Modelo De Escritura De Constituci N De Hipoteca Inmobiliaria Form

What is the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria

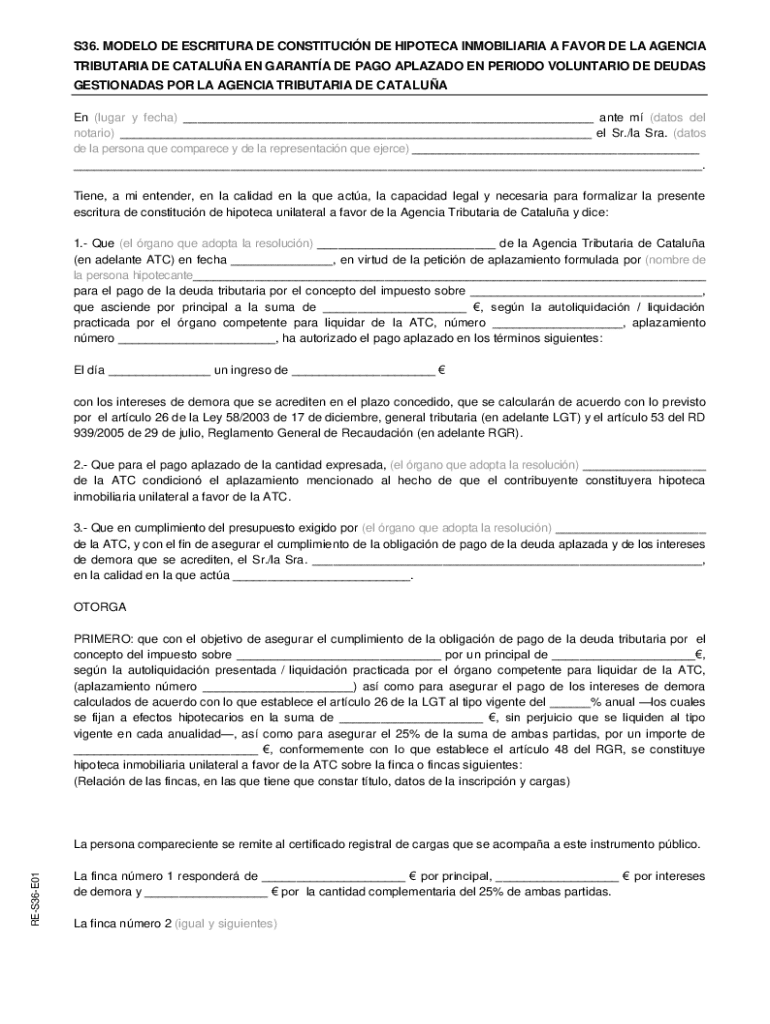

The Modelo De Escritura De Constitución De Hipoteca Inmobiliaria is a legal document used to establish a mortgage on real estate. This document serves as a formal agreement between the borrower and the lender, outlining the terms and conditions of the mortgage. It typically includes details such as the amount borrowed, interest rates, repayment terms, and the property being mortgaged. Understanding this document is essential for both parties to ensure clarity and legal compliance throughout the mortgage process.

Key elements of the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria

Several critical components make up the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria. These elements include:

- Parties Involved: Identification of the borrower and lender, including their legal names and addresses.

- Property Description: A detailed description of the property being mortgaged, including its address and legal description.

- Loan Amount: The total amount of money being borrowed, which forms the basis of the mortgage.

- Interest Rate: The agreed-upon interest rate applied to the loan amount.

- Repayment Terms: Specific details regarding how and when the borrower will repay the loan.

- Default Conditions: Conditions under which the lender can claim the property in case of default.

Steps to complete the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria

Completing the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria involves several important steps:

- Gather Information: Collect all necessary information about the property, borrower, and lender.

- Draft the Document: Use a template or legal software to draft the escritura, ensuring all key elements are included.

- Review the Document: Have both parties review the document for accuracy and completeness.

- Sign the Document: Both parties must sign the escritura in the presence of a notary public to ensure its legal validity.

- File the Document: Submit the signed document to the appropriate local government office for recording.

Legal use of the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria

The Modelo De Escritura De Constitución De Hipoteca Inmobiliaria is legally binding once signed and notarized. It serves as proof of the mortgage agreement and can be enforced in a court of law. Understanding the legal implications of this document is crucial for both borrowers and lenders, as it protects their rights and outlines their obligations. Failing to comply with the terms set forth in the escritura can lead to foreclosure and loss of the property.

How to obtain the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria

Obtaining the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria can be done through various means:

- Legal Templates: Many legal websites offer downloadable templates for the escritura.

- Real Estate Attorneys: Consulting with a real estate attorney can provide personalized assistance in drafting the document.

- Title Companies: Title companies often have resources and templates available for mortgage documents.

State-specific rules for the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria

Each state in the United States may have specific requirements regarding the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria. These can include:

- Notarization Requirements: Some states may require the document to be notarized to be legally binding.

- Filing Fees: There may be fees associated with filing the document with local authorities.

- Disclosure Requirements: Certain states may mandate additional disclosures related to the mortgage terms.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the modelo de escritura de constitucin de hipoteca inmobiliaria

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Modelo De Escritura De Constitución De Hipoteca Inmobiliaria?

A Modelo De Escritura De Constitución De Hipoteca Inmobiliaria is a legal document that establishes a mortgage on a property. It outlines the terms and conditions of the mortgage agreement between the lender and the borrower. Understanding this model is crucial for anyone looking to secure financing for real estate.

-

How can airSlate SignNow help with the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria?

airSlate SignNow simplifies the process of creating and signing a Modelo De Escritura De Constitución De Hipoteca Inmobiliaria. Our platform allows users to easily customize templates, ensuring that all necessary legal requirements are met. This streamlines the documentation process, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can find a plan that includes features for managing documents like the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria. Check our website for detailed pricing information and choose the plan that suits you best.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for effective document management, including eSigning, template creation, and secure storage. These features are particularly beneficial when handling documents like the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria. Our user-friendly interface ensures that you can manage your documents efficiently.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents such as the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria. We use advanced encryption and adhere to industry standards to protect your data. You can trust us to keep your information secure.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. Whether you need to connect with CRM systems or other document management tools, our platform can seamlessly integrate, making it easier to manage documents like the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria.

-

What are the benefits of using airSlate SignNow for real estate transactions?

Using airSlate SignNow for real estate transactions, including the Modelo De Escritura De Constitución De Hipoteca Inmobiliaria, offers numerous benefits. It speeds up the signing process, reduces paperwork, and enhances collaboration among parties involved. This efficiency can lead to quicker closings and improved customer satisfaction.

Get more for Modelo De Escritura De Constituci n De Hipoteca Inmobiliaria

- Impressos registo predial form

- No objection letter from wife to husband form

- Soonerride mileage reimbursement form 269408036

- Southern asia bible college form

- Scriveners affidavit pdf form

- Fillable online franklinlindsay application form franklin

- Michael kors jewellery form watch station

- Ncdss child welfare human trafficking screening tool htst form

Find out other Modelo De Escritura De Constituci n De Hipoteca Inmobiliaria

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer