Form 8829 Worksheet 98 195 196

What is the Form 8829 Worksheet 98 195 196

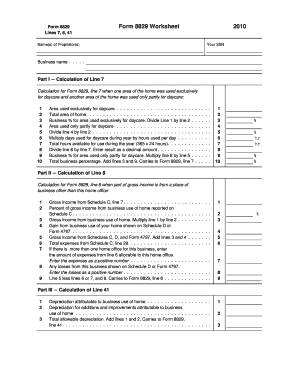

The Form 8829 Worksheet is a crucial document used by taxpayers in the United States to calculate the expenses related to the business use of a home. This form is particularly relevant for self-employed individuals who wish to deduct certain expenses on their tax returns. It allows users to determine the allowable deductions for home office expenses, including direct and indirect expenses, depreciation, and other related costs. Understanding this form is essential for maximizing tax benefits while ensuring compliance with IRS regulations.

How to use the Form 8829 Worksheet 98 195 196

Using the Form 8829 Worksheet involves several steps to accurately report home office expenses. Taxpayers should begin by gathering all relevant financial documents, including receipts and bills related to home office expenses. The form guides users through calculating the percentage of the home used for business, which is critical for determining deductible amounts. Each section of the worksheet corresponds to specific expenses, such as utilities, repairs, and mortgage interest. Careful attention to detail is necessary to ensure all eligible expenses are accounted for.

Steps to complete the Form 8829 Worksheet 98 195 196

Completing the Form 8829 Worksheet involves a systematic approach:

- Determine the total area of your home and the area used exclusively for business.

- Calculate the percentage of your home used for business by dividing the business area by the total home area.

- List all direct expenses related to the business use of your home, such as repairs and maintenance.

- Record indirect expenses, including utilities and mortgage interest, applying the business use percentage.

- Complete the depreciation section if applicable, based on the value of your home and the business area.

- Review the completed worksheet for accuracy before transferring the figures to your tax return.

Key elements of the Form 8829 Worksheet 98 195 196

Several key elements are essential to understand when working with the Form 8829 Worksheet. These include:

- Direct Expenses: Costs that are solely attributed to the business area, such as repairs made specifically to the home office.

- Indirect Expenses: Costs that benefit the entire home, like utilities and mortgage interest, which must be prorated based on business use.

- Depreciation: A method for allocating the cost of the home over time, applicable if the home is owned and used for business.

- Record Keeping: Maintaining accurate records and receipts is vital for substantiating claims made on the form.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines associated with the Form 8829 Worksheet. Typically, the form is submitted along with your annual tax return, which is due on April fifteenth of each year for most taxpayers. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates is essential to ensure compliance and avoid unnecessary fees.

Eligibility Criteria

Eligibility for using the Form 8829 Worksheet is primarily determined by the nature of your business and how you utilize your home. To qualify, you must use a portion of your home regularly and exclusively for business purposes. This means that the space cannot be used for personal activities. Additionally, self-employed individuals or those who have a business entity that allows for home office deductions are typically eligible. Understanding these criteria helps ensure that you can accurately report your home office expenses.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8829 worksheet 98 195 196

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8829 Worksheet 98 195 196?

The Form 8829 Worksheet 98 195 196 is a tax form used by business owners to calculate the expenses related to the business use of their home. This worksheet helps in determining the allowable deductions for home office expenses, ensuring compliance with IRS regulations. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the Form 8829 Worksheet 98 195 196?

airSlate SignNow simplifies the process of completing and submitting the Form 8829 Worksheet 98 195 196 by providing an easy-to-use platform for eSigning and document management. You can quickly fill out the necessary fields and securely send the form to your accountant or tax professional. This streamlines your tax preparation process.

-

Is there a cost associated with using airSlate SignNow for the Form 8829 Worksheet 98 195 196?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that enhance document management, including the ability to handle the Form 8829 Worksheet 98 195 196 efficiently. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form 8829 Worksheet 98 195 196?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the Form 8829 Worksheet 98 195 196. These tools ensure that your documents are completed accurately and sent promptly. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other software for the Form 8829 Worksheet 98 195 196?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Form 8829 Worksheet 98 195 196. This means you can connect with accounting software, CRM systems, and more to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Form 8829 Worksheet 98 195 196?

Using airSlate SignNow for the Form 8829 Worksheet 98 195 196 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to manage your documents digitally, which saves time and minimizes the risk of errors. This ultimately leads to a smoother tax filing experience.

-

Is airSlate SignNow user-friendly for completing the Form 8829 Worksheet 98 195 196?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the Form 8829 Worksheet 98 195 196. The intuitive interface guides you through the process, ensuring that you can fill out and eSign your documents without any hassle. This accessibility is ideal for users of all skill levels.

Get more for Form 8829 Worksheet 98 195 196

Find out other Form 8829 Worksheet 98 195 196

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe