HOW to READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam 2022-2026

Understanding the Pay Stub and Direct Deposit Advice

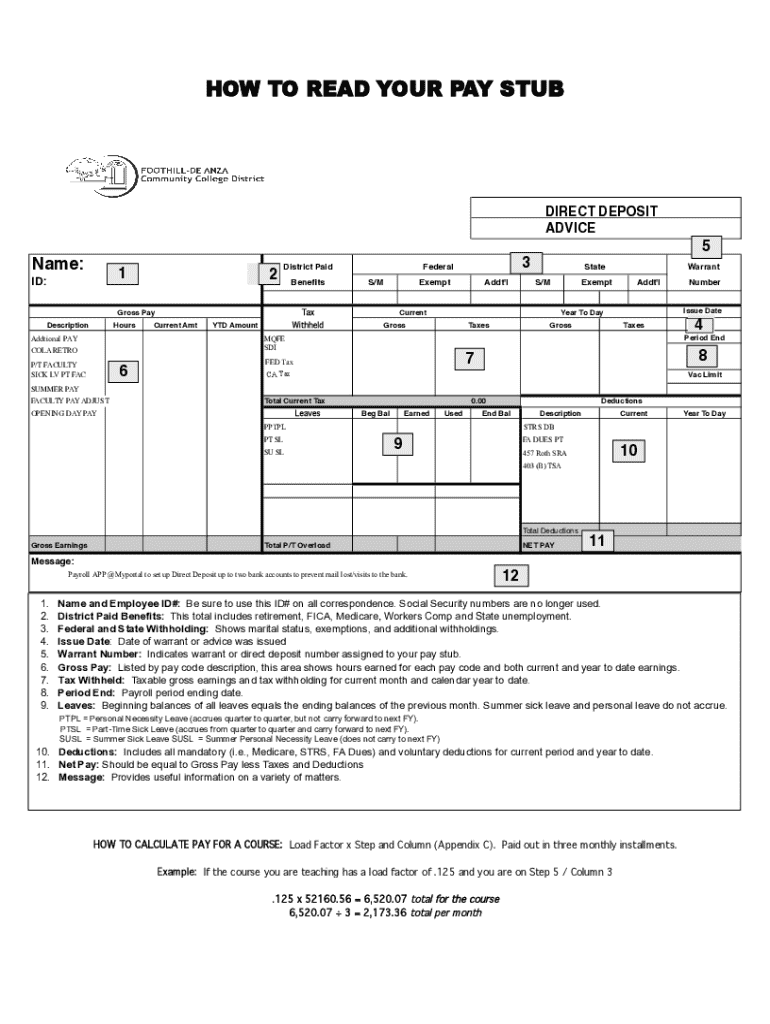

The pay stub is a crucial document that provides employees with detailed information about their earnings, deductions, and net pay for a specific pay period. It typically includes the employee's gross pay, various deductions such as taxes and retirement contributions, and the final amount deposited into the employee's bank account via direct deposit. Understanding how to read your pay stub helps ensure that you are accurately compensated and aware of your financial standing.

Key Elements of Your Pay Stub

When reviewing your pay stub, focus on the following essential elements:

- Gross Pay: This is the total amount earned before any deductions.

- Deductions: These may include federal and state taxes, Social Security, Medicare, health insurance premiums, and retirement contributions.

- Net Pay: This is the final amount you receive after all deductions have been applied.

- Pay Period: Indicates the start and end dates for the pay period covered by the pay stub.

- Year-to-Date (YTD) Totals: This shows cumulative earnings and deductions from the beginning of the calendar year to the current pay period.

How to Read Your Pay Stub

To effectively read your pay stub, follow these steps:

- Locate your gross pay for the pay period at the top of the pay stub.

- Review each deduction listed to understand what is being taken out of your pay.

- Check your net pay to see the amount that will be deposited into your account.

- Look at the pay period dates to ensure you are reviewing the correct time frame.

- Examine the YTD totals for a comprehensive view of your earnings and deductions for the year.

Obtaining Your Pay Stub

Employees can typically obtain their pay stubs from their employer's payroll department or through an online employee portal. If you are unsure how to access your pay stub, consider the following options:

- Contact your HR or payroll department for assistance.

- Check your company’s employee portal, if available, for digital access to pay stubs.

- Request a physical copy if you prefer not to access it online.

Legal Use of Pay Stubs

Pay stubs serve as official documentation of your earnings and deductions and are important for various legal and financial purposes. They may be required for:

- Applying for loans or mortgages.

- Verifying income for tax purposes.

- Filing for unemployment benefits.

It is essential to keep your pay stubs organized and accessible for future reference.

Examples of Pay Stub Usage

Understanding your pay stub can help in several scenarios:

- When applying for a loan, lenders often require recent pay stubs to verify income.

- Tax preparation may require you to reference your pay stubs to ensure accurate reporting of income.

- Monitoring deductions can help identify any discrepancies or unauthorized deductions.

Create this form in 5 minutes or less

Find and fill out the correct how to read your pay stubdirect deposit advice5nam

Create this form in 5 minutes!

How to create an eSignature for the how to read your pay stubdirect deposit advice5nam

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the best way to understand my pay stub?

To effectively learn HOW TO READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam, start by identifying key components such as gross pay, deductions, and net pay. Familiarize yourself with the terminology used in your pay stub to ensure you understand how your earnings are calculated. This knowledge will help you manage your finances better.

-

How can airSlate SignNow help with pay stub management?

airSlate SignNow offers a streamlined solution for managing documents, including pay stubs. By using our platform, you can easily eSign and send pay stubs securely, ensuring that you have access to important financial documents when needed. This can simplify the process of HOW TO READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam.

-

Are there any costs associated with using airSlate SignNow for pay stubs?

Yes, airSlate SignNow provides various pricing plans to cater to different business needs. Our cost-effective solutions ensure that you can manage your pay stubs and other documents without breaking the bank. Understanding HOW TO READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam can also help you assess the value of your investment.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure storage. These tools make it easier to manage your pay stubs and other important documents. Learning HOW TO READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam can enhance your experience by ensuring you know what to look for in your documents.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage your documents alongside your existing tools. This flexibility can enhance your workflow and assist you in understanding HOW TO READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam more effectively.

-

What benefits can I expect from using airSlate SignNow?

Using airSlate SignNow can save you time and reduce paperwork, allowing you to focus on your core business activities. The platform's user-friendly interface makes it easy to manage documents, including pay stubs. This efficiency can help you better understand HOW TO READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents, such as pay stubs, are protected. We use advanced encryption and security measures to safeguard your information. Knowing HOW TO READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam can help you appreciate the importance of document security.

Get more for HOW TO READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam

- Louisiana bond form 497308522

- Petition to borrow money and to mortgage minors interest in immovables concurrence of under tutor and judgment louisiana form

- Louisiana minors form

- Supplemental petition form

- Louisiana cancellation form

- Louisiana cancellation form 497308528

- Assignment of mortgage by individual mortgage holder louisiana form

- Assignment of mortgage by corporate mortgage holder louisiana form

Find out other HOW TO READ YOUR PAY STUBDIRECT DEPOSIT ADVICE5Nam

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template