21P 4706c 2024-2026

Understanding the 21P 4706c

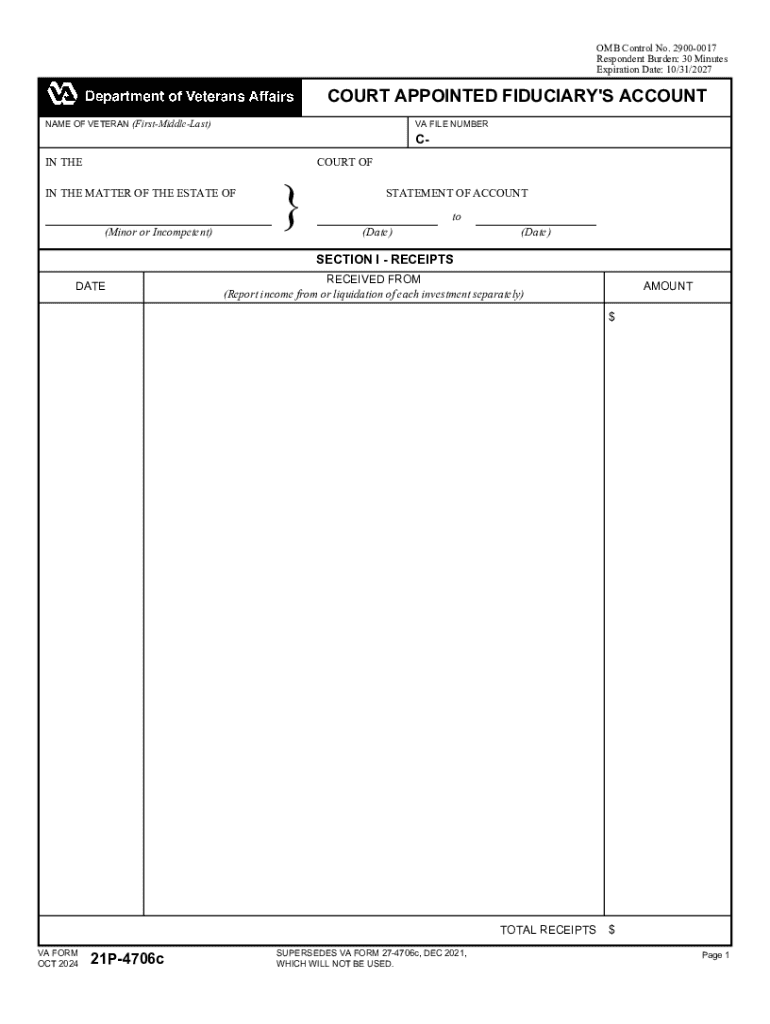

The 21P 4706c is a specific form used primarily for tax and financial purposes in the United States. It is essential for individuals and businesses who need to report certain information to the IRS. This form is often required for compliance with federal regulations, ensuring that all necessary data is accurately submitted. Understanding its purpose is crucial for proper filing and adherence to tax laws.

Steps to Complete the 21P 4706c

Completing the 21P 4706c involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial records and identification information. Next, carefully fill out each section of the form, ensuring that all details are correct and complete. It is advisable to review the form thoroughly before submission to catch any potential errors. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the requirements outlined by the IRS.

Obtaining the 21P 4706c

The 21P 4706c can be obtained directly from the IRS website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form to avoid any issues during submission. If you are working with a tax advisor, they can also provide you with the necessary forms and guidance on how to fill them out correctly.

Legal Use of the 21P 4706c

The legal use of the 21P 4706c is defined by IRS regulations. This form must be used in accordance with federal tax laws to report specific financial information accurately. Failure to use the form correctly can lead to penalties or audits. It is essential for users to understand the legal implications of the information they provide and ensure compliance with all applicable regulations.

Required Documents for the 21P 4706c

When preparing to fill out the 21P 4706c, it is important to have the necessary documents ready. This typically includes financial statements, identification numbers, and any previous tax returns that may be relevant. Having these documents on hand will facilitate a smoother completion process and help ensure that all required information is accurately reported.

Filing Deadlines for the 21P 4706c

Filing deadlines for the 21P 4706c are crucial for compliance. Generally, forms must be submitted by the specified dates set by the IRS to avoid penalties. It is advisable to check the IRS guidelines for the most current deadlines, as they may vary from year to year. Planning ahead and being aware of these dates can help ensure timely submission and avoid any issues with tax compliance.

Create this form in 5 minutes or less

Find and fill out the correct 21p 4706c

Create this form in 5 minutes!

How to create an eSignature for the 21p 4706c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 21P 4706c and how does it relate to airSlate SignNow?

21P 4706c is a specific document type that can be efficiently managed using airSlate SignNow. This platform allows users to send, eSign, and store 21P 4706c documents securely, streamlining the signing process for businesses.

-

What are the pricing options for using airSlate SignNow with 21P 4706c?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for handling 21P 4706c documents. You can choose from monthly or annual subscriptions, ensuring you find a plan that fits your budget while accessing all necessary features.

-

What features does airSlate SignNow offer for managing 21P 4706c documents?

With airSlate SignNow, you can easily create, send, and eSign 21P 4706c documents. The platform includes features like templates, automated workflows, and real-time tracking, making it simple to manage your documents efficiently.

-

How can airSlate SignNow benefit my business when dealing with 21P 4706c?

Using airSlate SignNow for 21P 4706c documents can signNowly enhance your business's efficiency. The platform reduces turnaround time for signatures, minimizes paperwork, and ensures compliance, ultimately leading to improved productivity.

-

Can I integrate airSlate SignNow with other tools for 21P 4706c management?

Yes, airSlate SignNow offers seamless integrations with various tools and applications, allowing you to manage 21P 4706c documents alongside your existing workflows. This flexibility helps streamline processes and enhances collaboration across teams.

-

Is airSlate SignNow secure for handling sensitive 21P 4706c documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your 21P 4706c documents. You can trust that your sensitive information is safe while using the platform.

-

What support options are available for users of airSlate SignNow with 21P 4706c?

airSlate SignNow provides comprehensive support options, including a knowledge base, live chat, and email support for users managing 21P 4706c documents. This ensures you have access to assistance whenever you need it.

Get more for 21P 4706c

- E 585 2009 form

- Nc1099ps form

- Cd 405 corporation tax return 2010 dor web site dor state nc form

- School board of broward county reference form

- Establish home school form escambia county school district

- Credit application priority one financial services inc form

- Marker science scholarship v application 2014 2015 henderson hcef form

- Medical evaluation for the physical impaired broward form

Find out other 21P 4706c

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online