Form 500 Virginia Corporation Income Tax Return 2024-2026

What is the Form 500 Virginia Corporation Income Tax Return

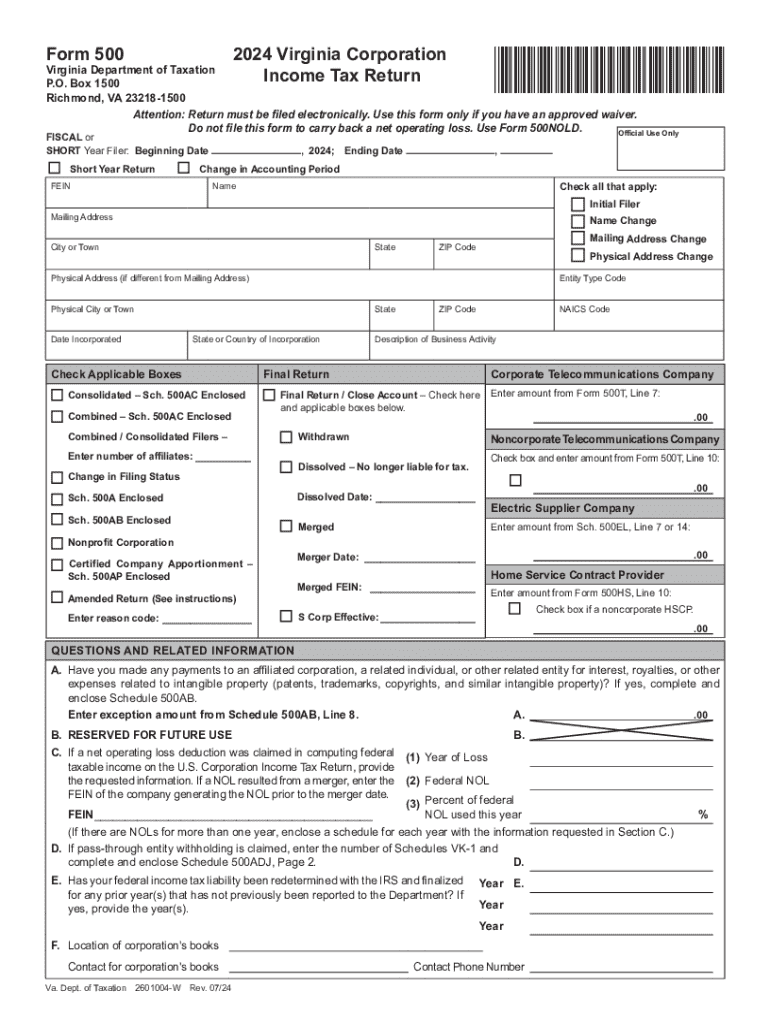

The Form 500 is the official Virginia Corporation Income Tax Return that corporations operating in Virginia must file. This form is essential for reporting the income, deductions, and credits of the corporation for state tax purposes. It is specifically designed for corporations, including C corporations and S corporations, and helps determine the amount of tax owed to the state of Virginia. Understanding this form is crucial for compliance with state tax laws and for ensuring that your corporation meets its financial obligations.

How to use the Form 500 Virginia Corporation Income Tax Return

Using the Form 500 involves several steps that ensure accurate reporting of your corporation's financial activities. First, gather all necessary financial documents, including income statements, balance sheets, and any supporting documentation for deductions and credits. Next, complete the form by entering your corporation's identifying information, such as the federal employer identification number (EIN) and business address. Carefully report your income, deductions, and any applicable tax credits. Finally, review the completed form for accuracy before submitting it to the Virginia Department of Taxation.

Steps to complete the Form 500 Virginia Corporation Income Tax Return

Completing the Form 500 requires attention to detail and adherence to specific guidelines. Follow these steps:

- Gather all relevant financial records, including income and expense reports.

- Fill out the corporation's identifying information at the top of the form.

- Report total income earned during the tax year.

- List all allowable deductions, ensuring to include necessary documentation.

- Calculate the taxable income by subtracting deductions from total income.

- Determine the tax liability based on the applicable tax rate.

- Sign and date the form, ensuring that it is submitted by the due date.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines to remain compliant with Virginia tax laws. The Form 500 is typically due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the due date is April 15. It is important to be aware of these deadlines to avoid penalties and interest charges for late submissions.

Required Documents

To complete the Form 500 accurately, several documents are required. These include:

- Income statements detailing revenue generated by the corporation.

- Balance sheets that provide a snapshot of the corporation's financial position.

- Documentation supporting any claimed deductions and credits.

- Prior year tax returns, if applicable, for reference and consistency.

Penalties for Non-Compliance

Failure to file the Form 500 on time or inaccuracies in the submitted information can result in significant penalties. The Virginia Department of Taxation may impose late filing fees, which can accumulate over time. Additionally, interest may be charged on any unpaid tax liabilities. It is crucial for corporations to understand these potential penalties and take proactive steps to ensure compliance with filing requirements.

Create this form in 5 minutes or less

Find and fill out the correct form 500 virginia corporation income tax return

Create this form in 5 minutes!

How to create an eSignature for the form 500 virginia corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 500 Virginia Corporation Income Tax Return?

The Form 500 Virginia Corporation Income Tax Return is a tax document that corporations in Virginia must file to report their income and calculate their tax liability. This form is essential for compliance with state tax laws and helps ensure that businesses meet their financial obligations.

-

How can airSlate SignNow help with the Form 500 Virginia Corporation Income Tax Return?

airSlate SignNow simplifies the process of preparing and submitting the Form 500 Virginia Corporation Income Tax Return by allowing users to eSign documents securely and efficiently. With our platform, businesses can streamline their tax filing process, ensuring that all necessary documents are completed accurately and on time.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features for managing tax documents, including customizable templates, secure eSigning, and document tracking. These features make it easier for businesses to handle the Form 500 Virginia Corporation Income Tax Return and other important tax documents efficiently.

-

Is airSlate SignNow cost-effective for filing the Form 500 Virginia Corporation Income Tax Return?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to file the Form 500 Virginia Corporation Income Tax Return. Our pricing plans are designed to accommodate various business sizes, ensuring that you get the best value for your document management needs.

-

Can I integrate airSlate SignNow with other accounting software for tax filing?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easy to manage your Form 500 Virginia Corporation Income Tax Return alongside your financial records. This seamless integration helps streamline your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including enhanced security, improved efficiency, and reduced paperwork. By utilizing our platform for the Form 500 Virginia Corporation Income Tax Return, businesses can save time and minimize the risk of errors in their tax filings.

-

How secure is airSlate SignNow when handling sensitive tax documents?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect sensitive tax documents, including the Form 500 Virginia Corporation Income Tax Return. Our platform ensures that your data remains confidential and secure throughout the entire signing and filing process.

Get more for Form 500 Virginia Corporation Income Tax Return

- Pressure test plan form pressure systems

- Standard product information

- Residential claim for food and medicine spoilage 2015 2019 form

- Btelesearchb inc instructions po box 673 name ssn 1 form

- Postal address 22037 hamburg form

- A member of the malca amit group of companies form

- Ikea centennial form

- Clt cra ltr consumer report request 100314 v1docx form

Find out other Form 500 Virginia Corporation Income Tax Return

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form