Report of Income from Property or Business 2024-2026

What is the Report Of Income From Property Or Business

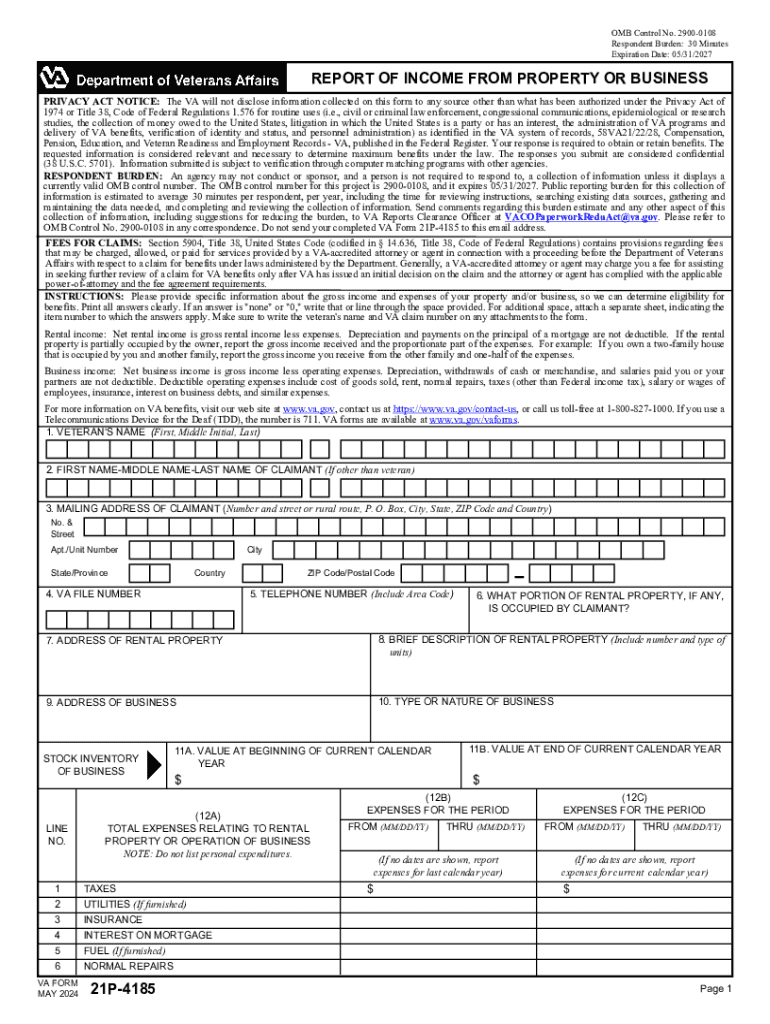

The Report Of Income From Property Or Business is a crucial document for individuals and entities that earn income through rental properties or business activities. This form is often used for tax reporting purposes, allowing taxpayers to disclose their income accurately to the Internal Revenue Service (IRS). It encompasses various types of income, including rents received from real estate, profits from business operations, and other related earnings. Understanding this form is essential for ensuring compliance with tax regulations and for accurately calculating tax liabilities.

How to use the Report Of Income From Property Or Business

Using the Report Of Income From Property Or Business involves several steps to ensure that all income sources are reported correctly. Taxpayers should first gather all relevant financial information, including income statements, receipts, and any other documentation related to their properties or business activities. Once the necessary data is compiled, individuals can begin filling out the form, ensuring that all income is reported in the appropriate sections. It is important to review the completed form for accuracy before submission to avoid potential penalties.

Steps to complete the Report Of Income From Property Or Business

Completing the Report Of Income From Property Or Business requires careful attention to detail. The following steps outline the process:

- Gather all financial documents related to your income from property or business.

- Identify the specific sections of the form that pertain to your income sources.

- Accurately input your income figures, ensuring that all amounts are correctly calculated.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the specified deadline.

Key elements of the Report Of Income From Property Or Business

Several key elements must be included in the Report Of Income From Property Or Business to ensure it is complete and accurate. These elements typically include:

- The total income received from rental properties or business operations.

- Expenses related to the properties or business, which can be deducted from total income.

- Any applicable depreciation on properties or business assets.

- Information regarding any partners or co-owners involved in the business.

Filing Deadlines / Important Dates

Filing deadlines for the Report Of Income From Property Or Business are critical for compliance. Generally, this form must be submitted by the tax filing deadline, which is typically April fifteenth for most taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or different fiscal year-end dates. It is essential to stay informed about these dates to avoid late filing penalties.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Report Of Income From Property Or Business. These guidelines include instructions on how to report different types of income, allowable deductions, and any specific requirements for various business structures. Familiarizing oneself with these guidelines can help ensure that the form is filled out correctly and that all income is reported in compliance with federal tax laws.

Create this form in 5 minutes or less

Find and fill out the correct report of income from property or business

Create this form in 5 minutes!

How to create an eSignature for the report of income from property or business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Report Of Income From Property Or Business?

A Report Of Income From Property Or Business is a detailed document that outlines the income generated from rental properties or business activities. It is essential for tax reporting and helps in understanding the financial performance of your investments. Using airSlate SignNow, you can easily create and eSign this report to streamline your documentation process.

-

How can airSlate SignNow help me with my Report Of Income From Property Or Business?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning your Report Of Income From Property Or Business. With customizable templates and secure storage, you can ensure that your documents are both professional and compliant. This simplifies the process, allowing you to focus on your business.

-

What features does airSlate SignNow offer for managing income reports?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSigning for managing your Report Of Income From Property Or Business. These tools enhance efficiency and ensure that your documents are processed quickly and securely. Additionally, you can integrate with other applications to streamline your workflow.

-

Is airSlate SignNow cost-effective for small businesses needing income reports?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to manage their Report Of Income From Property Or Business. With flexible pricing plans, you can choose the option that best fits your budget while still accessing powerful features. This makes it an ideal choice for businesses looking to save on operational costs.

-

Can I integrate airSlate SignNow with other software for my income reports?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your Report Of Income From Property Or Business. Whether you use accounting software or CRM systems, these integrations help streamline your processes and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for income documentation?

Using airSlate SignNow for your Report Of Income From Property Or Business provides numerous benefits, including enhanced security, ease of use, and faster turnaround times. The platform ensures that your documents are securely stored and easily accessible, while the eSigning feature accelerates the approval process, saving you valuable time.

-

How secure is airSlate SignNow for handling sensitive income reports?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Report Of Income From Property Or Business. Your documents are stored securely, and access is controlled to ensure that only authorized users can view or edit them. This commitment to security gives you peace of mind when handling sensitive information.

Get more for Report Of Income From Property Or Business

- Form cms r 0235 agreement for use of centers for hipaaspace

- Us department of labor payroll forms in word

- Lakeomjregistrationjfsohiogov form

- Unidos webline type 10021 type 10022 and slac confluence form

- Construction contract residential form

- Boat deposit receipt 523849824 form

- Service contract cancellation new car factory warranty list form

- Ga contractors final affidavit form

Find out other Report Of Income From Property Or Business

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself