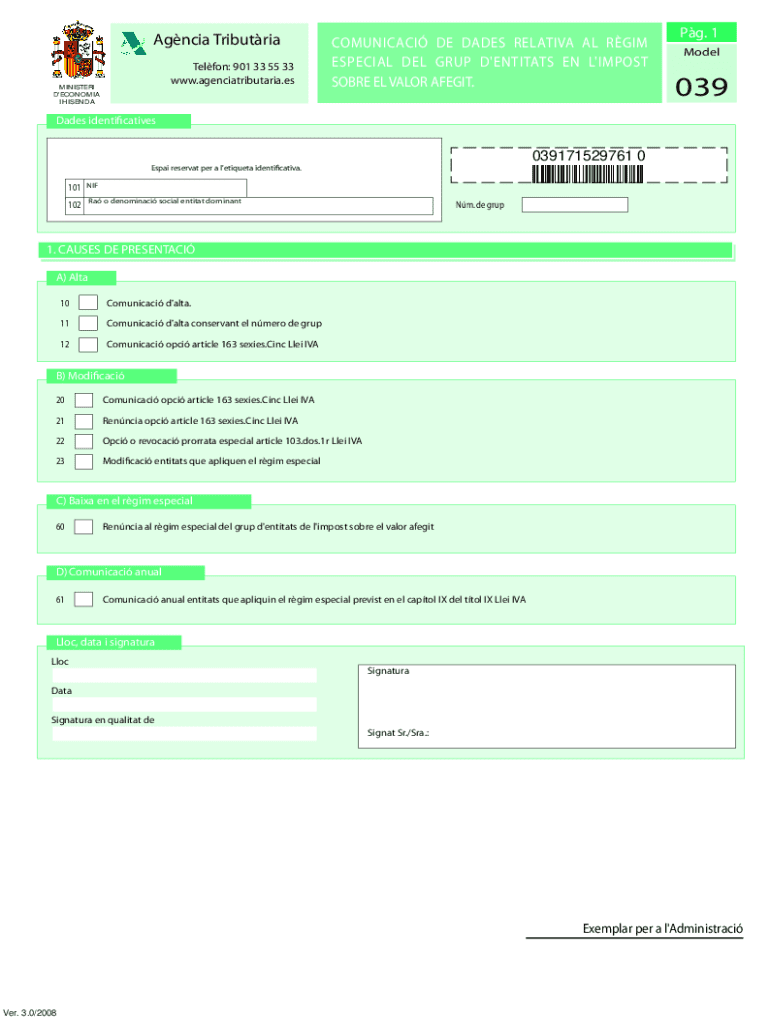

Model 039 Form

What is the Model 039

The Model 039 is a specific form utilized for various administrative and legal purposes, primarily within the context of business and tax documentation. This form serves as a standardized method for individuals and organizations to report certain information to government agencies. Understanding the Model 039 is essential for ensuring compliance with relevant regulations and for facilitating efficient processing of submissions.

How to use the Model 039

Using the Model 039 involves several straightforward steps. First, gather all necessary information required to complete the form accurately. This may include personal identification details, financial data, or business-related information. Next, fill out the form carefully, ensuring that all sections are completed as per the instructions provided. Once the form is filled, review it for any errors or omissions before submission.

Steps to complete the Model 039

Completing the Model 039 requires a methodical approach. Begin by downloading the form from an official source or accessing it through the appropriate channels. Follow these steps:

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal or business information as required.

- Provide any necessary supporting documentation if applicable.

- Double-check all entries for accuracy.

- Sign and date the form where indicated.

Legal use of the Model 039

The Model 039 must be used in accordance with applicable laws and regulations. It is important to ensure that the information provided is truthful and complete, as inaccuracies can lead to legal repercussions. Familiarize yourself with the specific legal requirements surrounding the use of this form to avoid potential penalties.

Required Documents

When submitting the Model 039, certain documents may be required to support your application or report. These documents can include identification proofs, tax records, or other relevant paperwork that validates the information provided on the form. Ensure that you have all necessary documents ready to accompany your submission.

Form Submission Methods

The Model 039 can be submitted through various methods, depending on the specific requirements of the issuing agency. Common submission methods include:

- Online submission through official portals.

- Mailing a hard copy to the designated address.

- In-person submission at local offices or designated locations.

Examples of using the Model 039

There are several scenarios where the Model 039 may be utilized. For instance, businesses may use it to report financial information to tax authorities, while individuals might need it for personal tax filings or compliance with regulatory requirements. Understanding these examples can help clarify when and how to effectively use the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the model 039

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Model 039 and how does it work?

The Model 039 is an advanced eSignature solution offered by airSlate SignNow that allows businesses to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient. With its user-friendly interface, the Model 039 ensures that users can easily navigate through document workflows.

-

What are the key features of the Model 039?

The Model 039 includes features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and integrates seamlessly with various applications. These features make the Model 039 a versatile tool for managing document signing.

-

How much does the Model 039 cost?

The pricing for the Model 039 varies based on the subscription plan chosen. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes. You can visit our pricing page for detailed information on the costs associated with the Model 039.

-

What are the benefits of using the Model 039?

Using the Model 039 can signNowly reduce the time spent on document management and signing processes. It enhances productivity by allowing users to send and receive signed documents quickly. Additionally, the Model 039 ensures compliance with legal standards, providing peace of mind for businesses.

-

Can the Model 039 integrate with other software?

Yes, the Model 039 is designed to integrate with a variety of software applications, including CRM systems and cloud storage services. This integration capability allows businesses to streamline their workflows and enhance overall efficiency. Check our integration page for a complete list of compatible applications.

-

Is the Model 039 secure for sensitive documents?

Absolutely, the Model 039 prioritizes security with features such as encryption and secure access controls. airSlate SignNow complies with industry standards to ensure that your documents are protected. You can trust the Model 039 to handle sensitive information safely.

-

How can I get started with the Model 039?

Getting started with the Model 039 is simple. You can sign up for a free trial on our website to explore its features. Once you're ready, you can choose a subscription plan that fits your business needs and start using the Model 039 immediately.

Get more for Model 039

- Grammatica spagnola zanichelli pdf gratis form

- Physical fitness worksheet form

- Que es fundempresa pdf form

- Parent portal okaloosa form

- Hold harmless agreement insurance requirements form

- Monroe county government building permit application form

- Charitable solicitation permit palm beach florida form

- Buy 5 entry form buy 5 entry form girl scouts of citrus

Find out other Model 039

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure