Web 8 23 D 400 Schedule S for Use Only N C 2023

Understanding the D-400 Schedule S

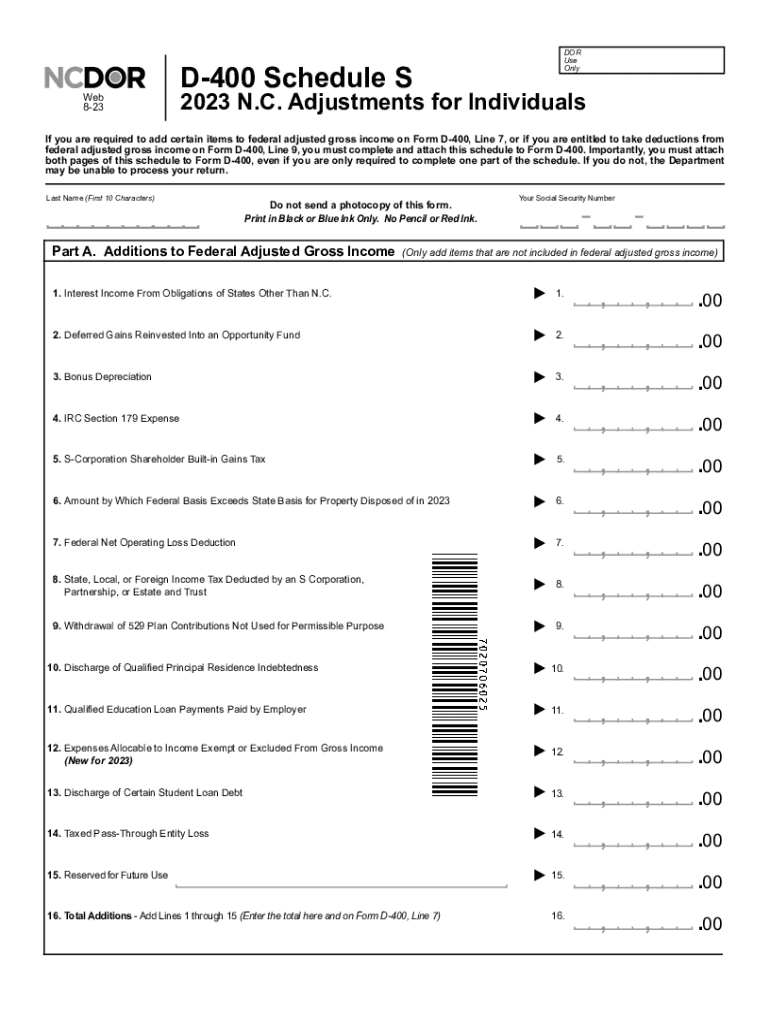

The D-400 Schedule S is a crucial form used by residents of North Carolina to report income from various sources, including partnerships, S corporations, and estates. This form is specifically designed for individuals who need to declare their share of income or loss from these entities on their state tax return. By accurately completing the D-400 Schedule S, taxpayers ensure compliance with North Carolina tax regulations while providing the necessary information to calculate their overall tax liability.

Steps to Complete the D-400 Schedule S

Completing the D-400 Schedule S involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial documents, including K-1 forms from partnerships or S corporations. Follow these steps:

- Enter your personal information at the top of the form, including your name, address, and Social Security number.

- Report your share of income or loss from each entity in the designated sections.

- Calculate your total income or loss by summing the amounts reported from all sources.

- Transfer the total to your D-400 tax return to determine your overall tax liability.

Review the completed form for accuracy before submission to avoid delays or penalties.

Filing Deadlines and Important Dates

Being aware of filing deadlines is essential for compliance. For the D-400 Schedule S, the filing deadline typically aligns with the North Carolina state income tax return due date, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider any extensions they may need to file, but it is important to note that any tax owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents for the D-400 Schedule S

To complete the D-400 Schedule S accurately, taxpayers must gather specific documents. Essential documents include:

- K-1 forms from partnerships or S corporations, detailing income, deductions, and credits.

- Any other relevant tax documents that provide information on income sources.

- Personal identification information, such as your Social Security number.

Having these documents ready will streamline the process of filling out the form and help ensure that all income is reported accurately.

Penalties for Non-Compliance

Failing to file the D-400 Schedule S or providing inaccurate information can result in significant penalties. The North Carolina Department of Revenue may impose fines, interest on unpaid taxes, and potential audits. It is crucial for taxpayers to ensure that all information is accurate and submitted on time to avoid these consequences. Understanding the importance of compliance can help taxpayers maintain good standing with state tax authorities.

Eligibility Criteria for Filing the D-400 Schedule S

Eligibility to file the D-400 Schedule S generally applies to individuals who have received income from partnerships, S corporations, or estates. Taxpayers must be residents of North Carolina and must report all applicable income sources on this form. Understanding the eligibility criteria ensures that taxpayers file the correct forms and comply with state tax regulations.

Quick guide on how to complete web8 23d 400 schedule sforuseonly n c

Prepare Web 8 23 D 400 Schedule S FOR Use Only N C effortlessly on any device

Online document organization has gained signNow traction among companies and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the correct format and securely maintain it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and seamlessly. Handle Web 8 23 D 400 Schedule S FOR Use Only N C on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to adjust and electronically sign Web 8 23 D 400 Schedule S FOR Use Only N C without stress

- Obtain Web 8 23 D 400 Schedule S FOR Use Only N C and then click Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to secure your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Web 8 23 D 400 Schedule S FOR Use Only N C and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct web8 23d 400 schedule sforuseonly n c

Create this form in 5 minutes!

How to create an eSignature for the web8 23d 400 schedule sforuseonly n c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 D 400 Schedule S used for?

The 2022 D 400 Schedule S is primarily used for reporting and calculating the income from partnerships and S corporations. It helps ensure that taxpayers accurately report their income and deductions, making it easier for them to file their tax returns with compliance.

-

How does airSlate SignNow simplify document signing for the 2022 D 400 Schedule S?

airSlate SignNow provides an intuitive platform that simplifies the signing process for the 2022 D 400 Schedule S. With easy-to-use templates and electronic signatures, businesses can efficiently manage their tax-related documents without the hassle of printing or scanning.

-

What are the pricing plans for airSlate SignNow related to the 2022 D 400 Schedule S?

airSlate SignNow offers flexible pricing plans that cater to various business needs, ensuring that users can manage documents related to the 2022 D 400 Schedule S without breaking the bank. Explore our subscription options to find the best plan that fits your budget and usage requirements.

-

Does airSlate SignNow integrate with tax software for preparing the 2022 D 400 Schedule S?

Yes, airSlate SignNow seamlessly integrates with various tax preparation software, allowing users to easily prepare and manage the 2022 D 400 Schedule S. This integration streamlines workflows, enabling quicker access to signed documents directly within your preferred software.

-

What features does airSlate SignNow offer to assist with the 2022 D 400 Schedule S?

airSlate SignNow offers features such as customizable templates, robust security measures, and real-time tracking, all of which facilitate the management of the 2022 D 400 Schedule S. These features help reduce processing time and improve efficiency in document handling.

-

Is airSlate SignNow a cost-effective solution for businesses needing to handle the 2022 D 400 Schedule S?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses that need to handle the 2022 D 400 Schedule S. By reducing the time and resources spent on document management, users can save money while maintaining compliance with their tax obligations.

-

Can I use airSlate SignNow for multiple users when preparing the 2022 D 400 Schedule S?

Yes, airSlate SignNow supports multiple users, making it ideal for teams working together on the 2022 D 400 Schedule S. Collaborate effectively with your colleagues, share access to documents, and streamline the signing process for all involved parties.

Get more for Web 8 23 D 400 Schedule S FOR Use Only N C

- Cheddars application pdf form

- Safeway companies employee association friends helping form

- Cuny employment application part 1 form

- W2request decisionhr com form

- Work related violence research project us department of form

- Employee self form

- Application for safety sensitive positions city of abilene texas form

- Nevada state funded sierra regional center src form

Find out other Web 8 23 D 400 Schedule S FOR Use Only N C

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online