120s 2024-2026

What is the 120s

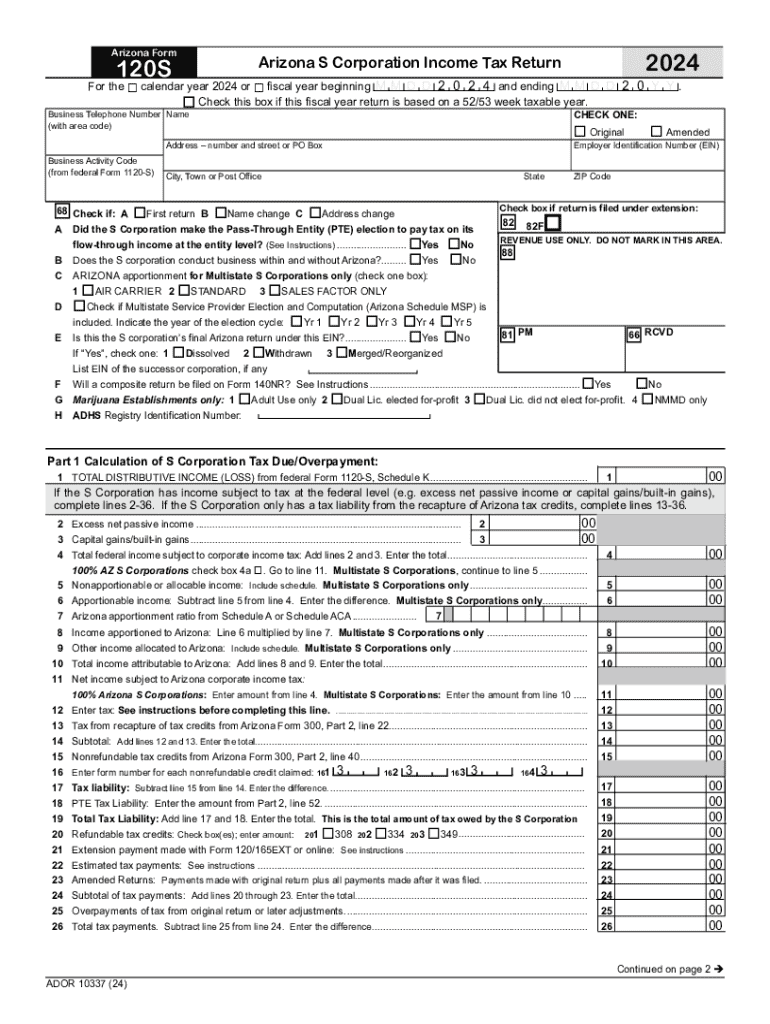

The 120s is a specific form used primarily for tax-related purposes in the United States. This form is essential for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). It is designed to streamline the process of documenting income, expenses, and other financial activities, ensuring compliance with federal tax regulations. Understanding the purpose and requirements of the 120s is crucial for accurate tax reporting and avoiding potential penalties.

How to use the 120s

Using the 120s involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form with accurate information, ensuring that all sections are completed as required. After completing the form, review it for any errors or omissions before submitting it to the IRS. The 120s can be filed electronically or via mail, depending on your preference and the specific requirements for your situation.

Steps to complete the 120s

Completing the 120s requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Detail any deductions or credits you are eligible for, as these can significantly affect your tax liability.

- Double-check all entries for accuracy before finalizing the form.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the 120s

The legal use of the 120s is governed by IRS regulations, which stipulate how and when the form must be used. It is important to ensure that the information reported on the form is truthful and complete, as providing false information can lead to severe penalties, including fines and potential legal action. Understanding the legal implications of the 120s helps taxpayers maintain compliance and avoid complications during audits or reviews by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 120s are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by April fifteenth of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, as these can vary based on specific tax situations or legislative updates. Marking these important dates on your calendar can help avoid late submissions and associated penalties.

Required Documents

To complete the 120s accurately, several documents are required. These typically include:

- Income statements, such as W-2s and 1099s.

- Receipts for deductible expenses.

- Prior year tax returns for reference.

- Any relevant financial statements or documentation supporting claims made on the form.

Having these documents organized and readily accessible can simplify the process of completing the 120s and ensure all necessary information is included.

Create this form in 5 minutes or less

Find and fill out the correct 120s

Create this form in 5 minutes!

How to create an eSignature for the 120s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 120s?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents quickly and securely. With its user-friendly interface, you can complete document workflows in just 120s, making it an efficient choice for busy professionals.

-

How much does airSlate SignNow cost for users looking for a 120s solution?

airSlate SignNow offers various pricing plans that cater to different business needs. For those seeking a quick and effective solution, you can start with a basic plan that allows you to manage documents and eSign them in under 120s, ensuring you stay within budget.

-

What features does airSlate SignNow offer for completing documents in 120s?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders, all designed to help you complete your document signing process in 120s or less. These features streamline your workflow and enhance productivity.

-

Can I integrate airSlate SignNow with other tools for faster processing in 120s?

Yes, airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and more. This integration allows you to manage your documents and eSign them efficiently, often within 120s, enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for quick eSigning in 120s?

Using airSlate SignNow for eSigning offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Completing your document signing in 120s ensures that you can focus on other important tasks without delays.

-

Is airSlate SignNow suitable for small businesses looking to sign documents in 120s?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it an ideal choice for small businesses. With the ability to eSign documents in just 120s, small businesses can streamline their operations and improve customer satisfaction.

-

How does airSlate SignNow ensure the security of documents signed in 120s?

airSlate SignNow prioritizes security by employing advanced encryption and authentication methods. This ensures that all documents signed within 120s are protected, giving users peace of mind while managing sensitive information.

Get more for 120s

- Sgli disability extension application and instructions benefits va form

- Orange registry 2004 2019 form

- Cell organelle structure and function guide chart form

- Hud npma 99 b 2018 2019 form

- Constitution of a charitable incorporated organisation whose only voting members are its charity trustees a pdf print friendly form

- Bogo card order form 2013 cropmarks

- Weekly preschool planner form

- Uscis travel 2016 2019 form

Find out other 120s

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now