Virginia Form 500 2020

What is the Virginia Form 500

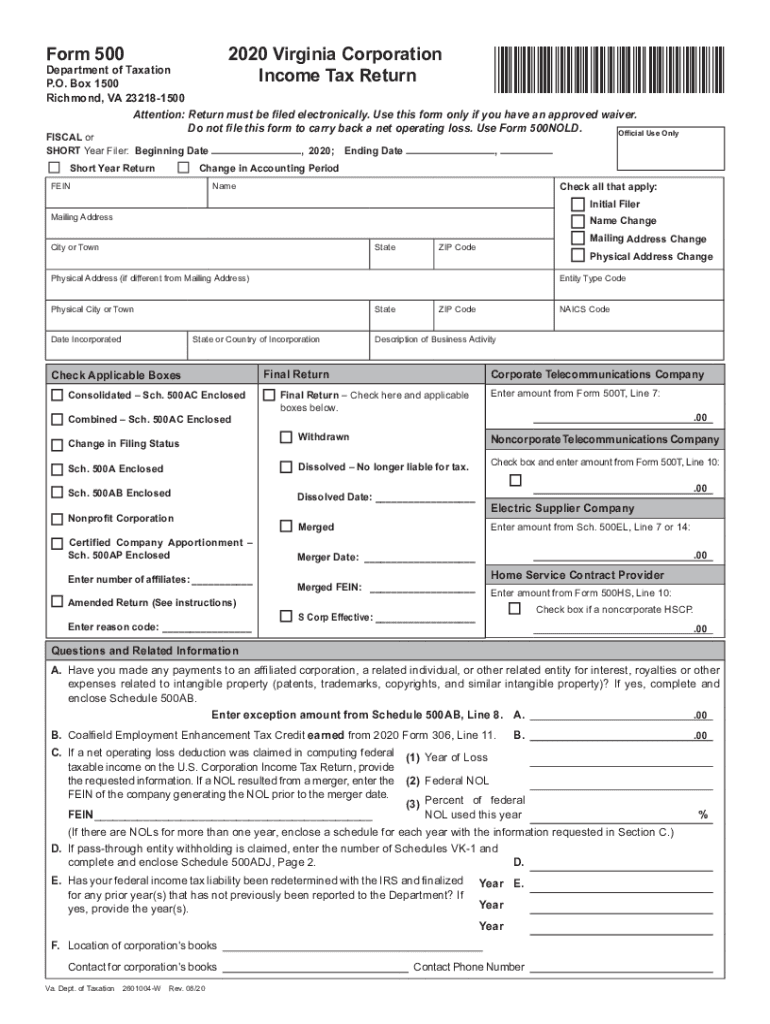

The Virginia Form 500 is a state income tax return form used by individuals and businesses to report their income and calculate their tax liability in Virginia. This form is essential for residents and non-residents who earn income within the state, ensuring compliance with Virginia tax laws. The form captures various income sources, deductions, and credits, allowing taxpayers to accurately determine the amount owed or the refund due.

How to use the Virginia Form 500

Using the Virginia Form 500 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Once the information is compiled, the form should be filled out carefully, ensuring all income and deductions are reported correctly. After completing the form, taxpayers can submit it either electronically or via mail, depending on their preference.

Steps to complete the Virginia Form 500

To complete the Virginia Form 500, follow these steps:

- Gather your financial documents, including income statements and deduction receipts.

- Download the Virginia Form 500 from the Virginia Department of Taxation website or access it through tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, interest, and dividends.

- Claim any deductions and credits you qualify for, ensuring you have documentation to support your claims.

- Calculate your total tax liability based on the provided tax tables or software calculations.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Virginia Form 500. Typically, the deadline for submitting the form is May first of the year following the tax year being reported. If May first falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may apply for, which can provide additional time to file but not to pay any taxes owed.

Required Documents

When completing the Virginia Form 500, specific documents are required to support the information reported. These documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation for any deductions, such as mortgage interest statements or charitable contribution receipts

- Records of any estimated tax payments made during the year

Form Submission Methods

Taxpayers have multiple options for submitting the Virginia Form 500. The form can be filed electronically through approved tax software, which often simplifies the process and allows for quicker refunds. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address provided by the Virginia Department of Taxation. In-person submissions at designated tax offices are also possible, although less common.

Create this form in 5 minutes or less

Find and fill out the correct virginia form 500

Create this form in 5 minutes!

How to create an eSignature for the virginia form 500

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia Form 500?

The Virginia Form 500 is a state tax return form used by corporations to report their income and calculate their tax liability. It is essential for businesses operating in Virginia to file this form accurately to comply with state tax regulations.

-

How can airSlate SignNow help with the Virginia Form 500?

airSlate SignNow streamlines the process of preparing and submitting the Virginia Form 500 by allowing users to eSign documents securely and efficiently. This eliminates the need for physical signatures and speeds up the filing process, ensuring timely submissions.

-

What are the pricing options for using airSlate SignNow for the Virginia Form 500?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes features that simplify the eSigning process for documents like the Virginia Form 500, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for managing the Virginia Form 500?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage, which are particularly beneficial for managing the Virginia Form 500. These tools help ensure that your documents are organized and easily accessible.

-

Is airSlate SignNow compliant with Virginia state regulations for the Form 500?

Yes, airSlate SignNow is designed to comply with Virginia state regulations, ensuring that your eSigned documents, including the Virginia Form 500, meet legal standards. This compliance helps protect your business from potential legal issues.

-

Can I integrate airSlate SignNow with other software for filing the Virginia Form 500?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to file the Virginia Form 500. This seamless integration allows for a more efficient workflow and reduces the chances of errors during the filing process.

-

What are the benefits of using airSlate SignNow for the Virginia Form 500?

Using airSlate SignNow for the Virginia Form 500 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface makes it easy for businesses to manage their tax documents without hassle.

Get more for Virginia Form 500

- City of deltona deltona self service form

- 8 ball score sheets palm beach county bca pool league form

- Health information access request form alberta health

- Icc model international sale contract form

- Travel expense request form

- Supsc 024 form

- Hr 039 form

- Form or 40 p oregon individual income tax return

Find out other Virginia Form 500

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template