Devolucin De Ingresos Indebidos Form

Understanding the Devolución De Ingresos Indebidos

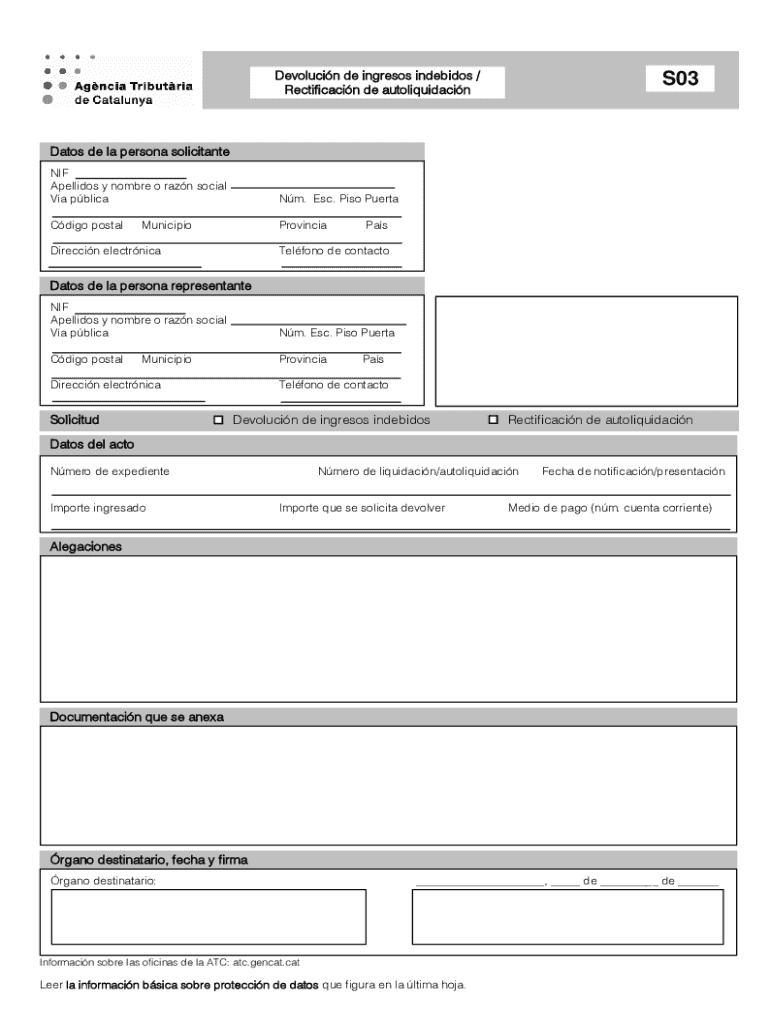

The Devolución De Ingresos Indebidos is a formal process used to reclaim funds that were received in error. This form is essential for individuals and businesses who have mistakenly received payments or benefits that they were not entitled to. It is crucial to understand the context in which this form applies, particularly in financial and tax scenarios. The process ensures that any overpayments are rectified, maintaining the integrity of financial records and compliance with regulations.

Steps to Complete the Devolución De Ingresos Indebidos

Completing the Devolución De Ingresos Indebidos involves several clear steps:

- Gather all relevant documentation, including proof of the erroneous payment.

- Fill out the form accurately, ensuring that all information is correct and complete.

- Attach any necessary supporting documents that validate your claim.

- Review the completed form for accuracy before submission.

Following these steps carefully can help expedite the processing of your request.

Required Documents for Submission

When submitting the Devolución De Ingresos Indebidos, specific documents are necessary to support your claim. These typically include:

- Proof of the erroneous payment, such as bank statements or payment notifications.

- Identification documents to verify your identity.

- Any correspondence related to the payment in question.

Ensuring that you have all required documents can prevent delays in processing your request.

Eligibility Criteria for the Devolución De Ingresos Indebidos

To qualify for the Devolución De Ingresos Indebidos, certain eligibility criteria must be met. Generally, these criteria include:

- The payment was made in error, and you were not entitled to receive it.

- You must have documentation to support your claim of the erroneous payment.

- The request for refund must be made within a specified timeframe, as dictated by relevant regulations.

Understanding these criteria is essential to ensure that your claim is valid and can be processed effectively.

Form Submission Methods

The Devolución De Ingresos Indebidos can be submitted through various methods, providing flexibility based on your preferences. The common submission methods include:

- Online submission through the appropriate government portal.

- Mailing the completed form to the designated office.

- In-person submission at local offices, if applicable.

Choosing the right submission method can impact the speed and efficiency of your claim's processing.

IRS Guidelines for the Devolución De Ingresos Indebidos

The Internal Revenue Service (IRS) provides specific guidelines regarding the Devolución De Ingresos Indebidos. These guidelines outline:

- How to determine if a payment was received in error.

- The proper procedures for filing a claim.

- Time limits for submitting the form.

Familiarizing yourself with these guidelines is vital to ensure compliance and successful processing of your request.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the devolucin de ingresos indebidos

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Devolucin De Ingresos Indebidos?

Devolucin De Ingresos Indebidos refers to the process of reclaiming funds that were mistakenly received or overpaid. This can occur in various financial transactions, and understanding the process is crucial for businesses to ensure compliance and recover their funds efficiently.

-

How can airSlate SignNow assist with Devolucin De Ingresos Indebidos?

airSlate SignNow provides a streamlined platform for businesses to manage documents related to Devolucin De Ingresos Indebidos. With our eSigning capabilities, you can quickly send and sign necessary forms, ensuring a faster resolution of your claims.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Our plans are designed to provide cost-effective solutions for managing documents, including those related to Devolucin De Ingresos Indebidos, without compromising on features.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage. These tools are particularly beneficial for handling documents associated with Devolucin De Ingresos Indebidos, making the process efficient and organized.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow. This integration capability is essential for businesses dealing with Devolucin De Ingresos Indebidos, as it allows for better data management and communication across platforms.

-

What are the benefits of using airSlate SignNow for Devolucin De Ingresos Indebidos?

Using airSlate SignNow for Devolucin De Ingresos Indebidos offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the document signing process, allowing businesses to focus on their core operations while ensuring compliance.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that all documents related to Devolucin De Ingresos Indebidos are handled securely, protecting your sensitive information throughout the process.

Get more for Devolucin De Ingresos Indebidos

- Mra tenth schedule regulation 22b form

- Statement of no income form

- Ckyc form fillable

- Primary teacher appointment form

- Generic scope of appointment form

- Regents earth science topographic profiles practice answer key form

- Dog license harford county maryland harfordcountymd form

- Home health agencies in virgin island address and form

Find out other Devolucin De Ingresos Indebidos

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template