Form 592 F California Franchise Tax Board Ftb Ca 2020

What is the Form 592 F California Franchise Tax Board Ftb Ca

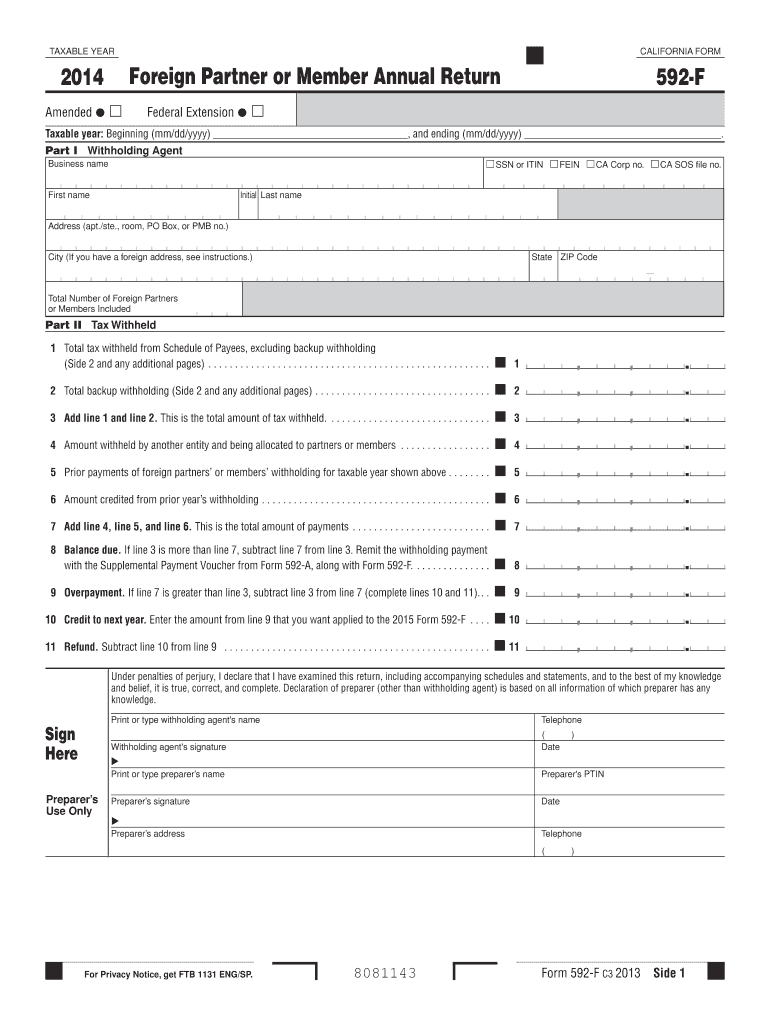

The Form 592 F is a tax document issued by the California Franchise Tax Board (FTB) that is used primarily for reporting withholding on income paid to non-residents. This form is essential for businesses and individuals who make payments to non-residents, ensuring compliance with California tax regulations. The form captures important details about the payer, the payee, and the amounts withheld, facilitating accurate tax reporting and remittance to the state.

How to use the Form 592 F California Franchise Tax Board Ftb Ca

Using the Form 592 F involves several steps to ensure proper completion and submission. First, gather all necessary information about the non-resident payee, including their name, address, and taxpayer identification number. Next, accurately report the amounts paid and the corresponding withholding amounts on the form. Once completed, the form must be submitted to the California Franchise Tax Board along with any required payments. It is crucial to retain a copy for your records and to ensure compliance with state tax laws.

Steps to complete the Form 592 F California Franchise Tax Board Ftb Ca

Completing the Form 592 F requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Form 592 F from the California Franchise Tax Board website.

- Fill in your information as the payer, including your name, address, and identification number.

- Input the non-resident payee's details accurately.

- Report the total payments made to the non-resident and the total withholding amount.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically or via mail, as per the FTB guidelines.

