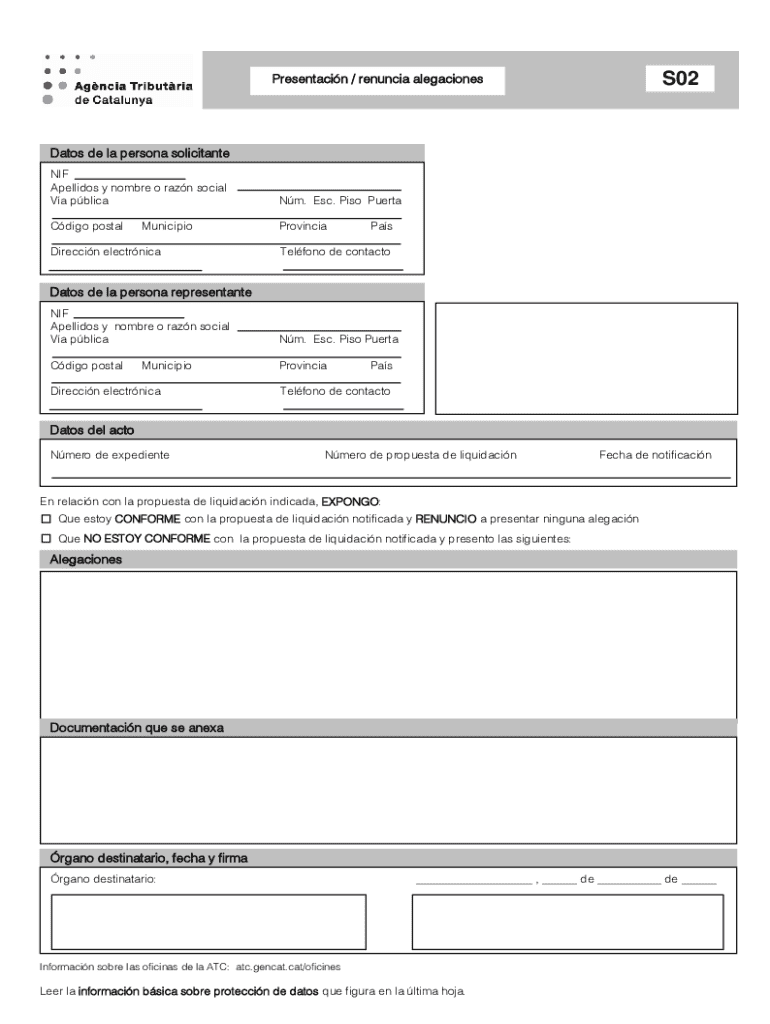

S02 Form

What is the S02

The S02 form is a specific document used in various administrative and regulatory processes. This form is often required by businesses and individuals to report specific information to government agencies. It plays a crucial role in ensuring compliance with legal and tax obligations within the United States. Understanding the purpose and requirements of the S02 is essential for proper completion and submission.

How to use the S02

Using the S02 form involves several key steps. First, gather all necessary information and documents required to complete the form accurately. Next, fill out the form with the relevant details, ensuring that all sections are completed as instructed. After completing the form, review it for accuracy before submission. Depending on the specific requirements, the form may need to be submitted electronically or via mail.

Steps to complete the S02

Completing the S02 form involves a systematic approach:

- Gather necessary documents, such as identification and financial records.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form, ensuring all information is accurate and complete.

- Double-check for any errors or omissions.

- Submit the form according to the specified guidelines, either online or by mail.

Legal use of the S02

The S02 form must be used in accordance with applicable laws and regulations. Misuse or incorrect filing of this form can lead to penalties or legal complications. It is important to understand the legal implications of the information provided on the S02, as it may be subject to audits or reviews by government authorities.

Filing Deadlines / Important Dates

Filing deadlines for the S02 form can vary based on the specific context in which it is used. It is essential to be aware of these deadlines to avoid late submissions, which may result in penalties. Keeping track of important dates related to the S02 will help ensure compliance and timely processing.

Required Documents

When completing the S02 form, several documents may be required to support the information provided. These documents can include proof of identity, financial statements, and any other relevant records. Having these documents ready will facilitate a smoother completion process and help avoid delays.

IRS Guidelines

The S02 form is subject to guidelines set forth by the IRS, which outline how the form should be completed and submitted. Familiarizing oneself with these guidelines is crucial for ensuring compliance and accuracy. The IRS provides resources that can assist in understanding the requirements associated with the S02 form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s02

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is S02 and how does it benefit my business?

S02 is a powerful feature of airSlate SignNow that streamlines the document signing process. By utilizing S02, businesses can enhance efficiency, reduce turnaround times, and improve overall workflow. This feature is designed to be user-friendly, making it accessible for all team members.

-

How much does airSlate SignNow with S02 cost?

The pricing for airSlate SignNow with S02 is competitive and designed to fit various business budgets. We offer flexible plans that cater to different needs, ensuring that you only pay for what you use. For detailed pricing information, visit our pricing page.

-

What features are included with S02?

S02 includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance the signing experience and ensure that your documents are handled efficiently. Additionally, S02 integrates seamlessly with other tools to further streamline your processes.

-

Can I integrate S02 with other software?

Yes, S02 is designed to integrate with various software applications, enhancing your existing workflows. Whether you use CRM systems, project management tools, or other business applications, S02 can connect seamlessly to improve efficiency. Check our integrations page for a full list of compatible applications.

-

Is S02 secure for sensitive documents?

Absolutely! S02 prioritizes security, employing advanced encryption and compliance measures to protect your sensitive documents. With airSlate SignNow, you can trust that your data is safe and secure throughout the signing process. We adhere to industry standards to ensure your peace of mind.

-

How does S02 improve the signing process?

S02 simplifies the signing process by allowing users to send, sign, and manage documents from any device. This flexibility means that you can complete transactions faster, regardless of location. The intuitive interface of S02 ensures that even those unfamiliar with digital signing can navigate it easily.

-

What support is available for S02 users?

We offer comprehensive support for all S02 users, including tutorials, FAQs, and customer service assistance. Our dedicated support team is available to help you with any questions or issues you may encounter. We aim to ensure that your experience with S02 is smooth and productive.

Get more for S02

- Emp5510 form

- Oregon lost boat title application form

- Dd form 2660

- Skandia universal remote form

- Ncrec forms

- Www exodushomes org wp content uploadsexodus homes exodus works p o box 3311 324 7983 fax www form

- Application for medicaid and affordable health coverage 780819916 form

- Vba 21 0966 are pdf veterans benefits administration va gov form

Find out other S02

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template