Fillable KANSAS Department of Revenue Affidavit to a 2022-2026

What is the Fillable KANSAS Department Of Revenue Affidavit To A

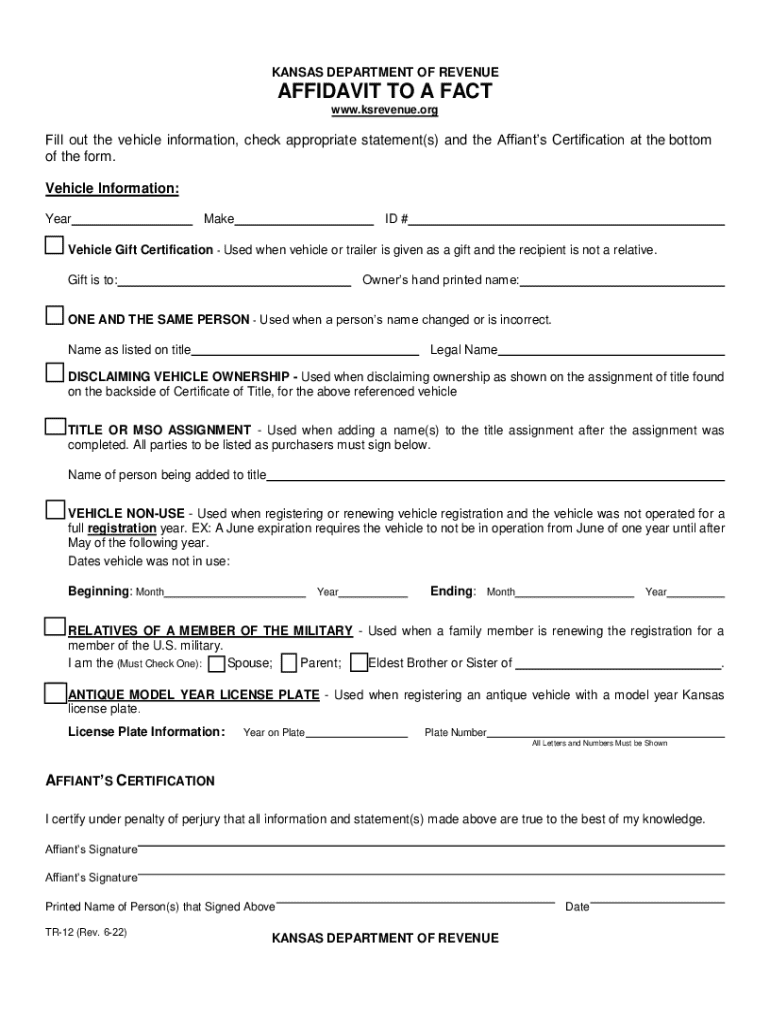

The Fillable KANSAS Department Of Revenue Affidavit To A is a legal document used primarily in Kansas for various tax-related purposes. This affidavit serves as a formal declaration to provide necessary information regarding a taxpayer's status or activities that may affect their tax obligations. It is essential for ensuring compliance with state tax laws and can be required in situations such as property tax exemptions, income tax filings, or other financial disclosures. Understanding the specifics of this affidavit is crucial for taxpayers to avoid potential penalties or legal issues.

How to use the Fillable KANSAS Department Of Revenue Affidavit To A

Using the Fillable KANSAS Department Of Revenue Affidavit To A involves several straightforward steps. First, download the form from the Kansas Department of Revenue website or obtain it through a local office. Once you have the form, fill it out with accurate information, ensuring that all required fields are completed. After filling out the affidavit, review it for any errors or omissions. Finally, submit the completed form to the appropriate department, either electronically or by mail, as specified by the Kansas Department of Revenue guidelines.

Steps to complete the Fillable KANSAS Department Of Revenue Affidavit To A

Completing the Fillable KANSAS Department Of Revenue Affidavit To A requires careful attention to detail. Follow these steps for successful completion:

- Download the form from a reliable source.

- Read the instructions thoroughly to understand what information is required.

- Fill in your personal details, including name, address, and taxpayer identification number.

- Provide any additional information requested, such as financial data or supporting documentation.

- Review the form for accuracy and completeness.

- Sign and date the affidavit as required.

- Submit the form according to the specified submission methods.

Legal use of the Fillable KANSAS Department Of Revenue Affidavit To A

The Fillable KANSAS Department Of Revenue Affidavit To A has specific legal implications. It is used to affirm the truthfulness of the information provided and can be subject to verification by the state. Misrepresentation or failure to provide accurate information on this affidavit can lead to legal consequences, including penalties or fines. Therefore, it is crucial for individuals to ensure that all statements made in the affidavit are truthful and supported by appropriate documentation.

Key elements of the Fillable KANSAS Department Of Revenue Affidavit To A

Several key elements are essential when filling out the Fillable KANSAS Department Of Revenue Affidavit To A. These include:

- Personal Information: Name, address, and taxpayer identification number.

- Purpose of the Affidavit: A clear statement of why the affidavit is being submitted.

- Supporting Documentation: Any necessary documents that substantiate the claims made in the affidavit.

- Signature: The affidavit must be signed and dated by the individual submitting it.

State-specific rules for the Fillable KANSAS Department Of Revenue Affidavit To A

Each state has its own regulations regarding the use of affidavits, and Kansas is no exception. The Fillable KANSAS Department Of Revenue Affidavit To A must comply with state-specific rules, including submission deadlines, required supporting documents, and the proper format. It is advisable for taxpayers to familiarize themselves with Kansas tax laws and consult the Kansas Department of Revenue for any updates or changes to regulations that may affect the use of this affidavit.

Create this form in 5 minutes or less

Find and fill out the correct fillable kansas department of revenue affidavit to a

Create this form in 5 minutes!

How to create an eSignature for the fillable kansas department of revenue affidavit to a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fillable KANSAS Department Of Revenue Affidavit To A?

A Fillable KANSAS Department Of Revenue Affidavit To A is a legal document used to affirm certain facts related to tax matters in Kansas. This form can be easily filled out online, ensuring that all necessary information is accurately provided. Using airSlate SignNow, you can complete and eSign this affidavit quickly and efficiently.

-

How can I create a Fillable KANSAS Department Of Revenue Affidavit To A?

Creating a Fillable KANSAS Department Of Revenue Affidavit To A is simple with airSlate SignNow. You can start by selecting the template from our library, fill in the required fields, and customize it as needed. Once completed, you can eSign and send it directly from the platform.

-

Is there a cost associated with using the Fillable KANSAS Department Of Revenue Affidavit To A?

Yes, there is a cost associated with using airSlate SignNow for the Fillable KANSAS Department Of Revenue Affidavit To A. However, our pricing plans are designed to be cost-effective, providing excellent value for businesses that need to manage documents efficiently. You can choose a plan that best fits your needs.

-

What features does airSlate SignNow offer for the Fillable KANSAS Department Of Revenue Affidavit To A?

airSlate SignNow offers a range of features for the Fillable KANSAS Department Of Revenue Affidavit To A, including customizable templates, eSignature capabilities, and secure document storage. Additionally, our platform allows for easy collaboration and tracking of document status, making it a comprehensive solution for your affidavit needs.

-

Can I integrate airSlate SignNow with other applications for the Fillable KANSAS Department Of Revenue Affidavit To A?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow when handling the Fillable KANSAS Department Of Revenue Affidavit To A. Whether you use CRM systems, cloud storage, or other business tools, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Fillable KANSAS Department Of Revenue Affidavit To A?

Using airSlate SignNow for the Fillable KANSAS Department Of Revenue Affidavit To A offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform simplifies the signing process, reduces paperwork, and ensures that your documents are legally binding and compliant with state regulations.

-

Is the Fillable KANSAS Department Of Revenue Affidavit To A legally binding?

Yes, the Fillable KANSAS Department Of Revenue Affidavit To A created and signed through airSlate SignNow is legally binding. Our eSignature technology complies with federal and state laws, ensuring that your affidavit holds up in legal situations. You can confidently use our platform for all your affidavit needs.

Get more for Fillable KANSAS Department Of Revenue Affidavit To A

Find out other Fillable KANSAS Department Of Revenue Affidavit To A

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free