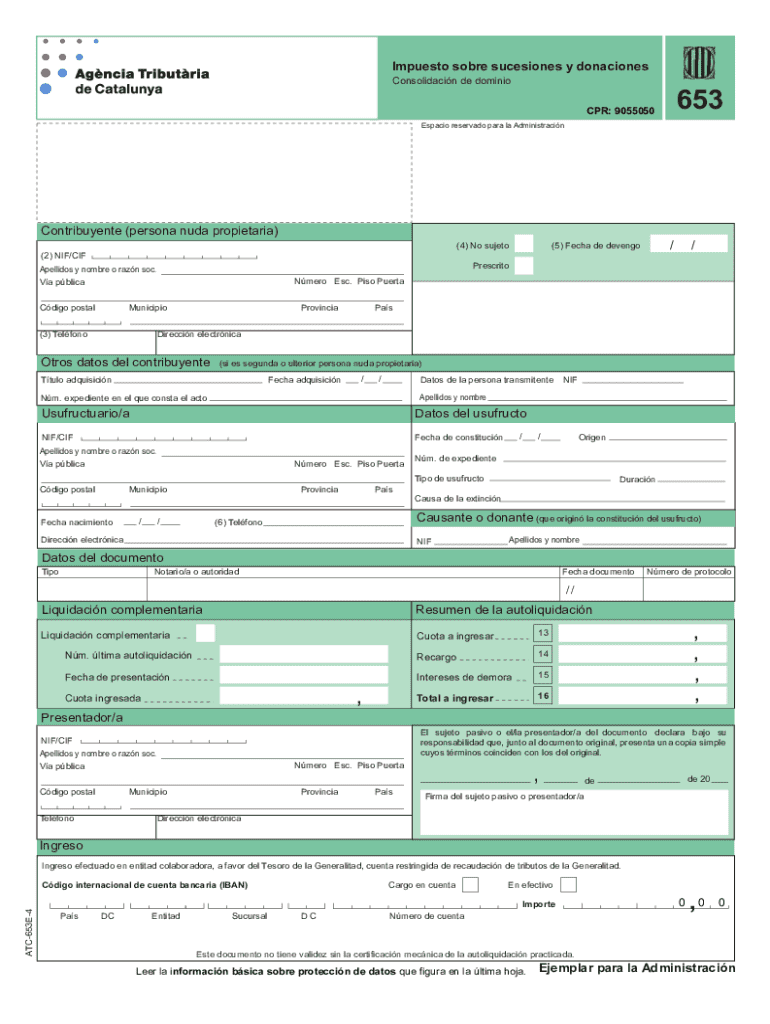

Impuesto Sobre Sucesiones Y Donaciones Form

What is the Impuesto Sobre Sucesiones Y Donaciones

The Impuesto Sobre Sucesiones Y Donaciones, or the Inheritance and Gift Tax, is a tax levied on the transfer of assets from deceased individuals or as gifts between living persons. This tax applies to the value of the assets transferred, and the rates can vary significantly based on the relationship between the giver and the recipient, as well as the total value of the assets involved. Understanding this tax is crucial for individuals planning their estates or considering significant gifts, as it can impact financial planning and inheritance strategies.

How to obtain the Impuesto Sobre Sucesiones Y Donaciones

To obtain the Impuesto Sobre Sucesiones Y Donaciones, individuals must first determine the applicable tax jurisdiction, as the rules may differ between states. Generally, the process begins with gathering necessary documentation, including information about the deceased’s estate or the value of the gift. This may involve obtaining appraisals or valuations of the assets. Once the documentation is complete, individuals can file the appropriate forms with the tax authority in their state, ensuring compliance with local laws and regulations.

Steps to complete the Impuesto Sobre Sucesiones Y Donaciones

Completing the Impuesto Sobre Sucesiones Y Donaciones involves several steps:

- Identify the assets involved in the transfer, whether through inheritance or as a gift.

- Determine the fair market value of these assets at the time of transfer.

- Gather required documents, including death certificates, wills, and appraisals.

- Calculate the tax liability based on the applicable rates and exemptions in your state.

- Complete the necessary forms and submit them to the appropriate tax authority by the deadline.

Key elements of the Impuesto Sobre Sucesiones Y Donaciones

Several key elements define the Impuesto Sobre Sucesiones Y Donaciones:

- Tax Rates: Vary based on the relationship between the parties and the value of the assets.

- Exemptions: Certain amounts may be exempt from taxation, particularly for close relatives.

- Filing Requirements: Specific forms must be completed and submitted to the tax authority.

- Deadlines: Timely filing is crucial to avoid penalties and interest.

Legal use of the Impuesto Sobre Sucesiones Y Donaciones

The legal use of the Impuesto Sobre Sucesiones Y Donaciones is primarily to ensure that the transfer of wealth is taxed appropriately. This tax serves as a means for governments to collect revenue from inheritances and gifts, which can be significant sources of income. It is essential for individuals to understand their legal obligations regarding this tax to avoid potential legal issues and ensure compliance with state and federal regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Impuesto Sobre Sucesiones Y Donaciones can vary by state, but generally, the tax must be filed within a specified period after the transfer occurs. It is important to check with the local tax authority for precise dates, as missing these deadlines can result in penalties. Typically, individuals should aim to file the necessary forms within nine months of the date of death or the date of the gift to avoid additional interest and penalties.

Required Documents

When preparing to file the Impuesto Sobre Sucesiones Y Donaciones, several documents are typically required:

- Death certificate for inherited assets.

- Will or trust documents outlining the distribution of assets.

- Appraisals or valuations of the assets being transferred.

- Identification documents for both the giver and recipient.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the impuesto sobre sucesiones y donaciones 629921500

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Impuesto Sobre Sucesiones Y Donaciones?

The Impuesto Sobre Sucesiones Y Donaciones is a tax levied on inheritances and donations in Spain. Understanding this tax is crucial for individuals and businesses involved in estate planning or transferring assets. airSlate SignNow can help streamline the documentation process related to this tax.

-

How can airSlate SignNow assist with Impuesto Sobre Sucesiones Y Donaciones documentation?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning documents related to the Impuesto Sobre Sucesiones Y Donaciones. This ensures that all necessary paperwork is completed accurately and efficiently, reducing the risk of errors. Our solution simplifies the entire process, making it accessible for everyone.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those dealing with Impuesto Sobre Sucesiones Y Donaciones. Our plans are designed to be cost-effective, ensuring that you only pay for the features you need. You can choose from monthly or annual subscriptions to find the best fit for your budget.

-

What features does airSlate SignNow offer for managing Impuesto Sobre Sucesiones Y Donaciones?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for managing Impuesto Sobre Sucesiones Y Donaciones documents. These features help streamline the process, ensuring compliance and efficiency. Additionally, users can track document status in real-time.

-

Are there any integrations available with airSlate SignNow for tax-related services?

Yes, airSlate SignNow integrates seamlessly with various tax-related services and software, enhancing your ability to manage Impuesto Sobre Sucesiones Y Donaciones. These integrations allow for easy data transfer and improved workflow efficiency. You can connect with popular platforms to ensure all your tax documentation is in one place.

-

What are the benefits of using airSlate SignNow for Impuesto Sobre Sucesiones Y Donaciones?

Using airSlate SignNow for Impuesto Sobre Sucesiones Y Donaciones offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the signing process, allowing you to focus on what matters most. Additionally, you can ensure that your documents are legally binding and compliant with regulations.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with Impuesto Sobre Sucesiones Y Donaciones?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses managing Impuesto Sobre Sucesiones Y Donaciones. Whether you are an individual planning your estate or a business handling multiple transactions, our platform provides the tools you need to succeed. It's user-friendly and adaptable to various needs.

Get more for Impuesto Sobre Sucesiones Y Donaciones

Find out other Impuesto Sobre Sucesiones Y Donaciones

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney