GiftPledge Payment Transmittal Form Development Accounting

What is the GiftPledge Payment Transmittal Form Development Accounting

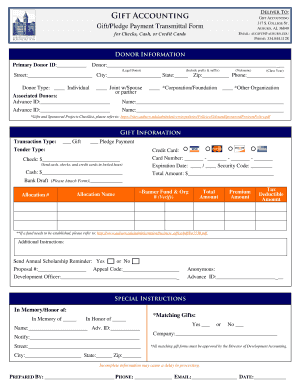

The GiftPledge Payment Transmittal Form is a crucial document used in development accounting to facilitate the processing of gift pledges. This form serves to officially communicate the details of a financial contribution, ensuring that all necessary information is captured for accurate record-keeping and compliance. It typically includes details such as the donor's name, contact information, the amount pledged, and the intended use of the funds. By utilizing this form, organizations can streamline their accounting processes and maintain transparency in their financial dealings.

How to use the GiftPledge Payment Transmittal Form Development Accounting

Using the GiftPledge Payment Transmittal Form involves several straightforward steps. First, ensure you have the latest version of the form, which can be obtained from your organization's finance department or website. Next, fill out the required fields with accurate information, including the donor's details and the specifics of the pledge. Once completed, the form should be submitted to the appropriate accounting department for processing. It is essential to keep a copy for your records, as this can help in tracking the status of the pledge and ensuring compliance with any reporting requirements.

Steps to complete the GiftPledge Payment Transmittal Form Development Accounting

Completing the GiftPledge Payment Transmittal Form involves the following steps:

- Obtain the form from your finance department or designated source.

- Fill in the donor's name and contact information accurately.

- Specify the amount of the gift pledge and the purpose of the funds.

- Include any additional information required by your organization.

- Review the form for completeness and accuracy.

- Submit the form to the designated accounting personnel.

Key elements of the GiftPledge Payment Transmittal Form Development Accounting

The key elements of the GiftPledge Payment Transmittal Form include:

- Donor Information: Full name, address, and contact details of the donor.

- Pledge Amount: The total amount pledged by the donor.

- Purpose of the Gift: A clear description of how the funds will be used.

- Date of Pledge: The date on which the pledge is made.

- Signature: The donor's signature to validate the pledge.

Form Submission Methods

The GiftPledge Payment Transmittal Form can typically be submitted through various methods, depending on the organization's policies. Common submission methods include:

- Online Submission: Many organizations offer a digital platform for submitting forms electronically.

- Mail: The completed form can be sent via postal service to the accounting department.

- In-Person: Donors may also choose to deliver the form directly to the appropriate office.

Legal use of the GiftPledge Payment Transmittal Form Development Accounting

The legal use of the GiftPledge Payment Transmittal Form is essential for ensuring compliance with financial regulations. This form acts as a formal record of the donor's commitment, which can be crucial for tax purposes and organizational accountability. Organizations must retain these forms for their records and may be required to provide them during audits or financial reviews. Proper use of the form helps protect both the donor's interests and the organization's integrity.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the giftpledge payment transmittal form development accounting

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the GiftPledge Payment Transmittal Form Development Accounting?

The GiftPledge Payment Transmittal Form Development Accounting is a specialized document designed to streamline the process of recording and managing donations. This form ensures accurate tracking of contributions, making it easier for organizations to maintain financial transparency and accountability.

-

How does the GiftPledge Payment Transmittal Form Development Accounting benefit my organization?

Using the GiftPledge Payment Transmittal Form Development Accounting can signNowly enhance your organization's efficiency in handling donations. It simplifies the documentation process, reduces errors, and provides a clear audit trail, ultimately saving time and resources.

-

Is the GiftPledge Payment Transmittal Form Development Accounting customizable?

Yes, the GiftPledge Payment Transmittal Form Development Accounting is fully customizable to meet your organization's specific needs. You can modify fields, add branding elements, and adjust the layout to ensure it aligns with your operational requirements.

-

What are the pricing options for using the GiftPledge Payment Transmittal Form Development Accounting?

Pricing for the GiftPledge Payment Transmittal Form Development Accounting varies based on the features and volume of usage. airSlate SignNow offers flexible plans that cater to different organizational sizes, ensuring you find a cost-effective solution that fits your budget.

-

Can I integrate the GiftPledge Payment Transmittal Form Development Accounting with other software?

Absolutely! The GiftPledge Payment Transmittal Form Development Accounting can be seamlessly integrated with various accounting and CRM systems. This integration allows for automatic data transfer, reducing manual entry and enhancing overall workflow efficiency.

-

How secure is the GiftPledge Payment Transmittal Form Development Accounting?

The GiftPledge Payment Transmittal Form Development Accounting is built with robust security measures to protect sensitive donor information. airSlate SignNow employs encryption and secure access protocols to ensure that all data remains confidential and secure.

-

What features are included with the GiftPledge Payment Transmittal Form Development Accounting?

Key features of the GiftPledge Payment Transmittal Form Development Accounting include eSigning capabilities, customizable templates, automated workflows, and real-time tracking of donations. These features work together to enhance the overall management of your donation processes.

Get more for GiftPledge Payment Transmittal Form Development Accounting

- Concrete mason contractor package kentucky form

- Demolition contractor package kentucky form

- Security contractor package kentucky form

- Insulation contractor package kentucky form

- Paving contractor package kentucky form

- Site work contractor package kentucky form

- Siding contractor package kentucky form

- Refrigeration contractor package kentucky form

Find out other GiftPledge Payment Transmittal Form Development Accounting

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document