Form 60 S Corporation Income Tax Return 2022

What is the Form 60 S Corporation Income Tax Return

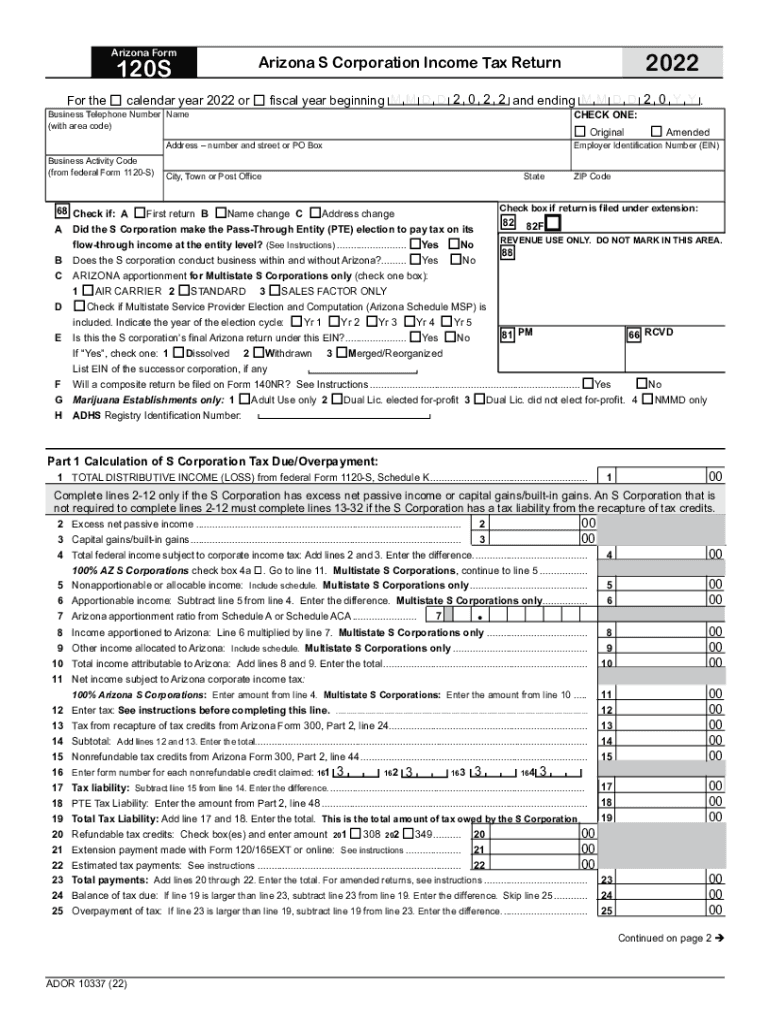

The Form 60 S Corporation Income Tax Return is a tax form used by S corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for S corporations, as it helps determine the corporation's tax liability and ensures compliance with federal tax laws. S corporations are unique business entities that allow income to pass through to shareholders, avoiding double taxation. Filing this form accurately is crucial for maintaining the corporation's tax status and fulfilling legal obligations.

How to use the Form 60 S Corporation Income Tax Return

Using the Form 60 S Corporation Income Tax Return involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, fill out the form by entering the corporation's income, expenses, and other financial details. It is important to follow the IRS guidelines closely, as inaccuracies can lead to penalties. Once completed, the form can be submitted either electronically or by mail, depending on the corporation's preference and compliance requirements.

Steps to complete the Form 60 S Corporation Income Tax Return

Completing the Form 60 S Corporation Income Tax Return requires careful attention to detail. Here are the key steps:

- Gather all financial records, including income, expenses, and deductions.

- Fill out the identifying information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income and deductions in the appropriate sections of the form.

- Calculate the taxable income and any credits the corporation is eligible for.

- Review the completed form for accuracy to avoid errors.

- Submit the form electronically or by mail, ensuring it is sent by the filing deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Form 60 S Corporation Income Tax Return are crucial for compliance. Generally, S corporations must file their returns by the fifteenth day of the third month after the end of their tax year. For corporations operating on a calendar year, this typically falls on March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Corporations may also request an extension, but it is important to ensure that any taxes owed are paid by the original deadline to avoid penalties.

Required Documents

To accurately complete the Form 60 S Corporation Income Tax Return, several documents are necessary. These include:

- Financial statements, such as income statements and balance sheets.

- Records of all income received throughout the tax year.

- Documentation of any deductions or credits the corporation intends to claim.

- Shareholder information, including ownership percentages and distributions.

- Any prior year tax returns that may provide relevant information.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Form 60 S Corporation Income Tax Return can result in significant penalties. These may include fines for late filing, failure to file, or inaccuracies in reporting income and deductions. The IRS may impose a penalty based on the number of months the return is late, which can accumulate quickly. Additionally, non-compliance can lead to audits and further scrutiny of the corporation's financial practices, which can be time-consuming and costly.

Create this form in 5 minutes or less

Find and fill out the correct form 60 s corporation income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 60 s corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 60 S Corporation Income Tax Return?

The Form 60 S Corporation Income Tax Return is a tax form used by S corporations to report income, deductions, and credits to the IRS. This form is essential for ensuring compliance with federal tax regulations and accurately reflecting the corporation's financial activities. Understanding how to properly fill out this form can help businesses avoid penalties and maximize their tax benefits.

-

How can airSlate SignNow help with the Form 60 S Corporation Income Tax Return?

airSlate SignNow streamlines the process of preparing and submitting the Form 60 S Corporation Income Tax Return by allowing users to easily eSign and send documents. Our platform ensures that all necessary signatures are collected efficiently, reducing the time spent on paperwork. This helps businesses focus on their core operations while ensuring compliance with tax regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the preparation and submission of the Form 60 S Corporation Income Tax Return, ensuring you get the best value for your investment. You can choose from monthly or annual subscriptions, with discounts available for long-term commitments.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow provides a range of features designed for efficient tax document management, including customizable templates, secure eSigning, and document tracking. These features simplify the process of preparing the Form 60 S Corporation Income Tax Return, making it easier to gather necessary information and signatures. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is fully compliant with tax regulations, ensuring that your Form 60 S Corporation Income Tax Return is handled securely and in accordance with legal requirements. Our platform uses advanced encryption and security measures to protect sensitive information. This compliance gives businesses peace of mind when managing their tax documents.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, making it easy to manage your Form 60 S Corporation Income Tax Return alongside your financial records. This integration helps streamline workflows and ensures that all necessary data is readily available for tax preparation. Check our integration options to find the best fit for your business.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the Form 60 S Corporation Income Tax Return, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, allowing for quicker turnaround times on important documents. Additionally, the ability to track document status ensures that nothing falls through the cracks during tax season.

Get more for Form 60 S Corporation Income Tax Return

Find out other Form 60 S Corporation Income Tax Return

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement