ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI Form

Understanding the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI

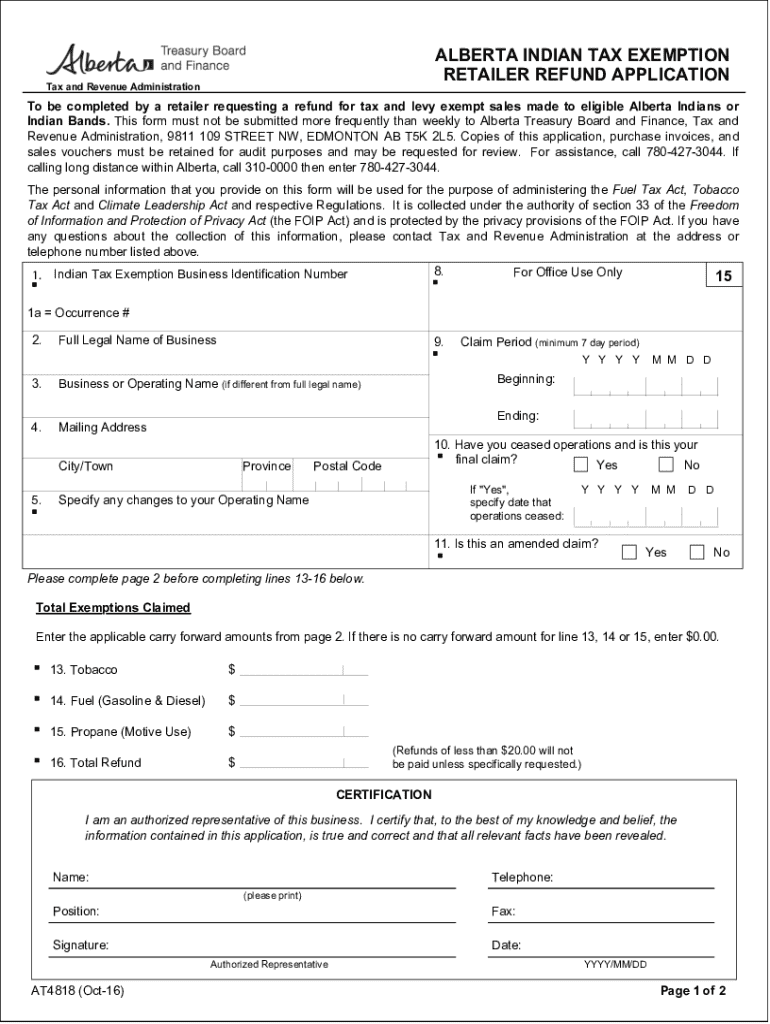

The ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI is a specific form designed for retailers operating in Alberta who wish to claim a refund for taxes paid on goods purchased for resale to eligible Indian customers. This exemption is based on the legal provisions that allow certain purchases to be exempt from provincial sales tax when sold to Indigenous individuals or communities. Understanding the purpose and eligibility criteria of this form is crucial for retailers to ensure compliance with tax regulations while maximizing their potential refunds.

Steps to Complete the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI

Completing the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI involves several key steps:

- Gather necessary documentation, including proof of purchase and evidence of eligibility for tax exemption.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Attach supporting documents that substantiate the claims made in the application.

- Review the completed application for accuracy before submission.

Following these steps carefully can help streamline the refund process and ensure compliance with Alberta tax regulations.

Eligibility Criteria for the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI

To qualify for the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI, retailers must meet specific eligibility criteria. These include:

- The retailer must be registered to collect provincial sales tax in Alberta.

- The goods purchased must be intended for resale to eligible Indian customers.

- Evidence must be provided that the purchaser is a registered Indian or a band, as defined by the Indian Act.

Understanding these criteria is essential for retailers to determine their eligibility and ensure they can successfully claim refunds.

Required Documents for the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI

When submitting the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI, several documents are required to support the application. These typically include:

- Proof of purchase receipts showing the sales tax paid.

- Documentation verifying the eligibility of the Indian purchaser, such as a status card.

- Any additional records that demonstrate the goods were sold for resale.

Providing complete and accurate documentation is vital for a successful refund process.

Form Submission Methods for the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI

The ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI can be submitted through various methods, ensuring flexibility for retailers. Common submission methods include:

- Online submission through the Alberta tax authority's official portal.

- Mailing the completed form and supporting documents to the designated tax office.

- In-person submission at local tax offices, if applicable.

Choosing the appropriate submission method can help expedite the review and processing of the application.

Legal Use of the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI

The legal framework surrounding the ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI is rooted in tax laws that govern sales tax exemptions for Indigenous individuals and communities. Retailers must adhere to these laws to ensure compliance and avoid penalties. This includes understanding the definitions of eligible purchasers and the types of goods that qualify for tax exemption. Legal guidance may be beneficial for retailers unfamiliar with the nuances of tax law.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alberta indian tax exemption retailer refund appli

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alberta Indian Tax Exemption Retailer Refund Appli?

The Alberta Indian Tax Exemption Retailer Refund Appli is a program designed to help eligible retailers in Alberta process tax exemptions for Indigenous customers. This application simplifies the refund process, ensuring that retailers can efficiently manage tax exemptions while complying with provincial regulations.

-

How does the Alberta Indian Tax Exemption Retailer Refund Appli benefit my business?

Using the Alberta Indian Tax Exemption Retailer Refund Appli can signNowly streamline your tax exemption processes, saving time and reducing administrative burdens. This tool not only enhances customer satisfaction by providing a seamless experience but also helps ensure compliance with Alberta's tax regulations.

-

What features does the Alberta Indian Tax Exemption Retailer Refund Appli offer?

The Alberta Indian Tax Exemption Retailer Refund Appli includes features such as automated tax exemption processing, easy document management, and real-time tracking of refund requests. These features are designed to make the refund process as efficient and user-friendly as possible for retailers.

-

Is there a cost associated with using the Alberta Indian Tax Exemption Retailer Refund Appli?

Yes, there may be costs associated with implementing the Alberta Indian Tax Exemption Retailer Refund Appli, depending on the specific features and integrations you choose. However, the investment can lead to signNow savings in time and resources, making it a cost-effective solution for retailers.

-

Can the Alberta Indian Tax Exemption Retailer Refund Appli integrate with other software?

Absolutely! The Alberta Indian Tax Exemption Retailer Refund Appli is designed to integrate seamlessly with various accounting and retail management software. This ensures that you can maintain a cohesive workflow and easily manage your tax exemption processes alongside other business operations.

-

Who is eligible to use the Alberta Indian Tax Exemption Retailer Refund Appli?

The Alberta Indian Tax Exemption Retailer Refund Appli is available to retailers who sell goods and services to Indigenous customers in Alberta. Eligibility typically requires compliance with specific provincial guidelines regarding tax exemptions, ensuring that the process is fair and transparent.

-

How can I get started with the Alberta Indian Tax Exemption Retailer Refund Appli?

Getting started with the Alberta Indian Tax Exemption Retailer Refund Appli is simple. You can visit our website to sign up for a demo or contact our sales team for more information on how to implement the solution in your business.

Get more for ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI

- Form 72a petition for divorce

- Fiche d inscription service de garde en milieu form

- Wccp chassis form

- Change of subcontractor brevard county form

- Residential appraisal request form

- To discuss how wigan council can support you please form

- Printable dental referral form template

- What is inheritance tax iht421 form and how to use it

Find out other ALBERTA INDIAN TAX EXEMPTION RETAILER REFUND APPLI

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast