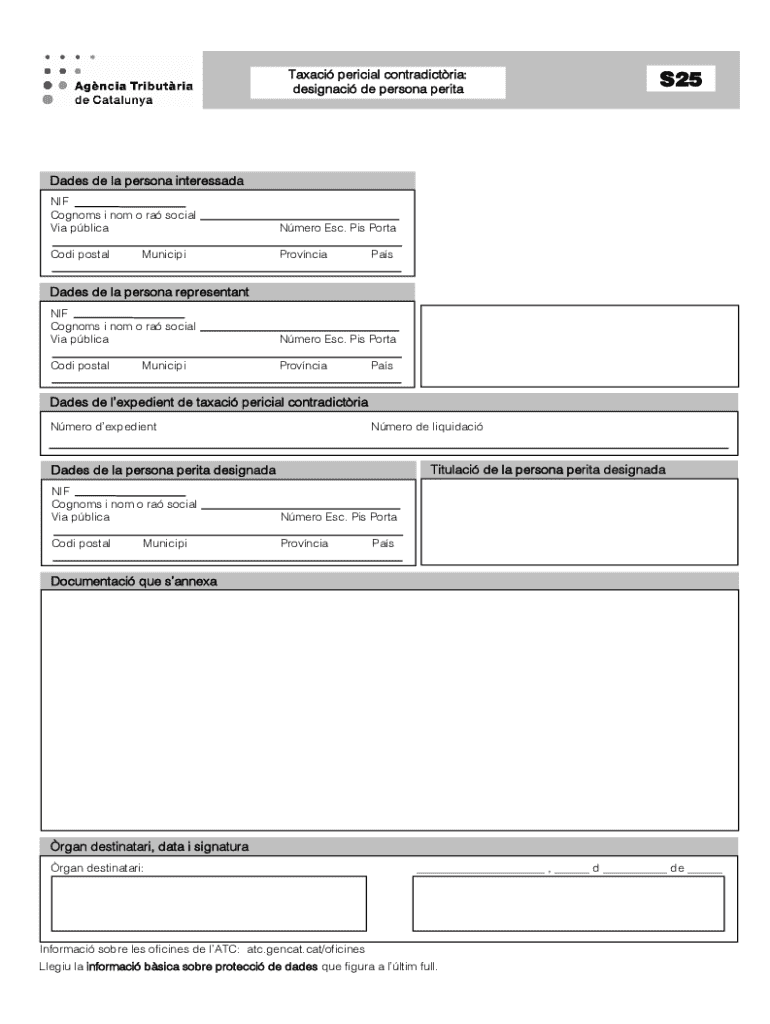

Taxaci Pericial Contradict Ria Form

What is the Taxació Pericial Contradictòria

The Taxació Pericial Contradictòria is a formal process used in legal and tax contexts to challenge the valuation of assets or properties determined by a tax authority. This process allows taxpayers to contest assessments that they believe are inaccurate or unjust. It serves as a mechanism for ensuring fairness in tax assessments, providing a structured approach for individuals or businesses to present their case and seek a reassessment based on evidence and expert testimony.

How to Use the Taxació Pericial Contradictòria

To effectively use the Taxació Pericial Contradictòria, taxpayers should first gather all relevant documentation that supports their claim. This may include property appraisals, photographs, and any previous correspondence with tax authorities. Next, it is essential to fill out the necessary forms accurately, ensuring that all required information is included. Once the form is completed, it should be submitted to the appropriate tax authority within the specified timeframe to initiate the review process.

Steps to Complete the Taxació Pericial Contradictòria

Completing the Taxació Pericial Contradictòria involves several key steps:

- Gather supporting documents, including previous valuations and expert appraisals.

- Fill out the Taxació Pericial Contradictòria form, ensuring all sections are completed accurately.

- Submit the form along with all supporting documents to the relevant tax authority.

- Await confirmation of receipt and any further instructions from the tax authority.

- Prepare for any hearings or meetings that may be scheduled as part of the review process.

Legal Use of the Taxació Pericial Contradictòria

The legal framework surrounding the Taxació Pericial Contradictòria allows taxpayers to formally contest property valuations. This process is governed by specific regulations that outline the rights of taxpayers and the obligations of tax authorities. Understanding these legal parameters is crucial for effectively navigating the process and ensuring compliance with all necessary requirements.

Key Elements of the Taxació Pericial Contradictòria

Several key elements are essential to the Taxació Pericial Contradictòria process:

- Documentation: Accurate and comprehensive documentation is vital for substantiating claims.

- Timeliness: Submissions must be made within designated deadlines to be considered valid.

- Expert Testimony: In some cases, expert opinions may be required to support the taxpayer's position.

- Review Process: Tax authorities will conduct a thorough review of the submitted materials before making a determination.

Required Documents

When filing a Taxació Pericial Contradictòria, several documents are typically required:

- Completed Taxació Pericial Contradictòria form.

- Previous property assessments or tax bills.

- Independent appraisals or valuations from qualified professionals.

- Any correspondence with tax authorities related to the valuation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxaci pericial contradictria

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Taxació Pericial Contradictòria?

Taxació Pericial Contradictòria refers to a legal process in which a valuation is contested and requires expert assessment. This process is crucial for resolving disputes over property values, ensuring that all parties receive a fair evaluation. Understanding this concept is essential for anyone involved in property transactions or legal disputes.

-

How can airSlate SignNow assist with Taxació Pericial Contradictòria?

airSlate SignNow provides a streamlined platform for managing documents related to Taxació Pericial Contradictòria. With our eSigning capabilities, you can easily send, sign, and store important documents securely. This simplifies the process and ensures that all necessary paperwork is handled efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those dealing with Taxació Pericial Contradictòria. Our plans are designed to be cost-effective, ensuring that you only pay for the features you need. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for Taxació Pericial Contradictòria?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for Taxació Pericial Contradictòria. These tools help streamline the documentation process, making it easier to manage and resolve disputes efficiently. Additionally, our user-friendly interface ensures a smooth experience.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow related to Taxació Pericial Contradictòria. You can connect with popular tools like Google Drive, Salesforce, and more, allowing for easy document management and collaboration. This integration capability helps you maintain efficiency in your processes.

-

What are the benefits of using airSlate SignNow for Taxació Pericial Contradictòria?

Using airSlate SignNow for Taxació Pericial Contradictòria offers numerous benefits, including increased efficiency and reduced turnaround times for document processing. Our platform ensures that all parties can sign documents quickly and securely, minimizing delays in legal proceedings. This ultimately leads to a smoother resolution of disputes.

-

Is airSlate SignNow secure for handling Taxació Pericial Contradictòria documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents related to Taxació Pericial Contradictòria. We ensure that your sensitive information remains confidential and secure throughout the signing process. Trust is key in legal matters, and we take it seriously.

Get more for Taxaci Pericial Contradict ria

Find out other Taxaci Pericial Contradict ria

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors