Do Not Staple or Paper Clip Rev 081324 Ohi 2024-2026

What is the Do Not Staple Or Paper Clip Rev 081324 Ohi

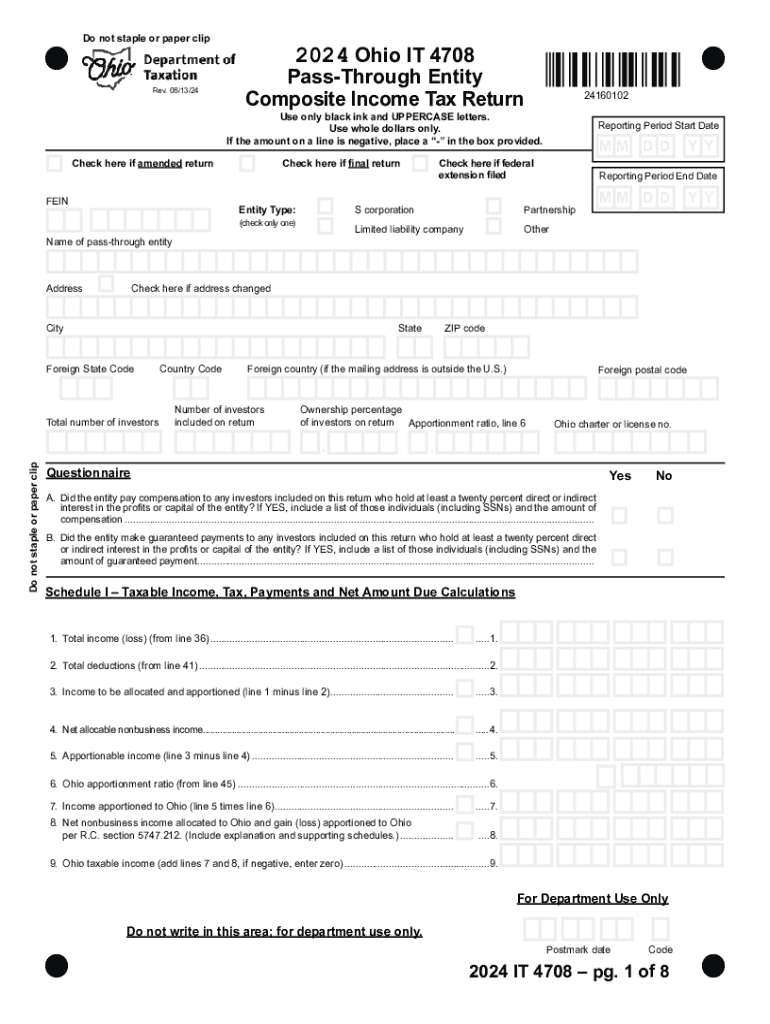

The Do Not Staple Or Paper Clip Rev 081324 Ohi is a specific form designed for use in various administrative and legal processes within the state of Ohio. This form is crucial for ensuring that documents are processed correctly without the interference of staples or paper clips, which can hinder scanning and data entry. The form is often utilized in contexts where accurate document submission is essential, such as tax filings, legal applications, or official requests.

How to use the Do Not Staple Or Paper Clip Rev 081324 Ohi

Using the Do Not Staple Or Paper Clip Rev 081324 Ohi involves a straightforward process. First, gather all necessary information required by the form. Complete the form accurately, ensuring that all fields are filled out as required. Once completed, submit the form without any staples or paper clips, as indicated. This is important to maintain the integrity of the document during processing.

Steps to complete the Do Not Staple Or Paper Clip Rev 081324 Ohi

Completing the Do Not Staple Or Paper Clip Rev 081324 Ohi involves several key steps:

- Gather all required documentation and information.

- Fill out the form clearly and accurately.

- Review the form to ensure all information is correct.

- Submit the form without using staples or paper clips.

- Keep a copy of the completed form for your records.

Legal use of the Do Not Staple Or Paper Clip Rev 081324 Ohi

The Do Not Staple Or Paper Clip Rev 081324 Ohi is often used in legal contexts where proper document submission is mandated. It is important to adhere to the guidelines of this form to avoid delays or rejections. Legal professionals and individuals alike must ensure that the form is filled out correctly and submitted in accordance with state regulations to maintain compliance.

Key elements of the Do Not Staple Or Paper Clip Rev 081324 Ohi

Key elements of the Do Not Staple Or Paper Clip Rev 081324 Ohi include:

- Clear instructions on what to avoid, such as staples and paper clips.

- Specific fields that require accurate information.

- Signature lines, if applicable, for verification purposes.

- Submission instructions detailing how and where to send the form.

Required Documents

When completing the Do Not Staple Or Paper Clip Rev 081324 Ohi, it is essential to have the following documents ready:

- Identification documents, if required.

- Supporting documents relevant to the form's purpose.

- Any previous correspondence related to the matter at hand.

Create this form in 5 minutes or less

Find and fill out the correct do not staple or paper clip rev 081324 ohi

Create this form in 5 minutes!

How to create an eSignature for the do not staple or paper clip rev 081324 ohi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 'Do Not Staple Or Paper Clip Rev 081324 Ohi'?

'Do Not Staple Or Paper Clip Rev 081324 Ohi' is a crucial instruction for ensuring that documents are processed correctly. By following this guideline, you can avoid complications during document handling and ensure that your submissions are accepted without issues.

-

How does airSlate SignNow support the 'Do Not Staple Or Paper Clip Rev 081324 Ohi' requirement?

airSlate SignNow provides a digital solution that eliminates the need for physical staples or paper clips. By using our eSigning platform, you can ensure compliance with the 'Do Not Staple Or Paper Clip Rev 081324 Ohi' directive while streamlining your document management process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Our plans are designed to provide cost-effective solutions while ensuring compliance with guidelines like 'Do Not Staple Or Paper Clip Rev 081324 Ohi'. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features help you manage your documents efficiently while adhering to instructions like 'Do Not Staple Or Paper Clip Rev 081324 Ohi'.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow allows businesses to enhance productivity and reduce turnaround times for document processing. By following the 'Do Not Staple Or Paper Clip Rev 081324 Ohi' guideline, you can ensure that your documents are handled correctly and efficiently.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. This capability ensures that you can maintain compliance with 'Do Not Staple Or Paper Clip Rev 081324 Ohi' while using your preferred tools.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that your documents, including those requiring 'Do Not Staple Or Paper Clip Rev 081324 Ohi', are protected throughout the signing process.

Get more for Do Not Staple Or Paper Clip Rev 081324 Ohi

- Id1 land registry form

- Preauth form capital blue cross

- Cherish perrywinkle autopsy report pdf form

- Ideal gas law problems worksheet form

- Instructions for application for criminal history form

- Form of affidavit to be made for the purpose of determining the size of the bond required of the administrator

- Affidavit form without credit fields qxp

- Glen gardner borough view and make nj open public form

Find out other Do Not Staple Or Paper Clip Rev 081324 Ohi

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online