecting the filer from potential audits or fines.

Required Documents for Submission

When submitting the TR 12 Affidavit, certain documents may be required to support the information provided. These documents typically include proof of purchase, such as a bill of sale or invoice, and any prior tax documents related to the vehicle. Ensuring that all supporting documents are included can facilitate a smoother review process by tax authorities.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the TR 12 Affidavit. These deadlines can vary by state and may depend on the specific vehicle transaction. Generally, it is advisable to submit the affidavit promptly after the transaction to avoid late fees or penalties. Keeping track of important dates ensures compliance with tax obligations.

Examples of Using the TR 12 Affidavit

Examples of scenarios where the TR 12 Affidavit is used include private vehicle sales, dealership transactions, and transfers of ownership. In each case, the affidavit helps clarify the tax obligations of the buyer and seller, ensuring that the correct tax rates are applied and payments are made to the appropriate authorities. Understanding these examples can help individuals navigate their specific situations more effectively.

Create this form in 5 minutes or less

Find and fill out the correct tr 12 affidavit to a fact rev 12 21 this publication will address whether sales or compensating use tax is due on a particular

Create this form in 5 minutes!

How to create an eSignature for the tr 12 affidavit to a fact rev 12 21 this publication will address whether sales or compensating use tax is due on a particular

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TR 12 Affidavit To A Fact Rev 12 21?

The TR 12 Affidavit To A Fact Rev 12 21 is a publication that clarifies whether sales or compensating use tax is applicable on specific vehicle transactions. It details the tax rate, payment recipients, and the timing and methods of payment. Understanding this affidavit is crucial for ensuring compliance with tax regulations.

-

How does airSlate SignNow assist with the TR 12 Affidavit To A Fact Rev 12 21?

airSlate SignNow provides a streamlined platform for electronically signing and sending documents, including the TR 12 Affidavit To A Fact Rev 12 21. This ensures that your affidavit is completed efficiently and securely, helping you meet tax obligations without hassle. Our solution simplifies the documentation process for vehicle transactions.

-

What are the benefits of using airSlate SignNow for vehicle transaction documents?

Using airSlate SignNow for vehicle transaction documents, including the TR 12 Affidavit To A Fact Rev 12 21, offers numerous benefits such as enhanced security, reduced processing time, and easy access to signed documents. Our platform is designed to make the signing process straightforward, ensuring you can focus on your business. Additionally, it helps maintain compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the TR 12 Affidavit To A Fact Rev 12 21?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible and cater to various needs, ensuring you get the best value for managing documents like the TR 12 Affidavit To A Fact Rev 12 21. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for managing vehicle transactions?

Absolutely! airSlate SignNow offers integrations with various software solutions, enhancing your ability to manage vehicle transactions efficiently. This includes CRM systems and accounting software, allowing you to streamline the process of handling documents like the TR 12 Affidavit To A Fact Rev 12 21. Integration ensures a seamless workflow across your business operations.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including electronic signatures, templates, and real-time tracking. These features are particularly useful for managing documents like the TR 12 Affidavit To A Fact Rev 12 21, ensuring that you can easily create, send, and store important paperwork. Our platform is user-friendly and designed to enhance productivity.

-

How secure is airSlate SignNow for handling sensitive documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect sensitive documents, including the TR 12 Affidavit To A Fact Rev 12 21. Our platform ensures that your data is safe during transmission and storage, giving you peace of mind when managing important vehicle transaction documents.

Get more for TR 12 Affidavit To A Fact Rev 12 21 This Publication Will Address Whether Sales Or Compensating Use Tax Is Due On A Particular V

- Divorce form in australia

- Gulp assessment form

- Sketchup quick reference card form

- Puppy reservation form

- Printable daycare business plan pdf form

- Class 2 filing representative affidavit form

- Consent to treat minor patient without parent present in order for us to treat a minor without a parentlegal guardian present form

- Fayetteville state university transcript request form

Find out other TR 12 Affidavit To A Fact Rev 12 21 This Publication Will Address Whether Sales Or Compensating Use Tax Is Due On A Particular V

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast