Anexo Ii Form

What is the Anexo II

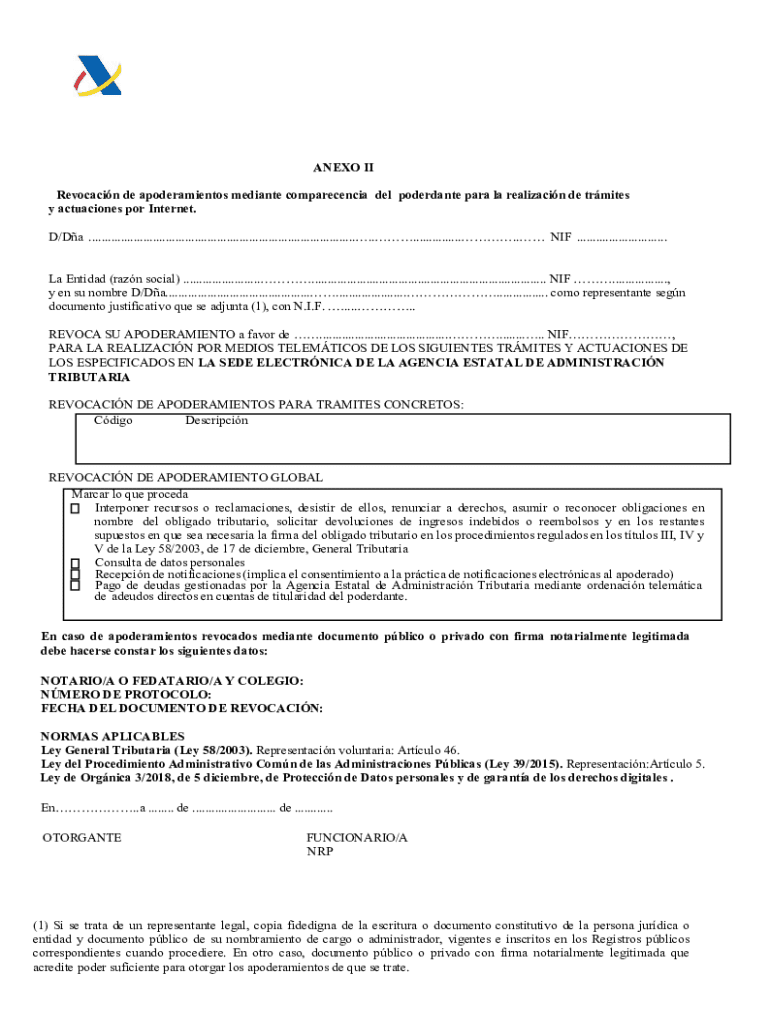

The Anexo II is a specific form used primarily for reporting purposes in various contexts, often related to tax or regulatory compliance. This form is crucial for individuals and businesses to accurately disclose financial information as required by law. Understanding its purpose is essential for ensuring compliance with relevant regulations.

How to use the Anexo II

Using the Anexo II involves several key steps. First, gather all necessary financial documents and information that pertain to the reporting period. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submission. It is also advisable to keep a copy for your records.

Steps to complete the Anexo II

Completing the Anexo II requires a systematic approach. Follow these steps:

- Collect relevant financial data, including income statements and expense reports.

- Fill out personal or business identification details at the top of the form.

- Complete each section according to the instructions provided, ensuring accuracy.

- Review the form for completeness and correctness.

- Sign and date the form as required.

Legal use of the Anexo II

The Anexo II must be used in accordance with applicable laws and regulations. Failure to comply can result in legal consequences, including penalties or audits. It is important to understand the specific legal context in which the form is used, as this can vary by state or by the nature of the reporting entity.

Required Documents

When preparing to complete the Anexo II, certain documents are typically required. These may include:

- Financial statements for the reporting period.

- Tax identification numbers for individuals or businesses.

- Supporting documentation for any claims or deductions.

Having these documents ready will facilitate a smoother completion process.

Filing Deadlines / Important Dates

Timely submission of the Anexo II is crucial to avoid penalties. It is important to be aware of the specific deadlines associated with this form, which can vary depending on the reporting context. Generally, these deadlines align with tax filing periods or regulatory reporting schedules.

Form Submission Methods

The Anexo II can typically be submitted through various methods, including:

- Online submission through designated government portals.

- Mailing a physical copy to the appropriate office.

- In-person submission at local offices, if applicable.

Choosing the right submission method can depend on personal preference or specific requirements set by the issuing authority.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the anexo ii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Anexo Ii and how does it relate to airSlate SignNow?

Anexo Ii refers to a specific document format that can be easily managed using airSlate SignNow. Our platform allows users to create, send, and eSign Anexo Ii documents efficiently, ensuring compliance and streamlined workflows.

-

How much does it cost to use airSlate SignNow for Anexo Ii documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while efficiently managing Anexo Ii documents, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Anexo Ii documents?

Our platform provides a range of features for Anexo Ii documents, including customizable templates, secure eSigning, and real-time tracking. These features enhance productivity and ensure that your document management process is seamless.

-

Can I integrate airSlate SignNow with other tools for Anexo Ii document management?

Yes, airSlate SignNow offers integrations with various applications, allowing you to manage Anexo Ii documents alongside your existing tools. This flexibility helps streamline your workflow and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for Anexo Ii documents?

Using airSlate SignNow for Anexo Ii documents provides numerous benefits, including faster turnaround times, improved accuracy, and enhanced security. Our solution empowers businesses to handle their documentation needs with ease and confidence.

-

Is airSlate SignNow user-friendly for managing Anexo Ii documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage Anexo Ii documents. Our intuitive interface ensures that you can quickly navigate the platform and complete your tasks efficiently.

-

How does airSlate SignNow ensure the security of Anexo Ii documents?

airSlate SignNow prioritizes the security of your Anexo Ii documents by implementing advanced encryption and compliance measures. This ensures that your sensitive information remains protected throughout the signing process.

Get more for Anexo Ii

- Caddy catalog form

- Hemocue glucose 201 quality control log sheet 400327131 form

- Glencoe geometry chapter 2 test form 1 answer key

- Inumc tithe form

- Gerald kendrick memorial scholarship form

- Youth cheer registration form miller family ymca youth cheer sevymca

- Brown bag food distribution sign in sheet volunteer lafoodbank form

- Reports amp records request police department form

Find out other Anexo Ii

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form