Form 966 Instructions 2016

Understanding Form 966 Instructions

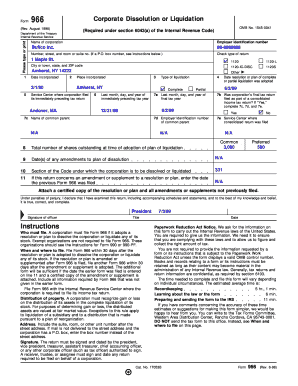

Form 966 is a crucial document for corporations in the United States that wish to dissolve or liquidate. The Form 966 Instructions provide detailed guidance on how to properly complete and submit this form. It outlines the necessary steps to ensure compliance with IRS regulations, detailing the information required for a successful filing. Understanding these instructions is essential for businesses to avoid penalties and ensure a smooth dissolution process.

Steps to Complete Form 966 Instructions

Completing Form 966 involves several key steps. First, gather all necessary information, including the corporation's name, address, and employer identification number (EIN). Next, indicate the date of the resolution to dissolve the corporation and provide a copy of the resolution itself. It's important to ensure that all information is accurate and complete, as errors can lead to delays or rejections. Finally, review the form thoroughly before submission to confirm that all required sections are filled out correctly.

Obtaining Form 966 Instructions

Form 966 Instructions can be obtained directly from the IRS website or through authorized tax professionals. The instructions are available in PDF format for easy download and printing. Additionally, many tax preparation software programs include the necessary forms and instructions, making it convenient for users to fill out and submit electronically. Ensuring you have the most current version of the instructions is vital, as tax regulations can change.

Legal Use of Form 966 Instructions

The legal use of Form 966 is specifically tied to the dissolution of corporations. Corporations must file this form to notify the IRS of their intent to dissolve and to provide details about the dissolution process. Properly following the Form 966 Instructions helps ensure that the corporation complies with federal tax laws, thereby avoiding potential legal repercussions. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal implications of filing this form.

Filing Deadlines for Form 966

Filing deadlines for Form 966 are critical to ensure compliance and avoid penalties. Generally, the form must be filed within thirty days following the adoption of the resolution to dissolve. It is essential to adhere to this timeline, as failure to do so can result in complications with the IRS. Keeping track of important dates and deadlines is an important aspect of the dissolution process.

Required Documents for Form 966

When completing Form 966, several documents are required to support the filing. This includes a copy of the resolution to dissolve the corporation, which must be adopted by the board of directors. Additionally, any other documents that may be required by state law should be included. Ensuring that all necessary documentation is submitted with the form is crucial for a successful filing.

Create this form in 5 minutes or less

Find and fill out the correct form 966 instructions

Create this form in 5 minutes!

How to create an eSignature for the form 966 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Form 966 Instructions?

The Form 966 Instructions provide detailed guidance on how to complete and file Form 966, which is used to notify the IRS of corporate dissolutions. Understanding these instructions is crucial for ensuring compliance and avoiding penalties. airSlate SignNow simplifies this process by allowing you to eSign and send documents securely.

-

How can airSlate SignNow help with Form 966 Instructions?

airSlate SignNow offers a user-friendly platform that streamlines the process of completing and submitting Form 966. With our eSignature capabilities, you can easily sign and send your documents, ensuring that you follow the Form 966 Instructions accurately. This saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form 966 Instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that help you manage Form 966 Instructions efficiently. You can choose a plan that fits your budget while ensuring you have the tools necessary for compliance.

-

What features does airSlate SignNow offer for managing Form 966 Instructions?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of Form 966 Instructions. These tools help you streamline the filing process and ensure that all necessary steps are followed. Additionally, our platform is designed to be intuitive and easy to navigate.

-

Can I integrate airSlate SignNow with other software for Form 966 Instructions?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage your documents related to Form 966 Instructions. This connectivity enhances your workflow and ensures that all your data is synchronized across platforms, making the filing process more efficient.

-

What are the benefits of using airSlate SignNow for Form 966 Instructions?

Using airSlate SignNow for Form 966 Instructions provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign documents quickly, ensuring that you meet deadlines without hassle. Additionally, the secure environment protects your sensitive information.

-

How does airSlate SignNow ensure compliance with Form 966 Instructions?

airSlate SignNow is designed to help you comply with Form 966 Instructions by providing clear templates and guidance throughout the document preparation process. Our platform also includes features that help you track changes and maintain records, ensuring that you can demonstrate compliance if needed. This reduces the risk of errors and penalties.

Get more for Form 966 Instructions

- Valdosta state university transcript form

- Forms and publicationsoffice of student financial services

- Student emergency funds application form

- Transcriptsoffice of the registraruniversity of la verne form

- Sonoma state university transcript request form

- La verne ca recently sold homes realtorcom form

- Community service verification form community service verification form

- Student id last four digits of ssn birth date form

Find out other Form 966 Instructions

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free