FTB 6274A Extension Request to File Information Returns

Understanding the FTB 6274A Extension Request To File Information Returns

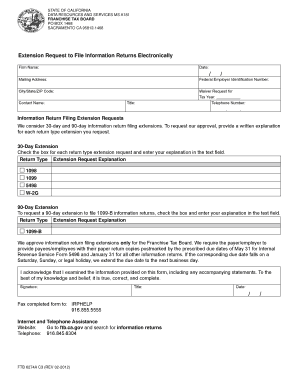

The FTB 6274A Extension Request To File Information Returns is a form used by businesses and individuals in the United States to request an extension for filing certain information returns. This form is particularly relevant for those who need additional time to gather necessary documentation or complete their returns accurately. By submitting this request, taxpayers can avoid late filing penalties while ensuring compliance with state tax regulations.

Steps to Complete the FTB 6274A Extension Request To File Information Returns

Completing the FTB 6274A involves several key steps to ensure that the request is processed smoothly. First, gather all necessary information, including your taxpayer identification number and details about the returns for which you are requesting an extension. Next, accurately fill out the form, paying close attention to the deadlines associated with your specific information returns. After completing the form, review it for any errors or omissions before submission.

Required Documents for the FTB 6274A Extension Request

When submitting the FTB 6274A, certain documents may be required to support your extension request. These typically include copies of any relevant tax returns or documentation that demonstrate your need for an extension. It is important to check the specific requirements for your situation, as additional documentation may be necessary based on the type of information return you are filing.

Filing Deadlines for the FTB 6274A Extension Request

Timely submission of the FTB 6274A is crucial to avoid penalties. Generally, the request must be filed by the original due date of the information returns for which you are seeking an extension. It is advisable to be aware of the specific deadlines applicable to your situation, as these can vary based on the type of return and the fiscal year of your business.

Legal Use of the FTB 6274A Extension Request

The FTB 6274A is a legally recognized document that allows taxpayers to formally request an extension for filing information returns. Utilizing this form properly can help ensure compliance with state tax laws and regulations. It is important to understand that submitting this request does not extend the time to pay any taxes owed; it only extends the time to file the returns.

Examples of Using the FTB 6274A Extension Request

There are various scenarios in which a taxpayer might use the FTB 6274A. For instance, a small business owner who has encountered unexpected delays in gathering financial records may submit this form to request additional time. Similarly, an individual who is waiting for necessary documentation from a third party may also find it beneficial to file the extension request to avoid penalties for late submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 6274a extension request to file information returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FTB 6274A Extension Request To File Information Returns?

The FTB 6274A Extension Request To File Information Returns is a form used by businesses to request an extension for filing information returns with the California Franchise Tax Board. This form allows taxpayers to extend their filing deadline, ensuring compliance while managing their reporting obligations effectively.

-

How can airSlate SignNow help with the FTB 6274A Extension Request To File Information Returns?

airSlate SignNow simplifies the process of completing and submitting the FTB 6274A Extension Request To File Information Returns. Our platform allows users to easily fill out the form, eSign it, and send it securely, streamlining the entire process for businesses.

-

What are the pricing options for using airSlate SignNow for the FTB 6274A Extension Request?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Whether you need basic features or advanced functionalities for handling the FTB 6274A Extension Request To File Information Returns, we have a plan that fits your needs and budget.

-

What features does airSlate SignNow provide for managing the FTB 6274A Extension Request?

With airSlate SignNow, you can access features like customizable templates, secure eSigning, and document tracking specifically for the FTB 6274A Extension Request To File Information Returns. These tools enhance efficiency and ensure that your documents are handled securely and professionally.

-

Are there any benefits to using airSlate SignNow for the FTB 6274A Extension Request?

Using airSlate SignNow for the FTB 6274A Extension Request To File Information Returns offers numerous benefits, including time savings, reduced paperwork, and enhanced compliance. Our user-friendly interface makes it easy to manage your requests without the hassle of traditional methods.

-

Can airSlate SignNow integrate with other software for filing the FTB 6274A Extension Request?

Yes, airSlate SignNow can integrate with various accounting and tax software to streamline the filing process for the FTB 6274A Extension Request To File Information Returns. This integration helps ensure that your data is consistent and reduces the risk of errors during submission.

-

Is airSlate SignNow secure for submitting the FTB 6274A Extension Request?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your FTB 6274A Extension Request To File Information Returns are submitted safely. We use advanced encryption and secure servers to protect your sensitive information throughout the process.

Get more for FTB 6274A Extension Request To File Information Returns

- Assignment of mortgage by corporate mortgage holder iowa form

- Unconditional waiver lien form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property iowa form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497305002 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property iowa form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential iowa form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property iowa form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property iowa form

Find out other FTB 6274A Extension Request To File Information Returns

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now