Legal use of the Form 592 F California Franchise Tax Board Ftb Ca

The Form 592 F is legally binding when filled out correctly and submitted according to California tax laws. It serves as a record of withholding and ensures that the appropriate taxes are remitted to the state. Compliance with the legal requirements surrounding this form is essential for both payers and payees to avoid penalties and ensure proper tax reporting. The form must be completed with accurate information to uphold its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Form 592 F are crucial for compliance. Typically, the form must be submitted by the end of the month following the close of the quarter in which payments were made to non-residents. For example, if payments were made in the first quarter, the form is due by April 30. It is important to stay informed about any changes to these deadlines to avoid penalties for late submission.

Form Submission Methods (Online / Mail / In-Person)

The Form 592 F can be submitted through various methods, including online filing, mail, or in-person delivery. Online submission is often the most efficient method, allowing for immediate processing. If mailing the form, ensure it is sent to the correct address as specified by the California Franchise Tax Board. In-person submissions can be made at designated FTB offices, providing an option for those who prefer direct interaction.

Quick guide on how to complete 2014 form 592 f california franchise tax board ftb ca

Complete Form 592 F California Franchise Tax Board Ftb Ca effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can find the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Form 592 F California Franchise Tax Board Ftb Ca on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign Form 592 F California Franchise Tax Board Ftb Ca with ease

- Find Form 592 F California Franchise Tax Board Ftb Ca and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that aim.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 592 F California Franchise Tax Board Ftb Ca and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 592 f california franchise tax board ftb ca

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 592 f california franchise tax board ftb ca

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 592 F for the California Franchise Tax Board?

Form 592 F is a tax form required by the California Franchise Tax Board (FTB Ca) for reporting payments made to non-resident independent contractors. It is essential for ensuring tax compliance when making payments that may be subject to California withholding. Properly completing Form 592 F helps avoid penalties and ensures timely reporting.

-

How can airSlate SignNow help with Form 592 F for the California Franchise Tax Board?

airSlate SignNow simplifies the process of completing and eSigning Form 592 F for the California Franchise Tax Board. With its intuitive interface, you can quickly fill out the form and send it for signatures to relevant parties. This accelerates the compliance process, ensuring that your tax-related documents are handled efficiently.

-

Is airSlate SignNow a cost-effective solution for managing Form 592 F?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 592 F for the California Franchise Tax Board. Our pricing plans are designed to fit various business needs, ensuring that you can affordably manage all your document signing needs without compromising on quality. You can save time and resources while maintaining compliance.

-

What features does airSlate SignNow provide for eSigning Form 592 F?

airSlate SignNow provides a range of features tailored for eSigning Form 592 F, including document templates, real-time tracking, and secure storage. You can also collect signatures from multiple users effortlessly, ensuring that your Form 592 F is completed accurately and on time. These features enhance your overall efficiency.

-

Can I integrate airSlate SignNow with other software for Form 592 F submissions?

Absolutely! airSlate SignNow offers integrations with popular business software, allowing seamless submissions of Form 592 F to the California Franchise Tax Board. These integrations streamline your workflow by eliminating manual processes and enhancing the overall efficiency of your document management.

-

What are the benefits of using airSlate SignNow for compliance with FTB Ca?

Using airSlate SignNow for compliance with the California Franchise Tax Board (FTB Ca) provides several benefits, including faster processing times and reduced administrative burdens. With its secure platform, you can ensure that sensitive information remains protected while easily managing Form 592 F. This results in better compliance and peace of mind.

-

Is there customer support available for Form 592 F inquiries at airSlate SignNow?

Yes, airSlate SignNow provides robust customer support for any inquiries related to Form 592 F and general usage. Our support team is available to assist you with specific questions about the form, compliance requirements, or using our platform. We are dedicated to ensuring you have a smooth experience and resolve any issues promptly.

Get more for Form 592 F California Franchise Tax Board Ftb Ca

- Dd form 1354 excel format

- Te9 witness statement unpaid penalty charge parking form

- Nyks application form download

- Declaration for imported electronic products subject to radiation control standards form

- Aasp 60 form

- Form 58u notice of objection unimproved land valuation

- London bethlem hospital patient admission registers and form

- Fuel drive off offence report queensland police service form

Find out other Form 592 F California Franchise Tax Board Ftb Ca

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors