Hotel Motel Excise Tax Form Columbus Ga 2009

What is the Hotel Motel Excise Tax Form Columbus Ga

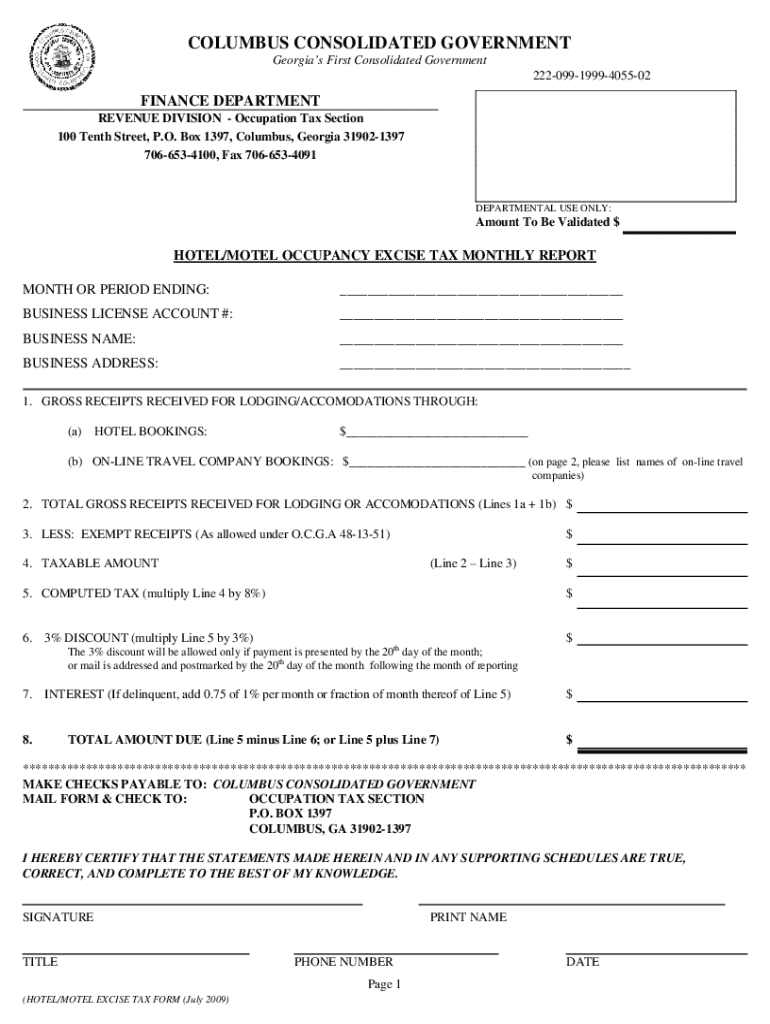

The Hotel Motel Excise Tax Form Columbus Ga is a specific document used by lodging establishments in Columbus, Georgia, to report and remit excise taxes on room rentals. This tax is typically levied on the rental of rooms in hotels, motels, and similar accommodations. The collected tax is used to fund local services and projects, contributing to the community's infrastructure and tourism initiatives.

How to use the Hotel Motel Excise Tax Form Columbus Ga

Using the Hotel Motel Excise Tax Form Columbus Ga involves several straightforward steps. First, ensure you have the correct form, which can be obtained from the local tax authority or relevant government website. Next, fill out the form with accurate information about your business, including the total number of rooms rented and the total rental income. After completing the form, submit it along with the required payment to the designated tax office by the specified deadline.

Steps to complete the Hotel Motel Excise Tax Form Columbus Ga

Completing the Hotel Motel Excise Tax Form Columbus Ga requires attention to detail. Follow these steps:

- Gather all necessary financial records related to room rentals.

- Fill in your business information, including name, address, and tax identification number.

- Report the total number of room nights rented and the gross rental income.

- Calculate the excise tax owed based on the applicable rate.

- Review the form for accuracy before submission.

Legal use of the Hotel Motel Excise Tax Form Columbus Ga

The legal use of the Hotel Motel Excise Tax Form Columbus Ga is essential for compliance with state and local tax regulations. Lodging operators must file this form accurately and on time to avoid penalties. Failure to comply can result in fines or other legal consequences. It is crucial to understand the local laws governing excise taxes to ensure proper usage of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Hotel Motel Excise Tax Form Columbus Ga are typically set by the local tax authority. It is important to be aware of these dates to ensure timely submission. Generally, the form must be filed quarterly, with specific due dates for each quarter. Missing these deadlines can lead to late fees and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Hotel Motel Excise Tax Form Columbus Ga can be submitted through various methods, including:

- Online submission via the local tax authority's website, if available.

- Mailing the completed form to the designated tax office address.

- In-person submission at the local tax office during business hours.

Penalties for Non-Compliance

Non-compliance with the requirements of the Hotel Motel Excise Tax Form Columbus Ga can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is essential for lodging operators to stay informed about their filing obligations and ensure all submissions are accurate and timely to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct hotel motel excise tax form columbus ga

Create this form in 5 minutes!

How to create an eSignature for the hotel motel excise tax form columbus ga

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hotel Motel Excise Tax Form Columbus Ga?

The Hotel Motel Excise Tax Form Columbus Ga is a document required for reporting and paying excise taxes on hotel and motel stays in Columbus, Georgia. This form ensures compliance with local tax regulations and helps businesses avoid penalties. Understanding this form is crucial for hotel operators and property owners.

-

How can airSlate SignNow help with the Hotel Motel Excise Tax Form Columbus Ga?

airSlate SignNow streamlines the process of completing and submitting the Hotel Motel Excise Tax Form Columbus Ga. With our easy-to-use platform, you can fill out the form electronically, eSign it, and send it directly to the relevant authorities. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the Hotel Motel Excise Tax Form Columbus Ga?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs, whether you are a small hotel or a large chain. Our cost-effective solution ensures that you can manage the Hotel Motel Excise Tax Form Columbus Ga without breaking the bank.

-

Are there any features specifically designed for the Hotel Motel Excise Tax Form Columbus Ga?

Yes, airSlate SignNow includes features tailored for the Hotel Motel Excise Tax Form Columbus Ga, such as customizable templates and automated reminders. These features help ensure that you never miss a filing deadline and that your forms are always accurate and up-to-date.

-

Can I integrate airSlate SignNow with other software for managing the Hotel Motel Excise Tax Form Columbus Ga?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and property management software. This integration allows you to manage your Hotel Motel Excise Tax Form Columbus Ga alongside your other financial documents, enhancing efficiency and organization.

-

What are the benefits of using airSlate SignNow for the Hotel Motel Excise Tax Form Columbus Ga?

Using airSlate SignNow for the Hotel Motel Excise Tax Form Columbus Ga offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, making it easier for you to manage your tax obligations without hassle.

-

Is airSlate SignNow secure for handling the Hotel Motel Excise Tax Form Columbus Ga?

Yes, airSlate SignNow prioritizes security and compliance. Our platform uses advanced encryption and security protocols to protect your sensitive information while handling the Hotel Motel Excise Tax Form Columbus Ga. You can trust us to keep your data safe.

Get more for Hotel Motel Excise Tax Form Columbus Ga

- Va widow form

- Legal last will and testament form for widow or widower with minor children virginia

- Legal last will form for a widow or widower with no children virginia

- Legal last will and testament form for a widow or widower with adult and minor children virginia

- Legal last will and testament form for divorced and remarried person with mine yours and ours children virginia

- Legal last will and testament form with all property to trust called a pour over will virginia

- Written revocation of will virginia form

- Last will and testament for other persons virginia form

Find out other Hotel Motel Excise Tax Form Columbus Ga

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF