Master Promissory Note MPN Direct Subsidized Loa 2019-2026

What is the Master Promissory Note MPN Direct Subsidized Loa

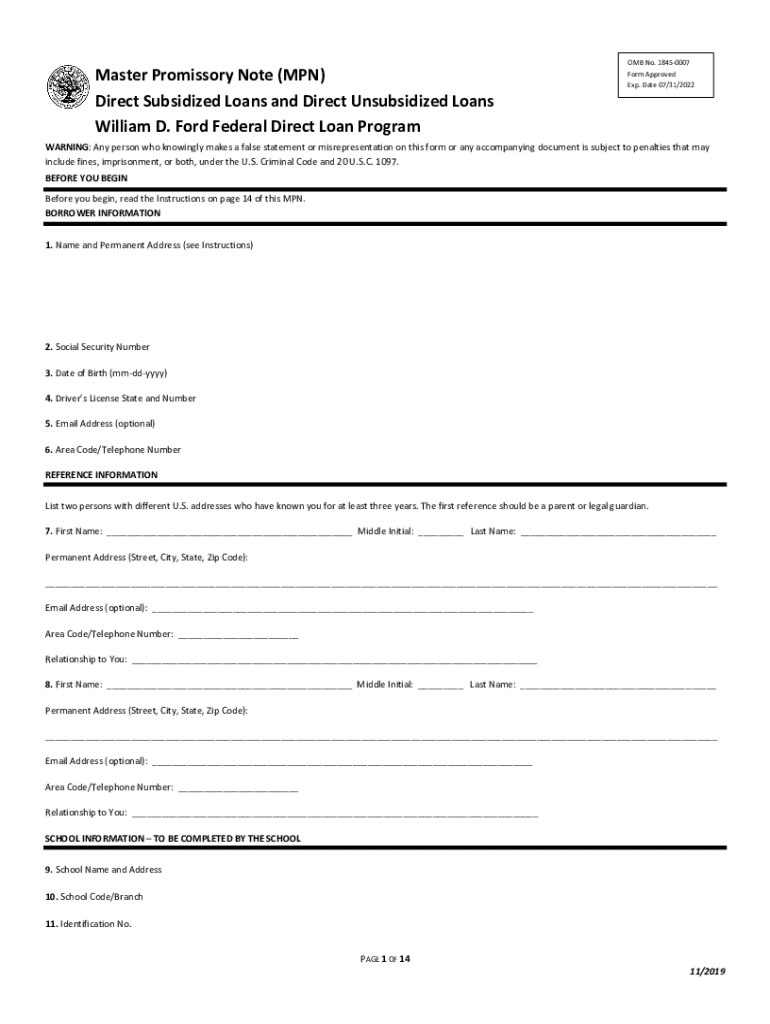

The Master Promissory Note (MPN) for Direct Subsidized Loans is a legal document that outlines the terms and conditions of a federal student loan. This note serves as a binding agreement between the borrower and the U.S. Department of Education, allowing students to borrow funds to cover educational expenses. The Direct Subsidized Loan is specifically designed for undergraduate students who demonstrate financial need. Unlike other loans, interest on a subsidized loan does not accrue while the borrower is enrolled at least half-time in school, during the grace period, or during deferment periods.

How to use the Master Promissory Note MPN Direct Subsidized Loa

To effectively use the Master Promissory Note for Direct Subsidized Loans, borrowers must first complete the Free Application for Federal Student Aid (FAFSA). Once eligibility is determined, students will receive a financial aid award letter from their school. The MPN must then be completed online through the Federal Student Aid website. This process involves providing personal information, including Social Security number, driver’s license number, and details about the school. After submitting the MPN, borrowers will receive confirmation of their loan eligibility.

Steps to complete the Master Promissory Note MPN Direct Subsidized Loa

Completing the Master Promissory Note involves several key steps:

- Access the Federal Student Aid website.

- Log in using your FSA ID.

- Select the option to complete a Master Promissory Note.

- Provide personal information as required.

- Review and accept the terms and conditions of the loan.

- Sign the MPN electronically.

- Submit the MPN for processing.

It is crucial to ensure all information is accurate to avoid delays in loan disbursement.

Key elements of the Master Promissory Note MPN Direct Subsidized Loa

The Master Promissory Note contains several important elements that borrowers should understand:

- Loan Amount: Specifies the total amount borrowed.

- Interest Rate: Details the interest rate applicable to the loan.

- Repayment Terms: Outlines when repayment begins and the duration of the repayment period.

- Borrower Rights: Describes the rights and responsibilities of the borrower.

- Default Consequences: Explains the implications of failing to repay the loan.

Understanding these elements helps borrowers make informed decisions about their financial obligations.

Eligibility Criteria

To qualify for a Direct Subsidized Loan, students must meet certain eligibility criteria:

- Be an undergraduate student enrolled at least half-time in an eligible program.

- Demonstrate financial need as determined by the FAFSA.

- Be a U.S. citizen or eligible non-citizen.

- Maintain satisfactory academic progress in college or career school.

Meeting these criteria is essential for accessing federal financial aid through subsidized loans.

Legal use of the Master Promissory Note MPN Direct Subsidized Loa

The Master Promissory Note is legally binding, meaning borrowers are obligated to adhere to the terms outlined within it. This includes making timely payments and understanding the consequences of default. The U.S. Department of Education has the authority to enforce the terms of the MPN, including pursuing collections for unpaid loans. Borrowers should keep a copy of their signed MPN for their records and refer to it throughout the life of the loan.

Create this form in 5 minutes or less

Find and fill out the correct master promissory note mpn direct subsidized loa

Create this form in 5 minutes!

How to create an eSignature for the master promissory note mpn direct subsidized loa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Master Promissory Note MPN Direct Subsidized Loa?

The Master Promissory Note MPN Direct Subsidized Loa is a legal document that outlines the terms and conditions of a federal student loan. It serves as a binding agreement between the borrower and the lender, detailing the borrower's responsibilities and the loan's repayment terms. Understanding this document is crucial for managing your student loans effectively.

-

How can airSlate SignNow help with the Master Promissory Note MPN Direct Subsidized Loa?

airSlate SignNow simplifies the process of signing and managing your Master Promissory Note MPN Direct Subsidized Loa. With our platform, you can easily eSign documents, ensuring a quick and secure transaction. This streamlines your loan process, allowing you to focus on your education rather than paperwork.

-

What are the pricing options for using airSlate SignNow for my Master Promissory Note MPN Direct Subsidized Loa?

airSlate SignNow offers flexible pricing plans that cater to various needs, including individual users and businesses. Our cost-effective solutions ensure that you can manage your Master Promissory Note MPN Direct Subsidized Loa without breaking the bank. Check our website for detailed pricing information and choose the plan that suits you best.

-

What features does airSlate SignNow provide for managing the Master Promissory Note MPN Direct Subsidized Loa?

airSlate SignNow provides a range of features designed to enhance your experience with the Master Promissory Note MPN Direct Subsidized Loa. These include customizable templates, secure eSigning, document tracking, and integration with popular applications. Our user-friendly interface makes it easy to manage your documents efficiently.

-

Are there any benefits to using airSlate SignNow for my Master Promissory Note MPN Direct Subsidized Loa?

Using airSlate SignNow for your Master Promissory Note MPN Direct Subsidized Loa offers numerous benefits, including increased efficiency and reduced paperwork. Our platform ensures that your documents are securely stored and easily accessible, allowing you to manage your loans with confidence. Additionally, our eSigning feature speeds up the approval process.

-

Can I integrate airSlate SignNow with other applications for my Master Promissory Note MPN Direct Subsidized Loa?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for the Master Promissory Note MPN Direct Subsidized Loa. Whether you use CRM systems, cloud storage, or other document management tools, our integrations ensure that you can manage your documents efficiently. This connectivity helps streamline your processes.

-

Is airSlate SignNow secure for handling my Master Promissory Note MPN Direct Subsidized Loa?

Absolutely! airSlate SignNow prioritizes security, ensuring that your Master Promissory Note MPN Direct Subsidized Loa and other documents are protected. We utilize advanced encryption and comply with industry standards to safeguard your information. You can trust us to keep your sensitive data secure throughout the signing process.

Get more for Master Promissory Note MPN Direct Subsidized Loa

Find out other Master Promissory Note MPN Direct Subsidized Loa

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors