DR 330 Notice to Employer Re Children's Medical Insurance 2019-2026

What is the DR 330 Notice To Employer Re Children's Medical Insurance

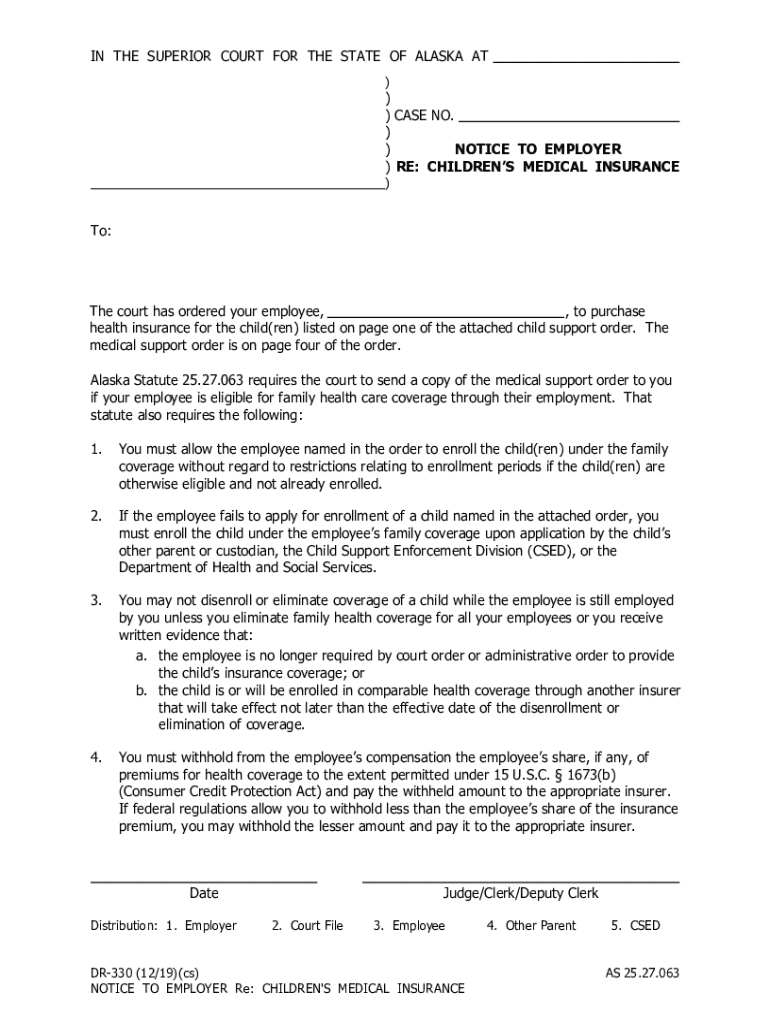

The DR 330 Notice To Employer Re Children's Medical Insurance is a formal document used in the United States to communicate information regarding a child's eligibility for medical insurance. This notice is typically issued by state agencies to employers, informing them of their obligations related to providing health insurance coverage for employees' children. The form ensures that employers are aware of any requirements to enroll eligible dependents in health insurance plans, facilitating access to necessary medical care for children.

How to use the DR 330 Notice To Employer Re Children's Medical Insurance

To effectively use the DR 330 Notice, employers should first review the information provided within the notice carefully. This includes understanding the specific requirements for covering employees' children under their health insurance plans. Employers must ensure compliance with state regulations by enrolling eligible children in a timely manner. It is also essential to maintain accurate records of all communications and actions taken in response to the notice to demonstrate compliance if needed.

Steps to complete the DR 330 Notice To Employer Re Children's Medical Insurance

Completing the DR 330 Notice involves several key steps:

- Review the notice for specific instructions and requirements.

- Gather necessary information about the employee and their child, including names, dates of birth, and any existing insurance coverage.

- Complete the required sections of the notice, ensuring all information is accurate and up to date.

- Submit the completed notice to the appropriate state agency or department as specified in the instructions.

- Keep a copy of the submitted notice for your records.

Legal use of the DR 330 Notice To Employer Re Children's Medical Insurance

The DR 330 Notice serves a legal purpose by ensuring that employers comply with state laws regarding children's medical insurance. It is essential for employers to treat this notice seriously and adhere to the guidelines outlined within it. Failure to comply with the requirements can result in legal repercussions, including fines or penalties. Employers should consult legal counsel if they have questions regarding their obligations under this notice.

Eligibility Criteria

The eligibility criteria for coverage under the DR 330 Notice typically include factors such as the child's age, relationship to the employee, and residency status. Generally, children under the age of 19 may qualify for coverage, but specific criteria can vary by state. Employers should familiarize themselves with the eligibility requirements relevant to their jurisdiction to ensure compliance and provide appropriate coverage for eligible dependents.

Form Submission Methods

The DR 330 Notice can usually be submitted through various methods, depending on state requirements. Common submission methods include:

- Online submission through the state agency's website.

- Mailing a physical copy to the designated agency address.

- In-person delivery at local government offices.

Employers should choose the method that best suits their needs while ensuring that they meet any deadlines specified in the notice.

Create this form in 5 minutes or less

Find and fill out the correct dr 330 notice to employer re childrens medical insurance

Create this form in 5 minutes!

How to create an eSignature for the dr 330 notice to employer re childrens medical insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DR 330 Notice To Employer Re Children's Medical Insurance?

The DR 330 Notice To Employer Re Children's Medical Insurance is a document that informs employers about their obligations regarding children's medical insurance coverage. It is essential for ensuring that employees are aware of their rights and responsibilities related to health insurance for their children.

-

How can airSlate SignNow help with the DR 330 Notice To Employer Re Children's Medical Insurance?

airSlate SignNow provides a streamlined platform for sending and eSigning the DR 330 Notice To Employer Re Children's Medical Insurance. Our solution simplifies the process, ensuring that documents are securely signed and stored, making compliance easier for businesses.

-

What are the pricing options for using airSlate SignNow for the DR 330 Notice To Employer Re Children's Medical Insurance?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can efficiently manage the DR 330 Notice To Employer Re Children's Medical Insurance.

-

What features does airSlate SignNow offer for managing the DR 330 Notice To Employer Re Children's Medical Insurance?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage. These tools make it easy to create, send, and track the DR 330 Notice To Employer Re Children's Medical Insurance, enhancing efficiency and compliance.

-

Are there any benefits to using airSlate SignNow for the DR 330 Notice To Employer Re Children's Medical Insurance?

Using airSlate SignNow for the DR 330 Notice To Employer Re Children's Medical Insurance offers numerous benefits, including time savings, reduced paperwork, and improved accuracy. Our solution helps businesses stay compliant while providing a better experience for employees.

-

Can airSlate SignNow integrate with other software for handling the DR 330 Notice To Employer Re Children's Medical Insurance?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the DR 330 Notice To Employer Re Children's Medical Insurance. This integration allows for better data management and communication across platforms.

-

Is airSlate SignNow secure for handling sensitive documents like the DR 330 Notice To Employer Re Children's Medical Insurance?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. You can trust that your DR 330 Notice To Employer Re Children's Medical Insurance and other sensitive documents are protected.

Get more for DR 330 Notice To Employer Re Children's Medical Insurance

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497311406 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497311407 form

- Michigan tenant in form

- Michigan landlord tenant 497311409 form

- Michigan landlord in form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497311411 form

- Michigan knowledge form

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497311413 form

Find out other DR 330 Notice To Employer Re Children's Medical Insurance

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors