Instructions for Form 5094 Sales, Use and Withholding SUW 2024

What is the Instructions For Form 5094 Sales, Use And Withholding SUW

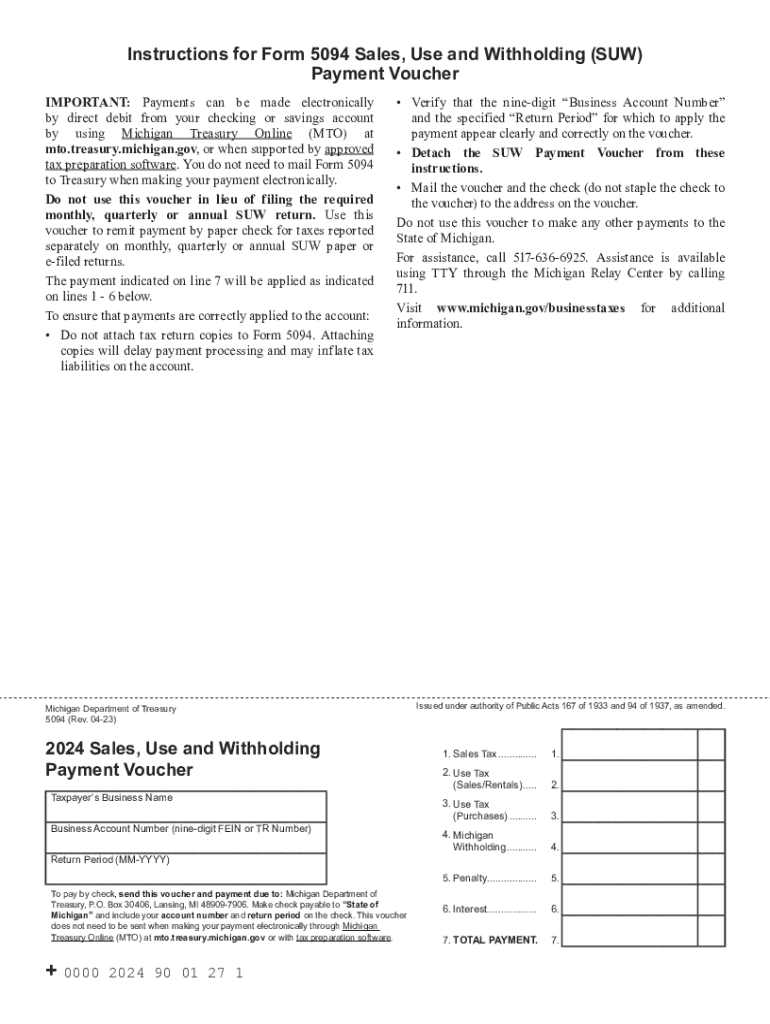

The Instructions For Form 5094 Sales, Use And Withholding SUW is a document issued by the state tax authority that provides guidance on how to report and remit sales, use, and withholding taxes. This form is essential for businesses operating in the United States that engage in taxable sales or services. It outlines the necessary steps to ensure compliance with state tax laws and helps taxpayers understand their obligations regarding tax collection and remittance.

Steps to complete the Instructions For Form 5094 Sales, Use And Withholding SUW

Completing the Instructions For Form 5094 involves several key steps:

- Gather necessary information, including sales records and any relevant tax identification numbers.

- Review the specific instructions provided for your state, as requirements may vary.

- Fill out the form accurately, ensuring all sections are completed as required.

- Calculate the total sales, use, and withholding taxes owed based on your records.

- Submit the completed form by the designated deadline, either electronically or by mail.

Key elements of the Instructions For Form 5094 Sales, Use And Withholding SUW

Several key elements are crucial when working with the Instructions For Form 5094:

- Taxpayer Information: Ensure your name, address, and tax identification number are correct.

- Sales and Use Tax Calculation: Accurately calculate the amount of tax owed based on your sales data.

- Withholding Tax Details: Include any necessary information regarding employee withholdings if applicable.

- Signature and Date: Ensure the form is signed and dated to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 5094 vary by state and can depend on the type of business entity. It is crucial to be aware of specific due dates to avoid penalties. Generally, forms are due on a quarterly or annual basis, and late submissions may incur interest and penalties. Check your state tax authority's website for the most accurate and up-to-date information regarding these deadlines.

Legal use of the Instructions For Form 5094 Sales, Use And Withholding SUW

The Instructions For Form 5094 must be used in accordance with state laws governing sales, use, and withholding taxes. Businesses are legally obligated to collect and remit these taxes as required. Failure to comply can result in penalties, interest, and potential legal action. It is essential for businesses to understand their legal responsibilities and ensure that they are using the form correctly to avoid any issues with tax authorities.

Who Issues the Form

The Instructions For Form 5094 is issued by the state tax authority, which is responsible for overseeing tax compliance within that jurisdiction. Each state may have its own variations of the form and accompanying instructions, tailored to local tax laws and regulations. It is important for businesses to refer to their specific state tax authority for the most relevant and accurate information regarding the form.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 5094 sales use and withholding suw

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 5094 sales use and withholding suw

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 5094 Sales, Use And Withholding SUW?

The Instructions For Form 5094 Sales, Use And Withholding SUW provide detailed guidance on how to complete the form accurately. This form is essential for reporting sales and use tax, as well as withholding tax obligations. Understanding these instructions ensures compliance and helps avoid potential penalties.

-

How can airSlate SignNow assist with the Instructions For Form 5094 Sales, Use And Withholding SUW?

airSlate SignNow simplifies the process of managing documents related to the Instructions For Form 5094 Sales, Use And Withholding SUW. Our platform allows you to easily create, send, and eSign necessary documents, ensuring that you stay compliant with tax regulations. This streamlines your workflow and saves valuable time.

-

What features does airSlate SignNow offer for handling tax forms like the Instructions For Form 5094 Sales, Use And Withholding SUW?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are perfect for handling tax forms like the Instructions For Form 5094 Sales, Use And Withholding SUW. These features enhance efficiency and ensure that all parties can easily access and sign documents. Additionally, our platform integrates seamlessly with other tools you may be using.

-

Is there a cost associated with using airSlate SignNow for the Instructions For Form 5094 Sales, Use And Withholding SUW?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible and cater to different needs, ensuring you get the best value while managing documents related to the Instructions For Form 5094 Sales, Use And Withholding SUW. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for managing the Instructions For Form 5094 Sales, Use And Withholding SUW?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Instructions For Form 5094 Sales, Use And Withholding SUW alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are in one place, improving efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents like the Instructions For Form 5094 Sales, Use And Withholding SUW?

Using airSlate SignNow for tax-related documents, including the Instructions For Form 5094 Sales, Use And Withholding SUW, provides numerous benefits. It enhances document security, reduces processing time, and ensures compliance with tax regulations. Additionally, our user-friendly interface makes it easy for anyone to navigate and manage their documents effectively.

-

How does airSlate SignNow ensure the security of documents related to the Instructions For Form 5094 Sales, Use And Withholding SUW?

airSlate SignNow prioritizes document security by employing advanced encryption and secure storage solutions. This ensures that all documents related to the Instructions For Form 5094 Sales, Use And Withholding SUW are protected from unauthorized access. Our platform also complies with industry standards to maintain the confidentiality of your sensitive information.

Get more for Instructions For Form 5094 Sales, Use And Withholding SUW

- Chapter 10 section 10 2 meiosis worksheet answer key form

- Score sheet template for 15 disc color vision test form

- Notice of court proceedings to collect debt form

- Thai retirement visa application form download

- Life insurance form change nomination

- Idhs form dmhdd 40

- Appointment for a minor form

- Allonge 100056442 form

Find out other Instructions For Form 5094 Sales, Use And Withholding SUW

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word