Schedule 2 Form and Instructions Income Tax ProInstructions for Schedule B Form 941 09 Schedule 2 Form and Instructions Income T 2020

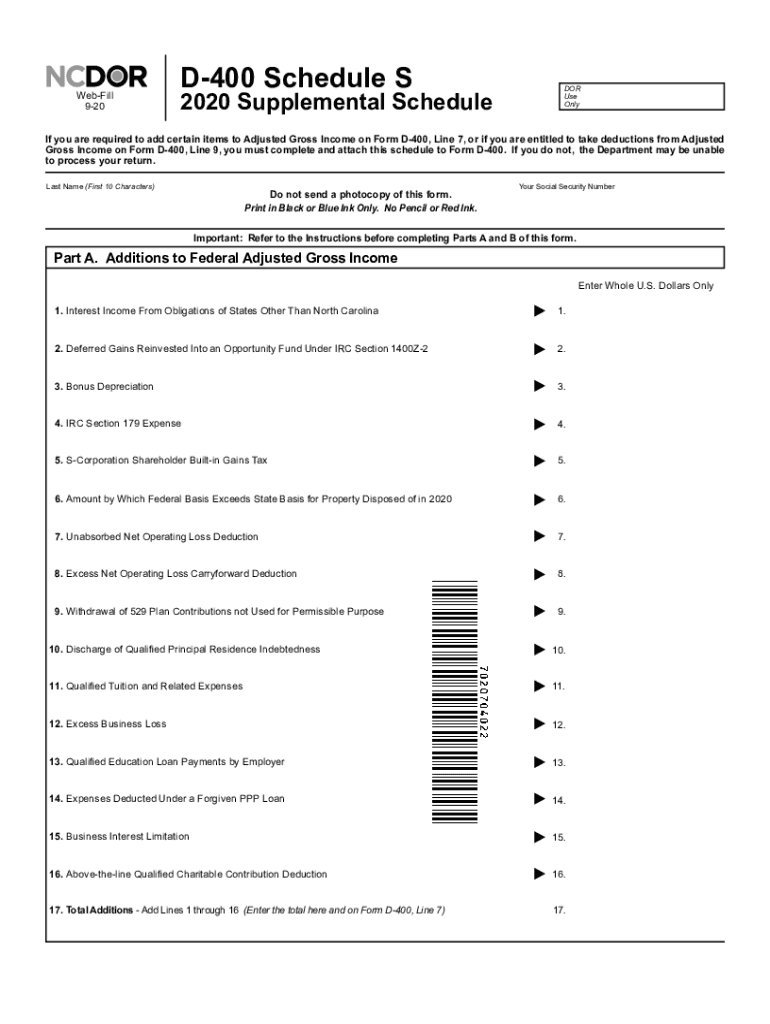

Understanding the North Carolina D-400 Schedule S Form

The North Carolina D-400 Schedule S form is a crucial document used for reporting income from various sources for tax purposes. This form is specifically designed for individuals who have income that is not subject to withholding, such as self-employment income, rental income, or income from partnerships and S corporations. Understanding the purpose and requirements of this form is essential for accurate tax reporting.

Steps to Complete the North Carolina D-400 Schedule S

Completing the D-400 Schedule S involves several key steps:

- Gather all necessary financial documents, including income statements and records of any deductions.

- Fill out personal information at the top of the form, ensuring accuracy in your name, address, and Social Security number.

- Report all applicable income sources in the designated sections, including self-employment income and other non-wage income.

- Calculate your total income and any allowable deductions to determine your taxable income.

- Review the completed form for accuracy before submitting it with your North Carolina D-400 tax return.

Legal Use of the North Carolina D-400 Schedule S

The D-400 Schedule S form is legally binding when filled out correctly and submitted in accordance with North Carolina tax laws. It is essential to ensure that all reported income is accurate and that any deductions claimed are legitimate. Misreporting income or claiming inappropriate deductions may lead to penalties or audits by the North Carolina Department of Revenue.

Filing Deadlines for the D-400 Schedule S

Filing deadlines for the North Carolina D-400 Schedule S typically align with the federal tax deadline. Generally, individuals must submit their tax returns, including the D-400 Schedule S, by April fifteenth of each year. It is important to keep track of any changes to tax laws or deadlines that may affect your filing obligations.

Required Documents for Completing the D-400 Schedule S

To accurately complete the North Carolina D-400 Schedule S, you will need several key documents:

- Income statements, such as 1099 forms or profit and loss statements for self-employment income.

- Records of any business expenses or deductions you plan to claim.

- Previous year’s tax return for reference and consistency.

- Any additional documentation that supports your income claims, such as rental agreements or partnership agreements.

Digital vs. Paper Version of the D-400 Schedule S

The North Carolina D-400 Schedule S can be completed in both digital and paper formats. Using a digital solution offers advantages such as ease of use, automatic calculations, and secure submission options. However, some individuals may prefer the traditional paper method. Regardless of the format chosen, ensure that all information is accurate and submitted on time to avoid penalties.

Quick guide on how to complete 2020 schedule 2 form and instructions income tax proinstructions for schedule b form 941 092020 2020 schedule 2 form and

Complete Schedule 2 Form And Instructions Income Tax ProInstructions For Schedule B Form 941 09 Schedule 2 Form And Instructions Income T effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Schedule 2 Form And Instructions Income Tax ProInstructions For Schedule B Form 941 09 Schedule 2 Form And Instructions Income T on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to modify and electronically sign Schedule 2 Form And Instructions Income Tax ProInstructions For Schedule B Form 941 09 Schedule 2 Form And Instructions Income T without effort

- Obtain Schedule 2 Form And Instructions Income Tax ProInstructions For Schedule B Form 941 09 Schedule 2 Form And Instructions Income T and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Schedule 2 Form And Instructions Income Tax ProInstructions For Schedule B Form 941 09 Schedule 2 Form And Instructions Income T while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule 2 form and instructions income tax proinstructions for schedule b form 941 092020 2020 schedule 2 form and

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule 2 form and instructions income tax proinstructions for schedule b form 941 092020 2020 schedule 2 form and

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the North Carolina D 400 Schedule S?

The North Carolina D 400 Schedule S is a form used for reporting income to the state's Department of Revenue. It is specifically designed for individuals and businesses to detail their taxable income, helping ensure compliance with state regulations. Understanding this form is crucial for accurate tax reporting in North Carolina.

-

How can airSlate SignNow help with the North Carolina D 400 Schedule S?

With airSlate SignNow, you can easily create, send, and eSign your North Carolina D 400 Schedule S documents. This streamlined process saves you time and reduces errors, ensuring that your tax forms are properly completed and submitted. The platform's user-friendly interface makes it simple for all users to manage their documentation efficiently.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to meet various business needs. Our plans provide different levels of features, including eSigning capabilities and document management tools suitable for handling the North Carolina D 400 Schedule S. You can choose the plan that best fits your requirements and budget.

-

Is airSlate SignNow secure for handling sensitive documents like the North Carolina D 400 Schedule S?

Yes, airSlate SignNow prioritizes the security of your documents. We implement encryption and advanced security protocols to ensure that your North Carolina D 400 Schedule S and other sensitive information are protected. You can confidently manage your tax forms knowing they are stored securely.

-

Can I integrate airSlate SignNow with other tools for filing the North Carolina D 400 Schedule S?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when preparing the North Carolina D 400 Schedule S. This connectivity allows you to efficiently gather information and document approvals, making the filing process smoother.

-

What features does airSlate SignNow offer for managing my North Carolina D 400 Schedule S?

airSlate SignNow includes several features that enhance the management of your North Carolina D 400 Schedule S. Key features include eSigning, document templates, and collaborative editing tools that allow you to easily create and finalize tax documents with your team or clients.

-

Will I receive reminders for important deadlines related to the North Carolina D 400 Schedule S?

Yes, airSlate SignNow offers reminder features that keep you informed about key filing deadlines for the North Carolina D 400 Schedule S. This ensures that you never miss a crucial date, allowing for timely submissions and avoiding potential penalties.

Get more for Schedule 2 Form And Instructions Income Tax ProInstructions For Schedule B Form 941 09 Schedule 2 Form And Instructions Income T

Find out other Schedule 2 Form And Instructions Income Tax ProInstructions For Schedule B Form 941 09 Schedule 2 Form And Instructions Income T

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT