Insurance Premium Tax Ipt Exemption Form 2025-2026

What is the Insurance Premium Tax ipt Exemption Form

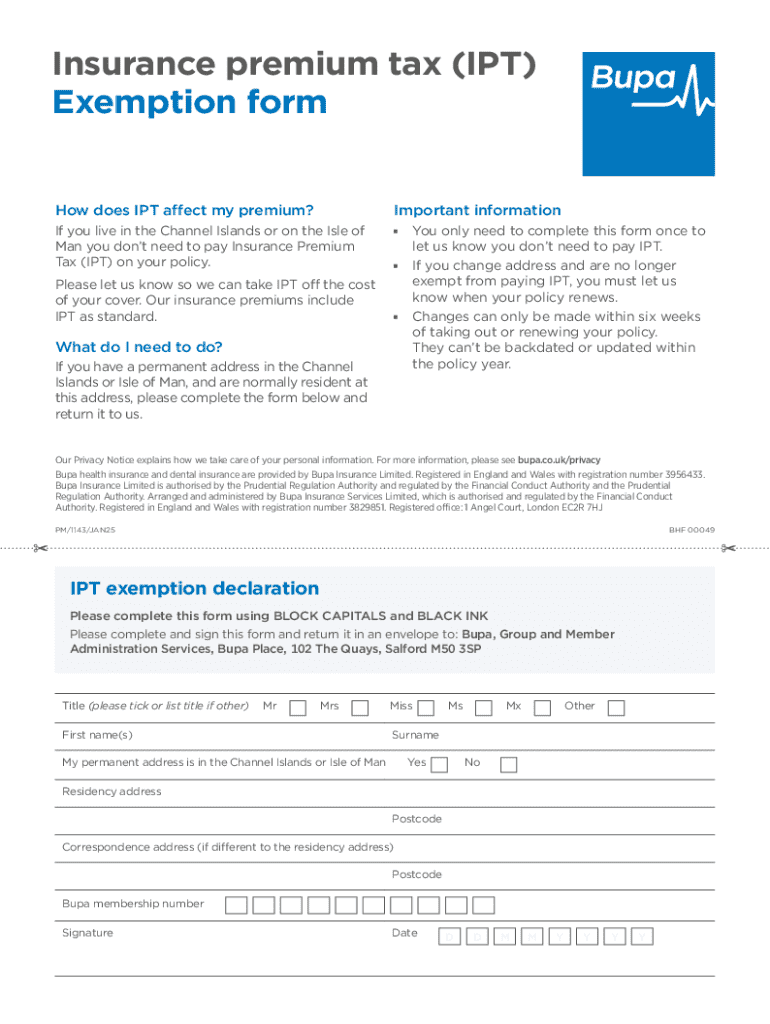

The Insurance Premium Tax ipt Exemption Form is a document used by businesses and individuals to apply for an exemption from paying insurance premium tax. This form is particularly relevant in states where such a tax is imposed on insurance premiums. By completing this form, eligible applicants can provide the necessary information to demonstrate their qualification for the exemption, which can lead to significant savings on insurance costs.

How to use the Insurance Premium Tax ipt Exemption Form

To effectively use the Insurance Premium Tax ipt Exemption Form, applicants should first ensure they meet the eligibility criteria for exemption. Once eligibility is confirmed, the form must be completed accurately, providing all required information. After filling out the form, it should be submitted to the appropriate state tax authority, either online or via mail, depending on the state's submission guidelines. Keeping a copy of the submitted form for personal records is also advisable.

Steps to complete the Insurance Premium Tax ipt Exemption Form

Completing the Insurance Premium Tax ipt Exemption Form involves several key steps:

- Gather necessary information, including personal or business details and tax identification numbers.

- Review the eligibility criteria to ensure that you qualify for the exemption.

- Fill out the form completely, ensuring all sections are addressed.

- Double-check the information for accuracy and completeness.

- Submit the form to the relevant state tax authority by the specified method.

Eligibility Criteria

Eligibility for the Insurance Premium Tax ipt Exemption Form typically includes specific conditions that applicants must meet. These may vary by state but often involve factors such as the type of insurance being purchased, the purpose of the insurance, and the applicant's status (individual or business). It is essential to review the specific eligibility requirements outlined by the state tax authority to ensure compliance.

Required Documents

When submitting the Insurance Premium Tax ipt Exemption Form, applicants may need to provide additional documentation to support their request. Common required documents include:

- A copy of the insurance policy for which the exemption is being requested.

- Proof of eligibility, such as business licenses or tax-exempt status documentation.

- Any other documents specified by the state tax authority.

Form Submission Methods

The Insurance Premium Tax ipt Exemption Form can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state tax authority's website.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Create this form in 5 minutes or less

Find and fill out the correct insurance premium tax ipt exemption form 781360493

Create this form in 5 minutes!

How to create an eSignature for the insurance premium tax ipt exemption form 781360493

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Insurance Premium Tax ipt Exemption Form?

The Insurance Premium Tax ipt Exemption Form is a document that allows eligible businesses to claim an exemption from paying insurance premium taxes. This form is essential for organizations that qualify under specific criteria, helping them save on costs associated with insurance premiums.

-

How can airSlate SignNow help with the Insurance Premium Tax ipt Exemption Form?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the Insurance Premium Tax ipt Exemption Form efficiently. Our user-friendly interface ensures that you can complete and manage your forms quickly, reducing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the Insurance Premium Tax ipt Exemption Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution ensures that you can manage the Insurance Premium Tax ipt Exemption Form without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing the Insurance Premium Tax ipt Exemption Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the Insurance Premium Tax ipt Exemption Form. These features ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the Insurance Premium Tax ipt Exemption Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Insurance Premium Tax ipt Exemption Form. This flexibility helps you maintain efficiency across your business operations.

-

What are the benefits of using airSlate SignNow for the Insurance Premium Tax ipt Exemption Form?

Using airSlate SignNow for the Insurance Premium Tax ipt Exemption Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the process, allowing you to focus on your core business activities while ensuring compliance.

-

How secure is airSlate SignNow when handling the Insurance Premium Tax ipt Exemption Form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data when managing the Insurance Premium Tax ipt Exemption Form, ensuring that your sensitive information remains confidential and secure.

Get more for Insurance Premium Tax ipt Exemption Form

- Scott safety patrol application naperville203 form

- Authorization to release health information iu health iuhealth

- Quotation marks worksheet pdf form

- Certificate of insurance coi definitionwhy request a certificate of insurance from a vendorcertificate of liability insurance form

- Vendor approval form 450847227

- Vesting startup agreement template form

- Vesting vesting certificate agreement template form

- Video agreement template form

Find out other Insurance Premium Tax ipt Exemption Form

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF