VA Form 21P 4185 REPORT of INCOME from PROPERTY or BUSINESS 2021

What is the VA Form 21P 4185 Report of Income from Property or Business

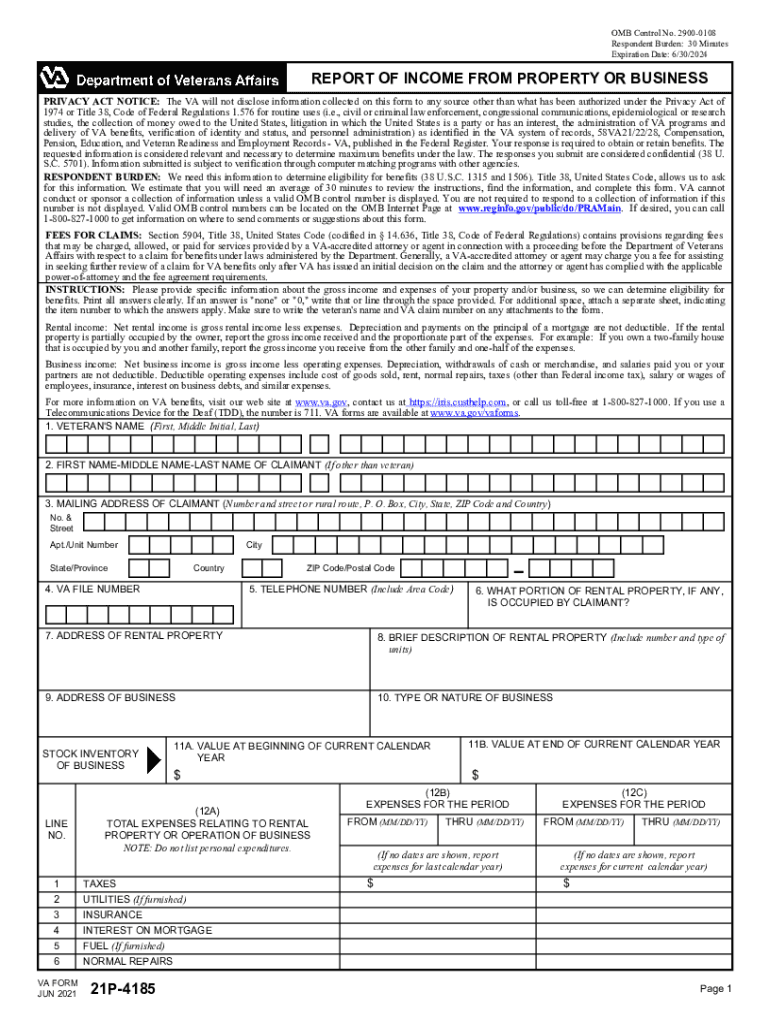

The VA Form 21P 4185 is a crucial document used by veterans and their dependents to report income generated from property or business activities. This form is essential for determining eligibility for various benefits provided by the Department of Veterans Affairs (VA). It captures detailed information about the income sources, which may include rental properties, businesses, or other income-generating assets. Accurate reporting on this form ensures that veterans receive the appropriate level of support based on their financial situation.

How to Use the VA Form 21P 4185 Report of Income from Property or Business

Using the VA Form 21P 4185 involves several steps to ensure that all required information is accurately provided. First, gather all necessary documentation related to your income sources. This may include financial statements, tax returns, and any relevant contracts or agreements. Next, carefully fill out the form, ensuring that all sections are completed to reflect your current financial status. Once completed, review the form for accuracy before submission to avoid delays in processing your benefits.

Steps to Complete the VA Form 21P 4185 Report of Income from Property or Business

Completing the VA Form 21P 4185 requires attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and tax returns.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Provide detailed information about each income source. This includes the type of income, amount received, and any associated expenses.

- Review the form for completeness and accuracy, ensuring that all sections are filled out correctly.

- Sign and date the form before submission.

Legal Use of the VA Form 21P 4185 Report of Income from Property or Business

The VA Form 21P 4185 is legally binding when completed and submitted correctly. It must adhere to specific regulations set forth by the VA to ensure compliance with federal guidelines. The information provided on this form is used to assess eligibility for benefits, making accuracy essential. Failure to provide truthful and complete information can lead to penalties or denial of benefits.

Key Elements of the VA Form 21P 4185 Report of Income from Property or Business

Several key elements must be included when completing the VA Form 21P 4185:

- Personal Information: Name, address, and Social Security number.

- Income Sources: Detailed descriptions of all income-generating properties or businesses.

- Income Amounts: Total income received from each source during the reporting period.

- Expenses: Any expenses associated with the income sources that can be deducted.

Form Submission Methods for the VA Form 21P 4185 Report of Income from Property or Business

The VA Form 21P 4185 can be submitted through various methods to accommodate different preferences. You can choose to submit the form online through the VA's secure portal, which allows for quicker processing. Alternatively, you may print the completed form and mail it to the appropriate VA office. In-person submissions are also an option at designated VA facilities, where assistance is available if needed. Each submission method has its own processing time, so consider your urgency when choosing how to submit the form.

Quick guide on how to complete va form 21p 4185 report of income from property or business

Complete VA Form 21P 4185 REPORT OF INCOME FROM PROPERTY OR BUSINESS effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle VA Form 21P 4185 REPORT OF INCOME FROM PROPERTY OR BUSINESS on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and eSign VA Form 21P 4185 REPORT OF INCOME FROM PROPERTY OR BUSINESS seamlessly

- Locate VA Form 21P 4185 REPORT OF INCOME FROM PROPERTY OR BUSINESS and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign VA Form 21P 4185 REPORT OF INCOME FROM PROPERTY OR BUSINESS and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct va form 21p 4185 report of income from property or business

Create this form in 5 minutes!

How to create an eSignature for the va form 21p 4185 report of income from property or business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VA Form 21P 4185?

VA Form 21P 4185 is a crucial document used to verify the income and asset information of veterans applying for benefits. This form plays a key role in determining eligibility for compensation and pension programs. Understanding how to fill out VA Form 21P 4185 correctly ensures that you receive the benefits you deserve.

-

How can airSlate SignNow help with VA Form 21P 4185?

airSlate SignNow simplifies the signing and submission process of VA Form 21P 4185, allowing users to easily eSign documents from any device. With its user-friendly interface, completing and sending VA Form 21P 4185 becomes more efficient and hassle-free. This ensures that veterans can focus on what matters most while we handle the paperwork.

-

Is there a cost associated with using airSlate SignNow for VA Form 21P 4185?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including a free trial for new users. The plans provide access to all features necessary for managing documents like VA Form 21P 4185 at a competitive rate. Investing in airSlate SignNow can save time and facilitate easier submissions of important forms.

-

What features does airSlate SignNow offer for VA Form 21P 4185 management?

airSlate SignNow provides a range of features including customizable templates, fast eSigning capabilities, and secure storage for VA Form 21P 4185. These features help streamline the document workflow and ensure that all submissions are completed accurately and promptly. Additionally, users can track document status in real-time.

-

Does airSlate SignNow integrate with other tools for managing VA Form 21P 4185?

Yes, airSlate SignNow easily integrates with various productivity and storage tools, enhancing the management of VA Form 21P 4185. Whether you are using Google Drive, Dropbox, or other CRM systems, these integrations allow for seamless file sharing and collaboration. This ensures that you can access your VA Form 21P 4185 and related documents from anywhere.

-

What are the benefits of using airSlate SignNow for VA Form 21P 4185 submissions?

By using airSlate SignNow for VA Form 21P 4185 submissions, veterans can ensure a quick, secure, and hassle-free experience. The platform's eSigning capabilities expedite the process, allowing for faster approvals and access to benefits. Additionally, it helps maintain compliance with all legal requirements related to eSignatures.

-

How secure is airSlate SignNow for submitting VA Form 21P 4185?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like VA Form 21P 4185. The platform complies with industry-leading security standards, ensuring that all data is encrypted both in transit and at rest. This provides peace of mind for veterans submitting important information.

Get more for VA Form 21P 4185 REPORT OF INCOME FROM PROPERTY OR BUSINESS

- Laborie credit union contact number form

- Certification of finances form

- Sales and use tax return annual reconciliation rhode island tax ri form

- Ny state tax return form

- Leave questionnaire form

- Das machtigingsformulier

- Pay what you want pricing for mobile applications the effect of form

- 18002772254 form

Find out other VA Form 21P 4185 REPORT OF INCOME FROM PROPERTY OR BUSINESS

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form