Hold Harmless Agreement Insurance Requirements Form

What is the Hold Harmless Agreement Insurance Requirements

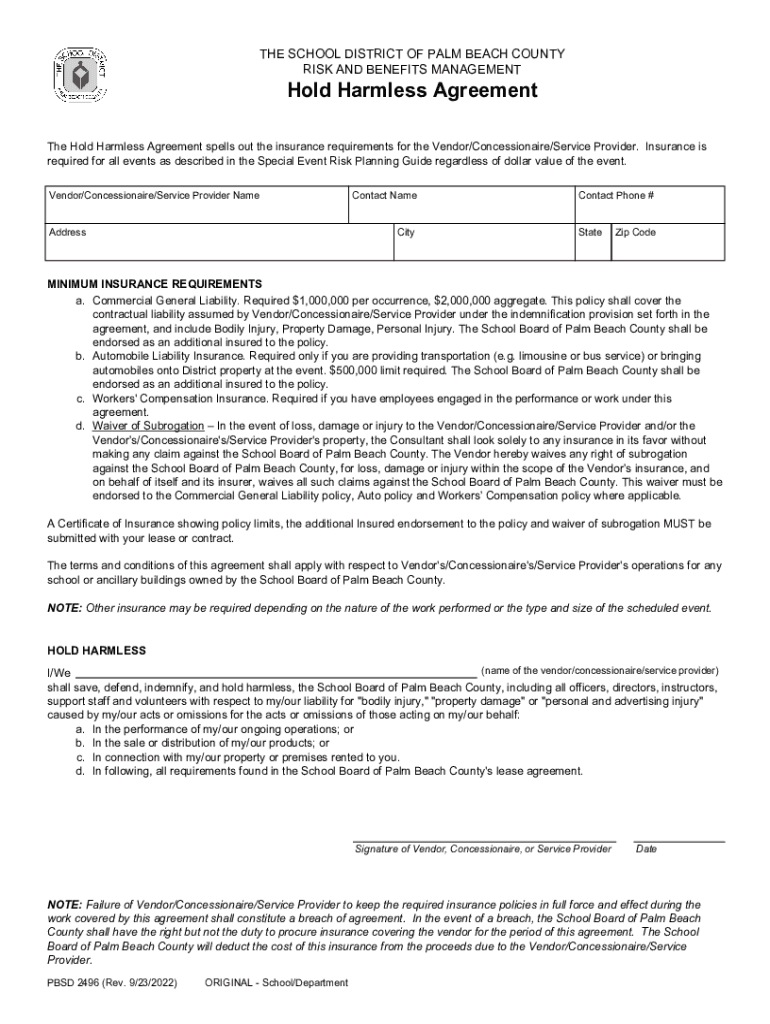

A Hold Harmless Agreement is a legal document that outlines the responsibilities of parties involved in a contract, particularly regarding liability and insurance requirements. This agreement is designed to protect one party from being held liable for damages or injuries that may occur during the execution of a project or service. In the context of insurance requirements, it specifies the necessary coverage that parties must maintain to safeguard against potential claims. Understanding the terms and conditions of this agreement is crucial for businesses and individuals to ensure they are adequately protected.

Key Elements of the Hold Harmless Agreement Insurance Requirements

Several key elements are essential in a Hold Harmless Agreement related to insurance requirements:

- Indemnification Clause: This clause specifies that one party agrees to indemnify the other for any losses or damages incurred.

- Scope of Coverage: The agreement should clearly define the types of insurance required, such as general liability, professional liability, or workers' compensation.

- Duration of Coverage: It is important to outline how long the insurance must remain in effect, particularly after the completion of a project.

- Proof of Insurance: The agreement may require parties to provide proof of insurance coverage, ensuring compliance with the stated requirements.

Steps to Complete the Hold Harmless Agreement Insurance Requirements

Completing a Hold Harmless Agreement involves several steps to ensure that all parties understand their obligations:

- Identify the Parties: Clearly state the names and roles of all parties involved in the agreement.

- Define the Scope: Outline the specific activities or services covered by the agreement.

- Detail Insurance Requirements: Specify the types and amounts of insurance coverage required.

- Include Indemnification Terms: Clearly articulate the indemnification obligations of each party.

- Review and Sign: Ensure all parties review the agreement thoroughly before signing to confirm understanding and acceptance.

Legal Use of the Hold Harmless Agreement Insurance Requirements

The legal use of a Hold Harmless Agreement is critical in various industries, particularly in construction, event planning, and service contracts. It serves as a protective measure, ensuring that one party does not bear the financial burden of another's negligence. However, the enforceability of such agreements can vary by state, making it essential to consult legal counsel to ensure compliance with local laws and regulations. Properly drafted agreements can significantly reduce the risk of litigation and provide clarity on liability issues.

State-Specific Rules for the Hold Harmless Agreement Insurance Requirements

Each state in the United States may have different laws governing the enforceability and requirements of Hold Harmless Agreements. Some states may impose restrictions on indemnification clauses, particularly in construction contracts, where they may not allow a contractor to indemnify a property owner for the owner's own negligence. It is crucial for parties to be aware of their state's specific rules and regulations to ensure that their agreement is valid and enforceable. Consulting with a legal professional familiar with state laws can provide valuable guidance.

Examples of Using the Hold Harmless Agreement Insurance Requirements

Hold Harmless Agreements are commonly used in various scenarios, including:

- Construction Projects: Contractors often require subcontractors to sign a Hold Harmless Agreement to protect against liability claims arising from work performed on a job site.

- Event Planning: Event organizers may ask vendors to sign a Hold Harmless Agreement to mitigate risks associated with accidents or injuries during events.

- Rental Agreements: Property owners may use these agreements to protect themselves from liability claims related to tenant activities.

Quick guide on how to complete hold harmless agreement insurance requirements

Effortlessly Prepare Hold Harmless Agreement Insurance Requirements on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without holdups. Manage Hold Harmless Agreement Insurance Requirements across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Steps to Modify and Electronically Sign Hold Harmless Agreement Insurance Requirements with Ease

- Obtain Hold Harmless Agreement Insurance Requirements and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, burdensome form navigation, or mistakes necessitating new document prints. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Adjust and electronically sign Hold Harmless Agreement Insurance Requirements to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hold harmless agreement insurance requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Hold Harmless Agreement and why are Insurance Requirements important?

A Hold Harmless Agreement is a legal contract that protects one party from liability for damages or losses incurred by another party. Understanding the Insurance Requirements associated with these agreements is crucial, as they ensure that adequate coverage is in place to mitigate risks. This helps businesses avoid potential financial pitfalls and legal disputes.

-

How does airSlate SignNow facilitate the creation of Hold Harmless Agreements?

airSlate SignNow provides an intuitive platform that allows users to easily create and customize Hold Harmless Agreements. With our user-friendly templates, you can incorporate specific Insurance Requirements tailored to your business needs. This streamlines the process, making it efficient and hassle-free.

-

What are the pricing options for using airSlate SignNow for Hold Harmless Agreements?

airSlate SignNow offers flexible pricing plans to accommodate various business sizes and needs. Our plans include features that support the creation and management of Hold Harmless Agreements, ensuring compliance with Insurance Requirements. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for managing Hold Harmless Agreements?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for managing Hold Harmless Agreements. This includes integration with project management tools and accounting software, ensuring that all Insurance Requirements are met efficiently. Our API allows for custom integrations as well.

-

What are the benefits of using airSlate SignNow for Hold Harmless Agreements?

Using airSlate SignNow for Hold Harmless Agreements offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that all Insurance Requirements are clearly outlined and easily accessible. Additionally, eSigning capabilities expedite the approval process, saving you time.

-

Is it easy to track the status of Hold Harmless Agreements in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your Hold Harmless Agreements. You can easily monitor the status of each document, ensuring that all parties comply with the necessary Insurance Requirements. This feature enhances accountability and keeps your projects on schedule.

-

What types of businesses can benefit from Hold Harmless Agreements?

Hold Harmless Agreements are beneficial for a wide range of businesses, including contractors, event organizers, and service providers. Any business that engages in activities with potential liability can utilize these agreements to clarify Insurance Requirements. This helps protect against unforeseen risks and liabilities.

Get more for Hold Harmless Agreement Insurance Requirements

- Horse trailer rental agreement hidden hills farm ampamp saddle club form

- Demonstration worksheet 4 h center for youth development 4h missouri form

- My independence hounslow form

- Sow skrill declaration docx form

- Investigation report template word form

- Ay22 23 hssp pfa certification form pdf

- Notice of commencement town of longboat key longboatkey form

- Homestead tax credit and exemptioniowa department of form

Find out other Hold Harmless Agreement Insurance Requirements

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy