D400 Schedule S 2024

What is the D400 Schedule S

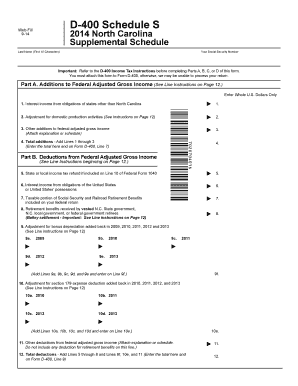

The D400 Schedule S is a supplemental form used in the United States for reporting specific income and deductions related to individual income tax returns. This form is particularly relevant for taxpayers who have income from sources such as partnerships, S corporations, estates, or trusts. By completing the D400 Schedule S, individuals can accurately report their share of income, losses, and deductions from these entities, ensuring compliance with federal tax regulations.

How to use the D400 Schedule S

Using the D400 Schedule S involves several key steps. First, gather all necessary financial documents related to your income sources, including K-1 forms from partnerships or S corporations. Next, fill out the form by providing details about your share of income, deductions, and credits. It is essential to ensure that all figures are accurate and correspond to the information provided by the entities from which you receive income. Finally, attach the completed D400 Schedule S to your main tax return form when filing.

Steps to complete the D400 Schedule S

Completing the D400 Schedule S requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including K-1s and other income statements.

- Enter your personal information at the top of the form, including your name and Social Security number.

- Report your share of income from each entity in the designated sections.

- Include any deductions or credits you are eligible for based on your income sources.

- Review the form for accuracy and completeness before submission.

Key elements of the D400 Schedule S

The D400 Schedule S includes several important sections that taxpayers must complete. Key elements include:

- Personal Information: This section requires your name, Social Security number, and other identifying details.

- Income Reporting: Here, you report income from partnerships, S corporations, estates, or trusts.

- Deductions and Credits: This section allows you to claim any applicable deductions or credits related to your reported income.

Filing Deadlines / Important Dates

Filing deadlines for the D400 Schedule S typically align with the general income tax return deadlines. For most taxpayers, this means that the form must be submitted by April fifteenth each year. If you require additional time, you may file for an extension, which typically grants an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To accurately complete the D400 Schedule S, certain documents are essential. These include:

- K-1 forms from partnerships or S corporations, detailing your share of income and deductions.

- Financial statements from estates or trusts if applicable.

- Any additional documentation that supports your reported income or deductions, such as receipts or invoices.

Create this form in 5 minutes or less

Find and fill out the correct d400 schedule s

Create this form in 5 minutes!

How to create an eSignature for the d400 schedule s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D400 Schedule S and how does it work?

The D400 Schedule S is a specific form used for reporting certain types of income and expenses. With airSlate SignNow, you can easily eSign and send your D400 Schedule S documents securely. Our platform simplifies the process, ensuring that your forms are completed accurately and efficiently.

-

How can airSlate SignNow help with D400 Schedule S submissions?

airSlate SignNow streamlines the submission process for your D400 Schedule S by allowing you to fill out, sign, and send documents electronically. This reduces the time spent on paperwork and minimizes errors. Our user-friendly interface ensures that you can manage your submissions with ease.

-

What are the pricing options for using airSlate SignNow for D400 Schedule S?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who frequently handle D400 Schedule S forms. You can choose from monthly or annual subscriptions, with options that provide additional features for enhanced document management. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing D400 Schedule S documents?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for your D400 Schedule S documents. You can also integrate with other tools to streamline your workflow. These features ensure that you have complete control over your document management process.

-

Are there any benefits to using airSlate SignNow for D400 Schedule S?

Using airSlate SignNow for your D400 Schedule S offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our solution allows you to manage your documents from anywhere, making it easier to stay organized and compliant. Experience the convenience of digital document management today.

-

Can I integrate airSlate SignNow with other software for D400 Schedule S processing?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your D400 Schedule S processing. Whether you use CRM systems, cloud storage, or accounting software, our integrations help streamline your workflow. This ensures that your document management is efficient and cohesive.

-

Is airSlate SignNow secure for handling sensitive D400 Schedule S information?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your D400 Schedule S information. Our platform is designed to keep your data safe while allowing you to eSign and send documents with confidence. Trust us to handle your sensitive information securely.

Get more for D400 Schedule S

Find out other D400 Schedule S

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template